Students can Download 1st PUC Business Studies Previous Year Question Paper March 2018 (South), Karnataka 1st PUC Business Studies Model Question Papers with Answers helps you to revise the complete Karnataka State Board Syllabus.

Karnataka 1st PUC Business Studies Previous Year Question Paper March 2018 (South)

Time: 3.15 Hours

Max Marks: 100

Instructions to candidates:

- Write the serial number of questions properly as given in the question paper while answering

- Write the correct and complete answers.

Section – A

I. Answer any ten of following questions in a word or a sentence each. While answering Multiple Choice Questions, write the serial number/alphabet of the correct choice and write the answer corresponding to it. Each question carries one mark: ( 10 × 1 = 10 )

Question 1.

Mention any one type of economic activity.

Answer:

Business is one type of economic activity.

Question 2.

Who is Kartha?

Answer:

Under Hindu Undivided Families, the business is headed by the eldest male member of the family is called Karta.

Question 3.

A government company is any company in which the paid-up capital held by the government is not less than

(a) 49%

(b) 51%

(c) 50%

(d) 25%

Answer:

(b) 51%

Question 4.

Expand RTGS.

Answer:

Real-Time Gross Settlement.

Question 5.

The payment mechanism most typical to e-business is

(a) Cash on delivery

(b) Cheques

(c) Credit and debit card

(d) e-cash

Answer:

(d) e-cash

Question 6.

Carbon monoxide emitted by automobiles directly contributes to

(a) Water pollution

(b) Noise pollution

(c) Sound pollution

(d) Air pollution

Answer:

(d) Air pollution

![]()

Question 7.

Who are promoters?

Answer:

A person or group of persons who conceive the idea of setting up a new business, assess its feasibility and take necessary steps to arrange the basic requirements, and establish a business unit say, a Company and put into operation is known as a promoter.

Question 8.

A.D.R. is issued in

(a) Canada

(b) China

(c) India

(d) the USA

Answer:

(d) the USA

Question 9.

What is the TAX holiday?

Answer:

A government incentive program that offers a tax reduction or elimination to businesses is called tax holiday.

Question 10.

What is retail trade?

Answer:

A retailer is a business enterprise that is engaged in the sale of goods and services directly to the ultimate consumers. He normally buys goods in large quantities from wholesalers and sells them in small quantities to the ultimate consumers.

Question 11.

What is import trade?

Answer:

Import trade refers to the purchase of goods from other countries for dòmestic use.

![]()

Question 12.

Name any one document of export business.

Answer:

Export invoice.

Section – B

II. Answer any ten of the following questions in two or three sentences each. Each question carries 2 marks: ( 10 × 2 = 20 )

Question 13.

State any two auxiliaries to trade.

Answer:

(a) Banking and Finance

(b) Transport and Communication

Question 14.

Define Partnership.

Answer:

According to Section 4(2) Indian Partnership Act, 192 defines partnership as “the relation between persons who have agreed to share the profit of the business carried on by all or any one of them acting for all.”

Question 15.

State any two merits of Departmental undertakings.

Answer:

Merits:

(a) These undertakings fâcilitate the Parliament to exercise effective control over their operations.

(b) These ensure a high degree of public accountability.

The limitations of the departmental undertaking are:

(a) Departmental undertakings fail to provide flexibility, which is ‘essential for the smooth operation of the business.

(b) The employees or heads of departments of such undertakings are not allowed to take independent decisions, without the approval of the ministry concerned. This leads to delays, in matters where prompt decisions are required.

![]()

Question 16.

What is e-banking?

Answer:

it means conducting banking operations through electronic means or devices such as computers mobile, ATMs, etc.

Question 17.

State any two benefits of e-business.

Answer:

Two benefits of e-business are:

(a) Global reach/access

(b) Convenience.

Question 18.

What is business ethics?

Answer:

Business ethics is defined as a set of moral standards which society expects from businessmen.

Question 19.

Give the meaning of minimum subscription.

Answer:

In order to prevent companies from commencing business with inadequate resources, it has been provided that the company must receive applications for a certain minimum number of shares before going ahead with the allotment of shares. According to the Companies Act, this is called the ‘minimum subscription’.

Question 20.

Give the meaning of shares.

Answer:

Share is the smallest unit into which the total capital of the company is the dividend.

Question 21.

Give the meaning of village industries.

Answer:

Village industry has been defined as any industry located in a rural area that produces any goods, renders any service with or without the use of power, and in which the fixed capital investment per head or artisan or worker does not exceed Rs. 50,000.

Question 22.

Give the meaning of supermarket.

Answer:

Super Market is a large-scale retail store that sells a wide varietý of products like food items, vegetables, fruits, groceries, utensils, clothes, electronic appliances, household goods, etc. all under one roof.

![]()

Question 23.

What is Franchising?

Answer:

According to Charles W.L. Hill, “Franchising is basically a špecialised form of licensing in which the franchisor not only sells the intangible property to the franchisee but also insists that the franchisee agrees to abide by strict rules as to how it does business.”

Question 24.

What are mate’s receipts?

Answer:

Mate’s receipt is given by the commanding officer of the ship to the exporter after the cargo is loaded on the ship. The mate’s receipt indicates the name of the vessel, berth, date of shipment, description of packages, marks and numbers, condition of the cargo àt the time of receipt on board the ship, etc.

Section – C

III. Answer any seven of the following questions in 10-12 sentences. Each question carries 4 marks: ( 7 × 4 = 28 )

Question 25.

Explain briefly any four objectives of the business.

Answer:

Economic objectives: Business is an economic activity so their primary objectives are economic.

(a) Earning profits: One of the objectives of the business is to earn profits on the capital employed. Profitability refers to profit in relation to capital investment. Every business must earn a reasonable profit which is so important for its survival and growth.

(b) Market standing: Market standing refers to the posìtion of an enterprise in relation to its competitors. A business enterprise must aim at standing on a stronger footing in terms of offering competitive products to its customers and serving them to their satisfaction.

(c) Optimum utilization of resources: it is also one of the economic objectives of the business. It means using the resources in an optimum manner (i.e. without wastage) that helps in reduction of cost and increases the profit.

Social objectives: Business is an economic activity that cannot be carried on in isolation; there is the social objective of the business. The important social objectives of modern businesses are:

(a) Providing employment: One of the important social objectives of a business is to provide employment to society. This can be achieved by establishing new business units, expanding the market, etc.

(b) Paying fair wages and providing other benefits to the employees: One of the important social objectives of a business is to pay fair wages and other benefits such as medical facilities, transport, housing, etc. to employees.

(c) Prevention of pollution: With the growth of industries, pollution has become a serious matter. Pollution affects the hygiene and the health of human beings and even animaLs. So, one of the social objectives and obligations of every business is to make efforts to prevent the pollution of air and water.

Question 26.

Briefly explain any four features of Global Enterprises.

Answer:

Features:

(a) huge capital resources: These enterprises are characterized by possessing huge financial resources and the ability to raise funds from different sources. Because of their financial strength, they are able to survive under all circumstances.

(b) Foreign collaboration: Global enterprises usually enter into agreements with Indian companies pertaining to the sale of technology, production of goods, use of brand names for the final products, etc.

(c) Advanced technology: These enterprises possess technological superiorities in their methods of production. They are able to conform to international stand4rds and quality specifications. This leads to the industrial progress of the country.

(d) Product innovation: These enterprises are characterized by having highly sophisticated research and development departments engaged in the task of developing new products and superior designs of existing products.

![]()

Question 27.

Explain briefly the functions of Commercial Banks.

Answer:

The main functions of commercial banks are accepting deposits from the public and advancing them loans. However, besides these functions, there are many other functions that these banks perform.

All these functions can be divided under the following heads:

(a) Accepting Deposits: The most important function of commercial banks is to accept deposits from the public. Various sections of society, according to their needs and economic condition, deposit their savings with the banks. Generally, there are three types of deposits which are as follows:

1. Saving Bank Account: Thee accounts are introduced by the bank to mobilize small savings of low and middle-income groups of people. The ‘saving account’ is generally opened in the bank by salaried persons or by persons who have a fixed regular income.

2. Current account: This account is opened by businessmen who have a higher number of regular transactions with the bank.

3. Recurring Deposit Account: In a recurring deposit account, a certain fixed amount is invested every month for a specified period and the total amount is repaid with interest at the end of the particular fixed period.

4. Fixed Deposit Account: If the money is deposited by the customer with a bank for a fixed period of time for a fixed rate of interest. it iš repayable on expiry of a specified period of time.

(b) Giving Loans: The second important function of commercial banks is to advance loans to their customers. Banks charge interest from the borrowers and this is the main source of their income Banks advance loans not only on the basis of the deposits of the public rather they also advance loans on the basis of depositing the money in the accounts of borrowers. In other words, they create loans out of deposits and deposits out of loans. This is called credit creation by commercial banks.

Banks generally give the following types of loans and advances:

- Bank Overdraft: An overdrive is an advance given by the bank allowing a customer to overdraw his current account up tò an agreed amount. Interest is charged at an agreed rate only on the amount overdrawn.

- Cash Credits: Cash credit is a short-term cash loan to a company. It is a financial accommodation under which an advance is granted on a separate account called a cash credit account up to a specified limit.

- Demand Loans: These are loans that can be recalled on demand by the banks. The entire loan amount is paid in a lump sum by crediting it to the loan account of the borrower, and thus entire loan becomes chargeable to interest with immediate effect.

- Short-term Loans: These loans may be given as personal loans, loans to finance working capital, or as priority sector advances. These are made against some security and the entire loan amount is transferred to the loan account of the borrower.

Discounting of Bills of Exchange: It is short-term financial assistance extended by the bank usually tõ the businesses that they have a current account with the bank. When a bill of exchange is presented before the bank for encashment, the bank credits the amount to the customer’s account after deducting some discount. On maturity of the bill, the payment is received by the bank from the drawee.

(c) Investment of Funds: The banks invest their surplus funds in three types of securities as Government securities, other approved securities, and other securities.

- Government securities include both, central and state governments, such as treasury bills, national savings certificates, etc.

- Other securities include securities of state-associated bodies like electricity boards. housing boards, debentures of land development banks units of UTI, shares of regional rural banks, etc.

(d) Agency Functions: Banks function in the form of agents and representatives of their customers. Customers give their consent for performing such functions. The important functions of these types are as follows:

- Banks collect cheques, drafts, bills of exchange, and dividends of the shares for their customers.

- Banks make payment for their clients and at times accept the bills exchange: of their customers for which payment is made at the fixed time.

- Banks pay the insurance premium of their customers. Besides this, they also deposit loan installments, income-tax, interest, etc. as per directions.

- Banks purchase and sell securities, shares, and debentures on behalf of their customers.

- Banks arrange to send money from one place to another for the convenience of their customers.

(e) Miscellaneous Functions: Besides the functions mentioned above, banks perform many other functions of general utility which are as follows:

- Banks make ai-arrangement of lockers for the safe custody of valuable assets of their customers such as gold, silver, ‘çal documents, etc.

- Banks give reference for their cu.4tomers.

- Banks collect necessary and useful statistics relating to trade and industry.

- For facilitating foreign trade, banks undertake to sell and purchase foreign exchange.

- Banks advise their clients relating to investment decisions as specialists.

- Bank does the underwriting of shares and debentures also.

- Banks issue letters of credit.

- During natural calamities, banks arc highly useful in mobilizing funds and donations.

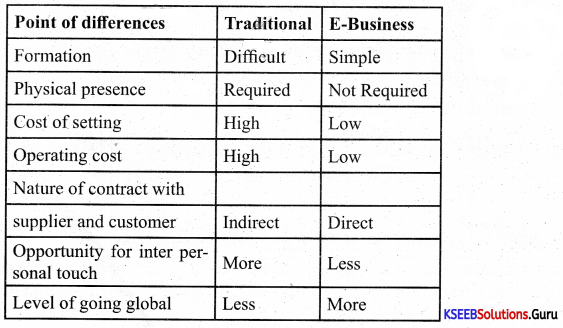

Question 28.

Bring out any four distinctions between traditional business and e-business.

Answer:

Question 29.

Explain the social responsibility of business towards.

(a) Shareholders

(b) Consumers

Answer:

Social responsibility of business towards shareholders:

(a) A fair rate of dividend should be regularly paid by the business enterprises to their owners.

(b) Management techniques should be effective and efficient so that the net present value of the business is maximized.

(c) Owners should be given the right to participate in the affairs of the enterprise.

(d) The tendency towards the growth of ‘Oligarchic management’ should be arrested.

(e) The owners should be given the full information regarding the working of the company. In other words, accurate and comprehensive reports have to be supplied.

(f) Financial information has to be disclosed and doubts, have to be clarified.

(g) Chairman and directors of the company should be easily accessible to the owner.

Social responsibility of business towards consumer:

(a) Ensuring availability of products in the right quantity, at the right place, and at the right time.

(b) Maintaining the quality of the goods, increasing the quality to the maximum extent so as to compete with any international product.

(c) Charging reasonable prices to its products.

(d) Correct weights and measures have to be used.

(e) The company must provide after-sale service for maintenance of goods.

(f) The business firms should avoid restrictive trade practices and see that full justice is done to the amount that is spent by a consumer.

(g) Constant investigation and discovery of growing wants of consumers, giving importance for research and development of new products that satisfy their wants

(h) Taking all such measures which promote consumer satisfaction, interest, and welfare.

![]()

Question 30.

Explain briefly any four clauses of the Memorandum of Association.

Answer:

(a) Name Clause: It contains the name by which the company will be established. The approval of the proposed name is taken in advance from the Registrar of the companies.

(b) Objects Clause: It contains a detailed description of the objects and rights of the company, for which it is being established. A company can undertake only those activities which are mentioned in the objects clause of its memorandum.

(c) Capital Clause: It contains the proposed authorized capital of the company. It gives the classification of the authorized capital into various types of shares, (like equity and preference shares) with their numbers and nominal value. A company is not allowed to raise more capital than the amount mentioned as its authorized capital. However, the company is permitted to alter this clause as per the guidelines prescribed by the Companies Act.

(d) Liability Clause: It contains financial limits up to which the shareholders are liable to pay off to the outsiders in the event of the company being dissolved or closed down.

Question 31.

Explain briefly the financial needs of a business.

Answer:

(a) To purchase fixed assets: Every type of business needs some fixed assets like land and building. furniture, machinery, etc. A large amount of money is required for the purchase of these assets.

(b) To meet day-to-day expenses: After the establishment of a business, funds are needed to carry out day-to-day operations.

(c) To fund business growth: Growth of business may include expansion of the existing line of business as well as adding new lines. To finance such growth, one needs more funds.

(d) To bridge the time gap between production and sales: The amount spent on production is realized only when sales are made. Normally, there is a time gap between production and sales and also between sales and realization of cash. Hence during this interval, expenses continue to be incurred, for which funds are required.

(e) To meet contingencies: Funds are always required to meet the ups and downs of business and for some unforeseen problems.

Question 32.

What are public deposits? Explain four merits of public deposit as a source of business finance.

Answer:

Merits

(a) The deposits that are raised by organizations directly from the public are known as public deposits.

(b) The procedure of obtaining deposits is simple and does not contain restrictive conditions as are generally there in a loan agreement.

(c) Cost of public deposits is generally lower than the cost of borrowings from banks and financial institutions.

(d) Public deposits do not usually create any charge on the assets of the company. e assets can be used as security for raising loans from other sources.

(e) As the depositors do not have voting rights, the control of the company is not diluted.

Demerits

(a) New companies generally find it difficult to raise funds through public deposits.

(b) It is an unreliable source of finance as the public may not respond when the company needs money.

(c) Collection of public deposits may prove difficult, particularly when the size of deposits required is large.

Question 33.

Briefly explain any four common incentives to attract small-scale industries in rural areas by the government.

Answer:

Some of the common incentives provided by the Government for industries in backward and hilly areas are as follows:

(a) Land: Every state offers developed plots for setting up industries. The terms and conditions may vary. Some states don’t charge rent in the initial years, while some allow payment in installments.

(b) Power: It is supplied at a concessional rate of 50%, while some states exempt such units from payment in the initial years.

(c) Water: It is supplied on a no-profit, no-loss basis or with 50% concession or exemption from water charges for a period of 5 years. Sales Tax: In all union territories, industries are exempted from sales tax, while some states extend the exemption for 5 years period.

(d) Octroi: Most states have abolished octroi.

(e) Raw materials: Units located in backward areas get preferential treatment in the matter of allotments of scarce raw materials like cement, iron, and steel, etc.

(f) Finance: Subsidy of 10-15% is given for building capital assets. Loans are also offered at concessional rates.

(g) Industrial estates: Some states encourage the setting up of industrial estates in backward areas.

(h) Tax holiday: Exemption from paying taxes for 5 or 10 years is given to industries established in backward, hilly and tribal areas.

![]()

Question 34.

Explain briefly the four merits of departmental stores.

Answer:

Merits

(a) Attract a large number of customers: As these stores are usually located in central places they attract a large number of customers during the best part of the day.

(b) Convenience in buying: By offering a large variety of goods under one roof the departmental stores provide great convenience to customers in buying almost all goods of their requirements at one place. As a result, they do not have to run from one place to another to complete their shopping.

(c) Attractive services: A departmental store aims at providing maxîmum services to the customers. Some of the services offered by it include home delivery of goods, execution of telephone orders, grant of credit facilities, and provision for restrooms, telephone booths, restaurants, salons, etc.

(d) Economy of large-scale operations: As these stores are organized at a very large scale, the benefits of large-scale operations, particularly, in respect of the purchase of goods are available to them.

(e) Promotion of sales: The departmental stores are in a position to spend a considerable amount of money on advertising and other promotional activities, which help in boosting their sales.

Section – D

IV. Answer any four of the following questions in 20-25 sentences each. Each question carries 8 marks: ( 4 × 8 = 32 )

Question 35.

Briefly explain the various types of financial institutions.

Answer:

Industrial Finance Corporation of India (IFCI):

- It was established in July 1948 as a statutory corporation under the Industrial Finance Corporation Act, 1948.

- Its objectives include assistance towards balanced regional development and encouraging new entrepreneurs to enter into the priority sectors of the economy.

State Financial Corporations (SFC):

- The State Financial Corporations Act, 1951 empowered the State Governments to establish State Financial Corporations.

- Its, objective providing medium and short-term finance to industries of the states.

- SFCs are helpful in ensuring balanced regional development, higher investment, more employment generation, and broad ownership of industries.

Industrial Credit and Investment Corporation of India (ICICI)

- This was established in 1955 as a public limited company under the Companies Act.

- Its objective is to assists the creation, expansion, and modernization of industrial enterprises exclusively in the private sector.

Question 36.

Explain briefly the import trade procedure.

Answer:

(a) Trade inquiry: The importing firm approaches the export firms with the help of trade inquiry they collecting information about their export prices and terms of exports. After receiving a trade inquiry, the exporter will prepare a quotation called a proforma invoice.

(b) Procurement of import license: There are certain goods that can be imported freely, while others need licensing. The importer needs to consult the Export-Import (EXIM) policy in force to know whether the goods that he or she wants to import are subject to import licensing.

(c) Obtaining foreign exchange: Since the supplier in the context of an import transaàtion resides in a foreign country, he/she demands payment in a foreign currency Payment in foreign currency involves the exchange of Indian currency into foreign currency.

(d) Placing order or indent: Aller obtaining the import license, the importer placeš an import order or indent with the exporter for the supply of the specified prodücts. The import order contains information about the price, quantity size, grade, and quality of goods ordered and the instructions relating to packing, shipping, ports of shipment and destination, etc

(e) Arranging for finance: The importer should make arrangements in advance to pay to the exporter on the arrival of goods at the port. Advanced planning for financing imports is necessary so as to avoid huge demurrages (i.e., penalties) on the imported goods lying uncleared at the port for want of payments.

(f) Obtaining a letter of credit: If the payment terms agreed between the importer and the overseas supplier is a letter of credit, then the importer should obtain the letter of credit from its bank and forward it to the overseas supplier.

(g) Receipt of shipment advice: After loading the goods on the vessel, the overseas supplier dispatches the shipment advice to the importer. Shipment advice contains information about the shipment of goods.

(h) Retirement of import documents: Having shipped the goods, the overseas supplier prepares a set of necessary documents as per the terms of contract and letter of credit and hands it over to his or her banker for their onward transmission and negotiation to the importer in the manner as specified in the letter of credit.

(i) Arrival of goods: Goods are shipped by the overseas supplier as per the contract. The person in charge of the carrier (ship or airway) informs the officer in charge at the dock or the airport about the arrival of goods in the importing country. He provides the document called import general manifest. import general manifest is a document that contains the details of the imported goods.

(j) Customs clearance and release of goods: All the goods imported into India have to pass through customs clearance after they cross the Indian borders. Customs clearance is a somewhat tedious process and calls for completing a number of formalities. It is, therefore, advised that importers appoint C&F agents who are well versed with such formalities and play an important role in getting the good’s customs cleared.

![]()

Question 37.

Explain the principles of insurance.

Answer:

(a) Principle of Utmost Good Faith: According to this principle, the insurance contract must be signed by both parties (i.e. insurer and insured) in absolute good faith or belief or trust. The person getting insured must willingly disclose and surrender to the insurer his complete true information regarding the subject matter of insurance.

Example: If any person has taken a life insurance policy by hiding the fact that he is a cancer patient and later on if he dies because of cancer then the Insurance Company can refuse to pay the compensation as the fact was hidden by the insured.

(b) Principle of Insurable Interest: As per this principle, the insured must have an insurable interest in the subject matter of insurance. It means the insured should gain by the existence or safety and lose by the destruction of the subject matter of insurance.

Example: If a person has taken the loan against the security of factory premises then the lender can take the fire insurance policy of that factory without being the owner of the factory because he has a financial interest in the factory premises.

(c) Principle of Indemnity: According to the principle of indemnity, an insurance contract is signed only for getting protection against unpredicted financial losses arising due to future uncertainties. The insurance contract is not made for making a profit else its sole purpose is to give compensation in case of any damage or loss.

Example: A person insured a car for 5 lakhs against damage or an accident case. Due to the accident, he suffered a loss of 3 lakhs, then the insurance company will compensate him 3 lakhs not only the policy amount i.e., 5 lakhs as the purpose behind it is to compensate not to make a profit.

(d) Principle of Contribution: According to this principle, the insured can claim the compensation only to the extent of actual loss either from all insurers in a proportion or from any one insurer.

Example: A person gets his house insured against fire for 50,000 with insurer A and for 25,000 with insurer B. A loss of 37,500 occurred. Then A is liable to pay 25,000 and B is liable to pay 12,500.

(e) Principle of Subrogation: According to the principle of subrogation, when the insured is compensated for the losses due to damage to his insured property, then the ownership right of such property shifts to the insurer.

Example: If a person receives Rs. 1 lakh for his or her damaged stock, then the ownership of the stock will be transferred to the insurance company and the person will hold no control over the stock.

(f) Principle of Mitigation of Loss: According to the Principle of mitigation of loss, the insured must always try his level best to minimize the loss of his insured property, in case of uncertain events like a fire outbreak or blast, etc. The insured must not neglect and behave irresponsibly during such events just because the property is insured.

Example: If a person has insured his house against ere, then, in case of fire, he or she should take all possible measures to minimize the damage to the property exactly in the manner he or she would have done in absence of the insurance:

(g) Principle of Causa Proxima: Principle of Causa Proxima (a Latin phrase), or in simple English words, the Principle of Proximate (i.e. Nearest) Cause, means when a loss is caused by more than one causes, the proximate or the nearest cause should be taken into consideration to decide the liability of the insurer.

Example: If an individual suffers a loss in a fire accident, then this should already be a part of the contract in order for this person to claim the insurance amount.

Question 38.

Explain any eight factors that affect the choice of an appropriate source of Business Finance.

Answer:

(a) Cost: There are two types of cost viz., the cost of procurement of funds and cost of utilizing the funds. Both these costs should be taken into account while deciding about the source of funds that will be used by an organization.

(b) Financial strength and stability of operations: The financial strength of a business is also a key determinant. In the choice of source of funds, the business should be in a sound financial position so as to be able to repay the principal amount and interest on the borrowed amount.

(c) Form of organization and legal status: The form of business organization and status influences the choice of a source for raising money.

(d) Purpose and time period: Business should plan according to the time period for which the funds are required. A short-term need for example can be met through borrowing funds at a low rate of interest through trade credit, commercial paper, etc. For long-term finance, sources such as the issue of shares and debentures are more appropriate.

(e) Risk profile: Businesses should evaluate each of the sources of finance in terms of the risk involved. For example, there is the least risk inequity as the share capital has to be repaid only at the time of winding up and dividends need not be paid if no profits are available.

(f) Control: A particular source of funds may affect the control and power of the owners on the management of a firm. Issue of equity shares may mean dilution of the control.

(g) Effect on crêdit worthiness: The dependence of business on certain sources may affect its creditworthiness in the market.

(h) Flexibility and ease: Another aspect affecting the choice of a source of finance is the flexibility and ease of obtaining funds. Restrictive provisions, detailed investigation, and documentation in case of borrowings from banks and financial institutions.

![]()

Question 39.

Explain four merits and four demerits of Mail Order Houses.

Answer:

Merits

(a) Limited capital requirement: Mail order business does not require heavy expenditure on building and other infrastructural facilities. Therefore, it can be started with a relatively low amount of capital.

(b) Elimination of middlemen: The biggest advantage of mail-order business from the point of view of consumers is that unnecessary middleman between the buyers and sellers are eliminated. This may result in a lot of savings both to the buyers as well as to the sellers.

(c) Wide reach: Under this system, the goods can be sent to all the places having postal services. This opens a wide scope for business as a large number of people throughout the country can be served through the mail.

(d) Convenience: Under this system goods are delivered to the doorstep of the customers. This results in great convenience to the customers in buying these products.

(e) Absence of bad debt: Since the mail-order houses do not extend credit facilities to the customers, there are no chances of any bad debt on account of non-payment of cash by the customers.

Limitations

(a) No credit: Supermarkets sell their products cash basis only. No credit facilities are made available to the buyers. This restricts the purchasing power of buyers from such markets.

(b) No personal attention: Supermarkets work on the principle of self-service. The customers, therefore, don’t get any personal attention. As a result, such commodities that require personal attention by salespeople cannot be handled effectively in supermarkets.

(c) Mishandling of goods: Some customers handle the goods kept on the shelf carelessly. This may raise costs in supermarkets.

(d) High overhead expenses: Supermarket incurs high overhead expenses. As a result, there have not been able to create low-price appeal among the customers.

(e) Possibility of abuse: This type of business provides a greater possibility of abuse to dishonest traders to cheat the customers by making false claims about the products or not honoring the commitments made through handbills or advertisements.

(f) High dependence on postal services: The success of mail-order business depends heavily on the availability of efficient postal services at a place. But in a vast country like ours, where many places are still without postal facilities, this type of business has Limited prospects.

Question 40.

What is a joint venture and explains the merits and demerits?

Answer:

A joint venture means establishing a firm that is jointly owned by two or more otherwise independent fiíms. In the widest sense of the term, it can also be described as any form of association which implies collaboration for more than a transitory period.

Advantages:

(a) Since the local partner also contributes to the equity capital of such a venture, the international firm finds it financially less burdensome to expand globally.

(b) Joint ventures make it possible to execute large projects requiring huge capital outlays and manpower.

(c) The foreign business firm benefits from a local partner’s knowledge of the host countries regarding the competitive conditions, culture, language, political systems, and business systems.

(d) In many cases entering into a foreign market is very costly and risky. This can be avoided by sharing costs and/or risks with a local partner under joint venture agreements.

Limitations:

(a) Foreign firms entering into joint ventures share the technology and trade secrets with local firms in foreign countries, thus always running the risks of such technology and secrets being disclosed to others.

(b) The dual ownership arrangement may lead to conflicts, resulting in a battle for control between the investing firms.

Section – E (PRACTICAL ORIENTED QUESTIONS)

V. Answer any two of the following questions: ( 2 × 5 = 10 )

Question 41.

As the owner of a business unit, what risks are faced by you in running it?

Answer:

The risk faced by the owner while mining a business unit are:

- Market information risk

- Consumer taste and preferences risk

- Government policy risk

- Capital risk

- Operational risk.

![]()

Question 42.

Give a list of any live institutions which support small businesses in India.

Answer:

Five institutions that support small businesses in India are:

(a) National Bañk for Agriculture and Rural Development (NABARD)

(b) National Small Industrial Corporation (NSIC)

(c) Small Industrial Development Bank of India (SIDBI)

(d) Rural and Women Entrepreneurship Development (RWED)

(e) District Industries Centres (DICs).

Question 43.

Mention any five foreign trade promotion measures and schemes undertaken by the Government of India.

Answer:

Five foreign trade promotion measures and schemes are undertaken by the Government of India to boost up foreign trade are:

(a) Duty drawback scheme.

(b) Advance licence sheme.

(c) Exemption from payment of sales taxes.

(d) Export promotion capital goods scheme.

(e) Export finance at concessional rates of interest.

(f) Export of services.

(g) Export processing zones.

(h) 100 percent export-oriented unit.