You can Download Chapter 5 Bank Reconciliation Statement Questions and Answers, Notes, 1st PUC Accountancy Question Bank with Answers Karnataka State Board Solutions help you to revise complete Syllabus and score more marks in your examinations.

Karnataka 1st PUC Accountancy Question Bank Chapter 5 Bank Reconciliation Statement

1st PUC Accountancy Recording of Transactions II One Mark Questions and Answers

Question 1.

What is bank reconciliation statement?

Answer:

The statement which explains causes of differences between the cash bank balance and the pass book balance called bank reconcilitation statement.

Question 2.

Why is bank reconciliation statement is prepared?

Answer:

- Statement helps the customer to reconcile the difference between pass book and cash book.

- To know the real balance of pass book and cash book means real cash balance.

- To keep track on cheque issues and cheque deposited into account.

Question 3.

State any one reasons for the difference between cash book balance and pass book balance.

Answer:

The differences between cash and pass book casuse are :

- Cheque deposited into bank but not realised.

- Cheque issued to parties but not presented.

- Any expenses directly debited by bank book and not in the cash book.

- Any income directly received by bank and not recorded by business.

![]()

Question 4.

Write one features of Bank Reconciliation statement (BRS).

Answer:

Features of Bank reconciliation statement are:

- It is prepare by customer of the bank but not the banker.

- BRS explains the differences between the bank pass book and cash book

- It helps to keep track on cheque issue and deposits.

Question 5.

What do you understand by the following?

(a) Debit balance as per cash book.

(b) Credit balance as per cash book.

Answer:

(a) Debit balance as per cash book: Cash balance as per companies books of a/c’s called debit balance.

(b) Credit balance as per cash book: The overdrawn balance of cash in companies books a/c called credit balance.

Question 9.

What is bank overdraft?

Answer:

It is a current a/c. Where bank provide opportunity to withdraw more than deposit called (B.O.D.) Bank Over Draft.

Question 10.

Mention one methods of preparing BRS.

Answer:

The Two methods of preparing BRS

- Statement method or one column method.

- Debit column and credit column method or two column method

Question 12.

Who prepare bank reconcilation?

Answer:

The bank reconciliation statement prepared by customer and not by banker.

1st PUC Accountancy Recording of Transactions II Additional Questions and Answers

Question 1.

What do you understand by the following?

(a) Debit balance as per cash book.

(b) Credit balance as per cash book.

Answer:

(a) Debit balance as per cash book: Balance of cash as per pass book called debit balance, (b) Credit balance as per cash book: Overdrawn cash balance o,f bank balance as per pass book called credit balance.

Question 2.

What do you understand by the following.

(a) Favourable balance as per cash book.

(b) Unfavourable balance as per cash book.

Answer:

Favourable Balance as per cash book: The Debit Balance of cash is favourable balance of cash book.

Unfavourable cash book: The Negative Balance of cash is unfavourable cash book

Question 3.

What is Pass book?

Answer:

The printing statement or book which explain the transactions of deposit holder called pass book.

![]()

Question 4.

Mention Two methods of preparing BRS.

Answer:

The Two methods of preparing BRS

- Statement method or one column method.

- Debit .column and credit column method or two column method

Question 5.

Write any two advantages of BRS.

Answer:

- BRS helps to know the real value of cash balance of business in particular period end.

- It helps to detect/errors irregularities and frauds committed by employees, in the business.

Question 6.

State the need for the preparation of bank reconciliation statement?

Answer:

The need to prepare Bank Reconciliation Statement is given below:

- It helps in finding out the errors and omissions committed in the Cash Book and the Pass Book.

- It shows uncleared cheques, which have already been debited in the Cash Book but have not been yet recorded in the Pass Book.

- It helps in checking embezzlement of money from the bank account.

- It helps in measuring the accuracy of the transactions recorded in the Cash Book.

- It facilities in preparing revised Cash Book that reflects true bank balance.

Question 7.

What is Bank Overdraft?

Answer:

Bank overdraft is a liability to an account holder. When the account holder withdraws excess amount over available bank balance, he/she runs a negative bank balance. The negative bank balance is an obligation to the account holder and is called bank overdraft. In other words, bank overdraft is the excess of withdrawal over deposits,

Question 8.

Briefly explain the statement ‘Wrongly debited by the bank’ with example.

Answer:

Amount wrongly debited by the bank implies a situation when the bank wrongly debits a Pass Book. The following are the common mistakes that occur in the Pass Book when bank wrongly debits in the Pass Book. Mistakes occurs in case a person has more than one account in a bank. For example, a cheque of ₹ 2,000 issued from his Current Account was wrongly paid through his Savings Account.

Question 9.

State the causes of difference occured due to time lag.

Answer:

The causes of difference that occur due to time lag are,

- When issued cheques are not presented for payment in the period for which Bank Reconciliation Statement is being prepared, i.e., date of issue and the date of presenting the cheques are not same.

- When deposited cheques are not cleared in the period for which the Bank Reconciliation Statement is being prepared.

Question 10.

Briefly explain the term favourable balance as per cash book.

Answer:

Favourable balance (Debit Balance), as per the Cash Book, is an asset to an account holder. It is also known as debit balance as per the Cash Book. Favourable balance is the excess of total of debit side over total of credit side of a bank column of a Cash Book.

In other words, favourable balance means excess of deposits over withdrawals.

![]()

Question 11.

Enumerate the steps to ascertain the correct cash book balance.

Answer:

Genrally, differences between the Cash Book and the Pass Book arise due to the reason that items have not been recorded in the Cash Book. In order to ascertain the correct Cash Book balance, we need to prepare corrected (Adjusted) Cash Book.

The below given steps are involved in the preparation of corrected (Adjusted) Cash Book.

Step 1: Note down the bank balance as per the Cash Book.

Step 2: Rectify all the errors committed in the Cash Book.

Step 3: Enter those transactions in the debit of the Cash Book, in the that are only in the debit of the Pass Book.

Step 4: Enter those transactions in the credit of the Cash Book that are only in the debit of the Pass Book.

Step 5: The Cash Book is totalled and balancing figure is calculated. This balancing figure is use for preparing BRS.

1st PUC Accountancy Recording of Transactions II Essay type / Long Questions and Answers

Question 1.

What is a bank reconciliation statement? Why is it prepared?

Answer:

Bank reconciliation statement is a statement prepared for determining causes of differences and. reconciling bank balance (as per the Cash Book) with the balance as per the Pass Book or vice versa.

Bank Reconciliation Statement (BRS) is prepared when the bank balance of the Cash Book is not equal to the balance shown by the Pass Book on the same date (when BRS is being prepared). In order to match the two respective balances, errors and omissions are to be located and rectified, which is the main rationale behind preparing the Bank Reconciliation Statement.

The need for preparation of Bank Reconciliation Statement is:

- It helps in finding out the errors and omissions committed in the Cash Book and in the Pass Book.

- It shows uncleared cheques that have already been debited in the Cash Book but have not yet been recorded in the Pass Book.

- It helps in checking embezzlement of money from the bank account.

- It helps in measuring the accurancy of transactions recorded in the Cash Book.

- It facilitates in preparing revised cash book that reflects a true bank balance.

Question 2.

Explain the reasons where the balance shown by the bank Passbook does not agree with the balance as shown by the bak column of the cash book.

Answer:

Below given are the reasons on account of which the balance shown by the bank Pass Book does not agree with the balance shown by the bak column of the Cash Book.

1. Differences due to time lag: Differences may arise, if the date of recording transactions in the bank column of the Cash Book is not same to that of the Pass Book.

2. Cheques issued by the firm but not presented in the bank: Usually, issue of a cheque is recorded in the bank column of the Cash Book on the date that is mentioned

(mentioned date) on the cheque. Sometimes, the holder of the cheque does not present the cheque on the date which is mentioned on it. This may lead to differences in the balance between the Pass Book and the bank balance of the Cash Book.

3. Deposit of cheque recorded in the Cash Book at the time of deposit but collected later or not collected by the bank: Deposit of a cheque is recorded in the bank column of the Cash Book on the date of clearance. Usually, date of deposit and date of clearance are not the same. This difference in the two respective dates leads to a mismatch between the Pass Book and the bank balance of the Cash Book.

4. Transactions recorded only in the Pass Book: Transactions, like interest allowed by bank on the deposits, bank charges etc., are recorded first in the Pass Book. After getting intimation from the bank, these are recorded in the bank column of the Cash Book. However, sometimes due to delay in intimation of these transactions to the customers, the Cash Book remains not updated, which leads to the difference between the Pass Book and the bank balance of the Cash Book.

Question 3.

Explain the process of preparing bank reconciliation statement with amended cash

balance.

Answer:

Bank Reconciliation statement can be prepared with the adjusted /amended bank column of the cash book by the below given steps.

Step 1 : Note down the bank balance as per the Cash Book.

Step 2 : Rectify all the errors committed in the Cash Book.

Step 3 : Enter those transactions in the debit column of the Cash Book that are only in the credit column of the pass book.

Step 4 : Enter those transactions in the credit column of the Cash Book that are only in the debit column of the Pass Book.

Step 5 : After completing the above steps, the balance or the overdraft, as per amended Cash Book, arrives, with which Bank Reconciliation Statement can be prepared.

![]()

1st PUC Accountancy Recording of Transactions II Twelve Marks Questions and Answers

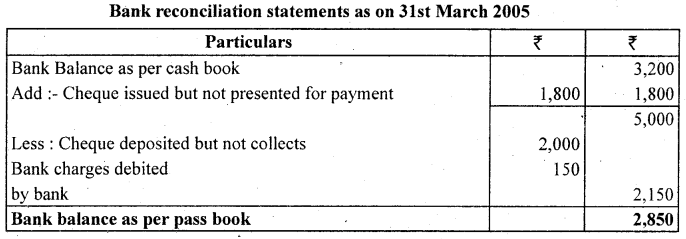

Question 1.

(i) Balance as per cash book ₹ 3,200

(ii) Cheque issued but not presented for payment ₹ 1,800

(iii) Cheque deposited but not collected upto March 31, 2005 ₹ 2000

(iv) Bank charges debited by bank ₹ 150

(v) Bank charges debited by bank ₹ 150

Answer:

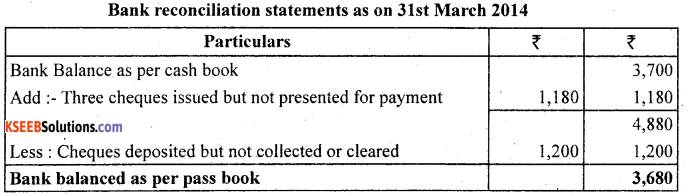

Question 2.

On March 31, 2005 the cash book showed a balance ₹ 3,700 as cash at bank, but the bank passbook made up to same date showed that cheques for ₹ 700. ₹ 300 and ₹ 180 respectively had not presented for payment. Also cheque amounting to ₹ 1,200 deposited into the account had not been credited. Prepare a bank reconciliation statement.

Answer:

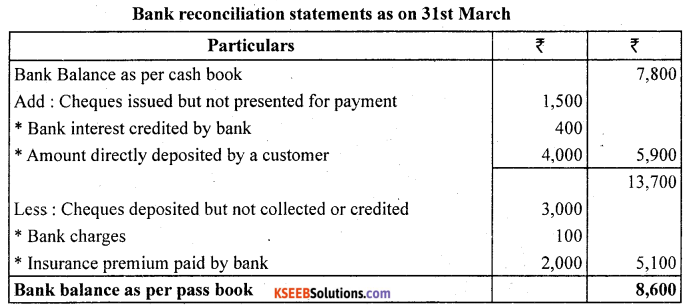

Question 3.

The cash book shows a bank balance of ₹ 7,800. On comparing the cash book with passbook the following discrepancies were noted:

(a) Cheque deposited in bank but not credited ₹ 3,000

(b) Cheque issued but not yet present for payment ₹ 1,500

(c) Insurance premium paid by the bank ₹ 2000

(d) Bank interest credit by the bank ₹ 400

(e) Bank charges ₹ 100

(d) Directly deposited by a customer ₹4,000.

Answer:

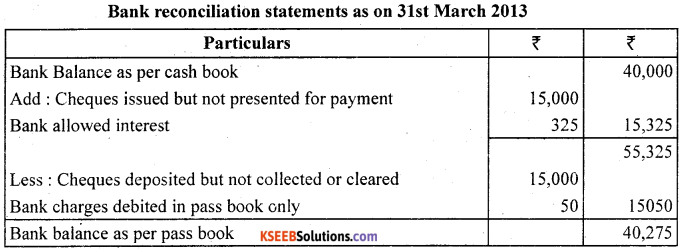

Question 4.

Bank balance of ₹ 40,000 showed by the cash book of Atul on December 31, 2005. It was found that three cheques of ₹ 2,000. ₹ 5,000 and ₹ 8,000 deposited during the month of December were not credited in the passbook till January 0.2, 2005. Two cheque of ₹ 7,000 and ₹ 8,000 issued on December 28, were not presented for payment till January 03, 2005. In addition to it bank had credited Atual for ₹ 325 as interest and had debited him with ₹ 50 as bank charges for which there were no corresponding entries in the cash book.

Prepare a bank reconciliation statement as on December 31, 2004.

Answer:

Question 5.

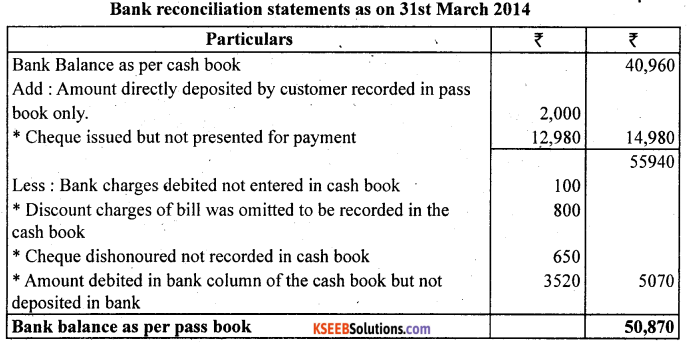

On comparing the cash book with passbook of Naman it is found that on March 31, 2005, bank balance of ₹ 40,960 showed by the cash book differs from the bank balance with regard to the following:

(a) Bank charges ₹ 100 on March 31,2005, are not entered in the cash book.

(b) On March 21, 2005, a debtor paid ₹ 2,000 into the company’s bank in settlement of his account, but no entry was made in the cash book of the company in respect of this.

(c) Cheques totaling ₹ 12,980 were issued by the company and duly recorded in the cash book before March 31, 2005, but had not been presented at the bank for payment until after that date.

(d) All bill for ₹ 6,900 discounted with the bank is entered in the cash book with recording the discount charge of ₹ 800.

(e) ₹ 3,520 is entered in the cash book as paid into bank on March 31st 2005. but not credited by the bank until the following day.

(f) No entry has been made in the cash book to record the dishon or on March 15, 2005 of a cheque for ₹ 650 received from Bhanu.

Answer:

Prepare a reconciliation statement as on March 31,2005.

![]()

Question 6.

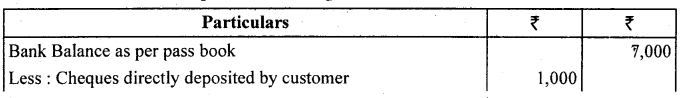

Prepare bank reconciliation statement as on December 31, 2004. On this day the passbook of Mr. Himanshu showed a balance of ₹ 7,000.

(a) Cheques of ₹ 1,000 directly deposited by a customer.

(b) The bank has credited Mr. Himanshu for ₹ 700 as interest. ”

(c) Cheques for ₹ 3000 were issued during the month of December but of these cheques for ₹ 1,000 were not presented during the month of December.

Answer:

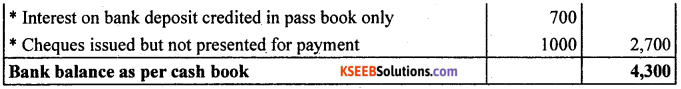

Question 7.

The passbook of Mr. Mohit current account showed a credit Balance of ₹ 20,000 on dated December 31, 2005. Prepare a bank reconciliation statement with the following information.

(i) A cheque of ₹ 400 drawn on his saving account has been shown on current account.

(ii) He issued two cheques of ₹ 300 and ₹ 500 on of December 25, but only the 1st cheque was presented for payment

(iii) One cheque issued by Mr. Mohit of ₹ 500 on December 25, but it was not presented for payment whereas it was recorded twice in the cash book.

Answer:

Question 8.

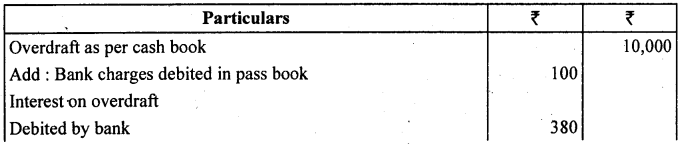

Prepare bank reconciliation statement.

(i) Overdraft shown as per cash book on December 31 2005 ₹10,000.

(ii) Bank charges for the above period also debited in the passbook ₹ 100.

(iii) Interest on overdraft for six months ending December 31, 2005 ₹ 380 debited in the passbook.

(iv) Cheques issued but not incashed prior to December 31,2005 amounted to ₹ 2,150.

(v) Interest on investment collected by the bank and credited in the passbook ₹ 600.

(vi) Cheques paid into bank but not cleared before December, 31,2005 were ₹ 1,100.

Answer:

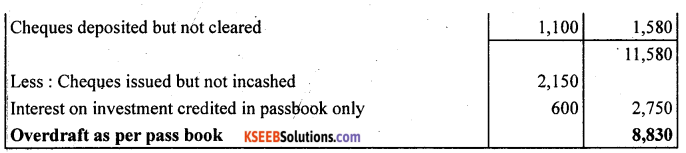

Question 9.

Kumar find that the bank balance shown by his cash book on December 31, 2005 is ₹ 90,600 (Credit) but the passbook shows a difference due to the following reason:

A cheque (post dated) for ₹ 1,000 has been debited in the bank column of the cash book but not presented for payment. Also, a cheque for ₹ 8000 drawn in favour of Manohar has not yet been presented for payment. Cheques totaling ₹ 1,500 deposited in bank have not yet been collected and cheque for ₹ 5,000 has been dishonoured.

Answer:

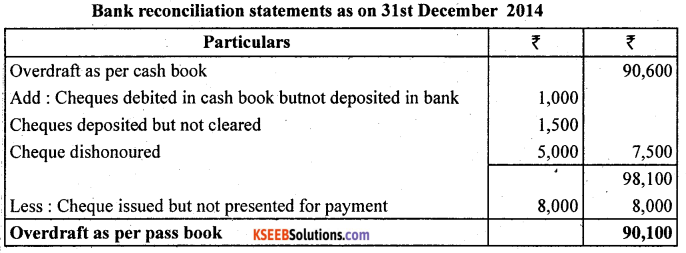

Question 10.

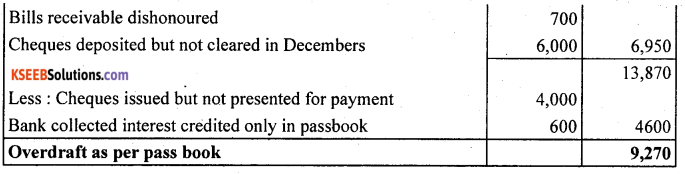

On December 31,2005, the cash book of Mittal Bros. Showed an overdraft of ₹ 6,920. From the following particulars prepare a bank reconciliation statement and ascertain the balance as per passbook.

(1) Debited by bank for ₹ 200 on account of interest on overdraft and ₹ 50 on account of charges for collecting bills.

(2) Cheques drawn but not encashed before December, 31 2005 for ₹ 4,000.

(3) The bank has collected interest and has credited ₹ 600 in passbook.

(4) A bill receivable for ₹ 700 previously discounted with the bank had been dishiioured and debited in the passbook.

(5) Cheques paid into bank but not collected and credited before December 31, 2005 amounted ₹ 6,000.

Answer:

Question 11.

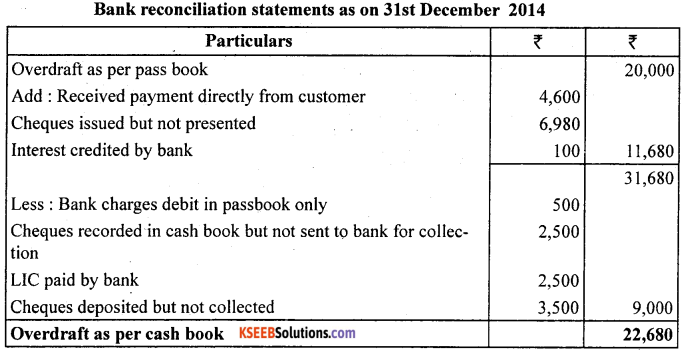

Overdraft shown by the passbook of Mr. Murli is ₹ 20,000. Prepare bank reconciliation statement on dated December 31,2005.

(i) Bank charges debited as per passbook ₹ 500.

(ii) Cheques recorded in the cash book but not sent to the bank for collection ₹ 2,500.

(iii) Received a payment directly from customer ₹ 4,600.

(iv) Cheque issued but not presented for payment ₹ 6,980.

(v) Interest credited by the bank ₹ 100.

(vi) LIC paid by bank ₹ 2,500.

(vii) Cheques deposted with the bank but not collected ₹ 3,500.

Answer:

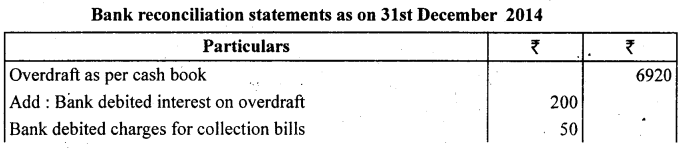

Question 12.

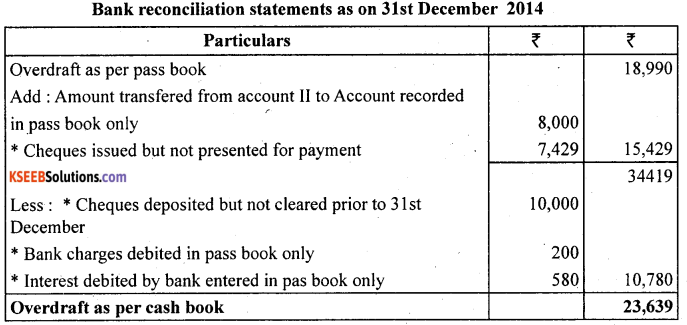

Raghav and Co. have two bank accounts. Account No. I and account No. II. From the following particulars relating to account No. I, find out the balance on that account of December 31,2005 according to the cash book of the firm.

(i) Cheques paid into bank prior to December 31,2005, but not credited for ₹ 10,000.

(ii) Transfer of funds from account No. II to account no. I recorded by the bank on December 31, 2005 but not presented until after that date for ₹ 7,429.

(iii) Cheques issued prior to December 31,2005 but not presented until after that date for ₹ 7,429.

(iv) Bank charges debited by bank not entered in the cash book for ₹ 200.

(v) Interest Debited by the bank not entered in the cash book ₹ 580.

(vi) Overdraft as per passbook ₹ 18,990.

Answer:

![]()

Question 13.

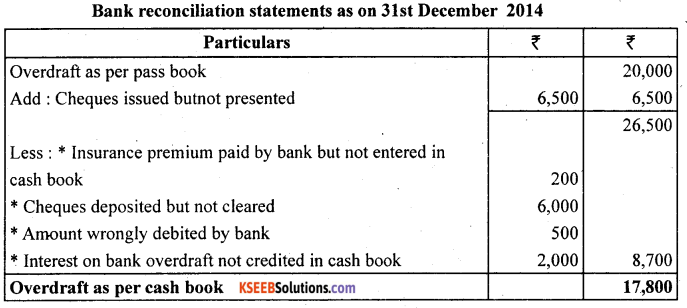

Prepare a bank reconciliation statement from the following particulars and show the balance as per cash book.

(i) Balance as per passbook on December 31,2005 overdrawn ₹ 20,000.

(ii) Interest on bank overdraft not entered in the cash book ₹ 2,000.

(iii) ₹ 200 insurance premium paid by bank has not been entered in the cash book.

(iv) Cheques drawn in the last week of December, 2005, but not cleared till date for ₹ 3,000 and ₹ 3,500.

(v) Cheques deposited into bank on November, 2005, but yet to be credited on dated December 31,2005 ₹ 6,000.

(vii) Wrongly debited by bank ₹ 500.

Answer:

Question 14.

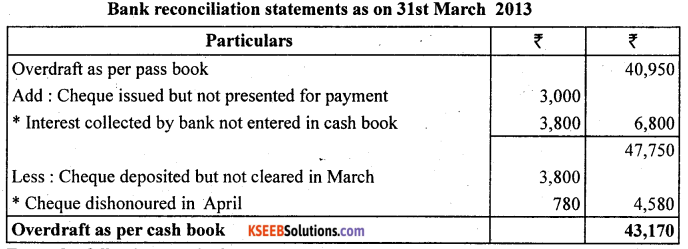

The passbook of Mr. Randhir showed an overdraft of ₹ 40,950 on March 31,2005.

Prepare bank reconciliation statement on March 31,2005.

(i) Out of cheques amounting to ₹ 8,000 drawn by Mr. Randhir on March 27 a cheque for ₹ 3,000 was encashed on April 03.

(ii) Credited by bank with ₹ 3,800 for interest collected by them, but the amount is not entered in the cash book.

(iii) ₹ 10,900 paid in by Mr. Randhir in cash and by cheques on March, 31 cheques amounting to ₹ 3,800 were collected on April, 07.

(iv) A cheque of ₹ 780 credited in the passbook on March 28 being dishonoured is debited again in the passbook on April 01, 2005. There was no entry in the cash book about the dishonour of the cheque until April 15.

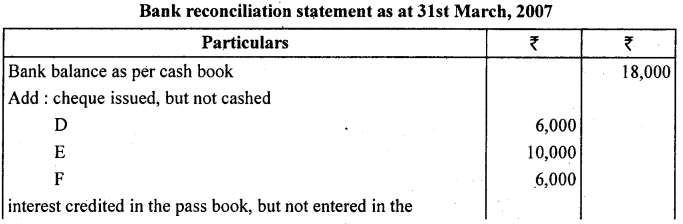

Question 15.

From the following particulars, prepare a Bank reconciliation statement showing the balance as per pass book on 31st March 2007. The following cheques were paid into the firm’s current account in March, 2003, but were credited by the bank in April 2007. Mr. A ₹ 5,000; Mr. B ₹ 6,000 ; Mr. C. ₹ 4,800.

The following cheques were issued by the firm in March, 2007, but were cashed in April, 2007 Mr. D. ₹ 6,000 ; Mr. E. ₹ 10,000 Mr. F. ₹ 6000. The pass book shows a credit of ₹ 500 for interest and a debit of ₹ 10 for Bank charges.

The Bank balance as per cash Book was ₹ 18,000.

Answer:

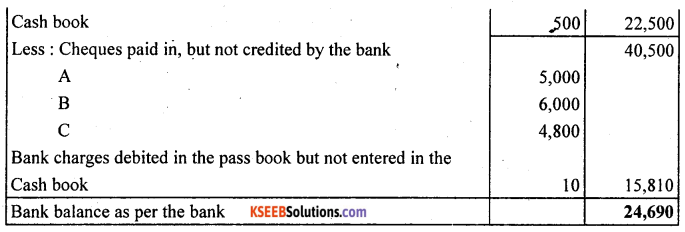

Question 16.

On 30th April, 2005. My pass book showed a credit balance of ₹ 18,000. On 28th April, I have paid in cheques amounting to ₹ 4000. But of these only cheques worth ₹ 2,400 were credited in the pass book. I had issued cheques amounting to ₹ 5,000 of which cheques worth ₹ 4000 only were presented for payment. These was a credit in my pass book of ₹ 400 for interest on my investments collected by my bank. I also found that a cheque for ₹ 500 debited to Bank. Account has been omitted to be banked. An entry of ₹ 1,000 being the amount paid by a customer directly into the book appeared in the pass book.

Answer:

![]()

Question 17.

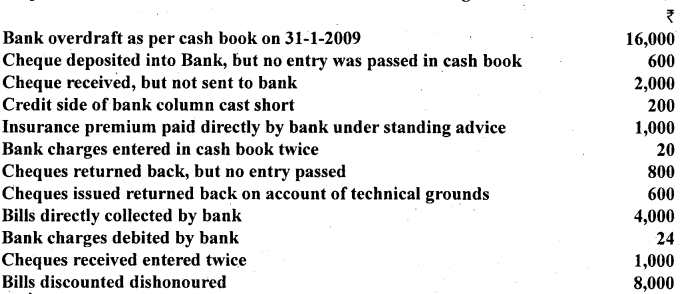

Prepare a Bank Reconciliation statement from the following statement

Answer:

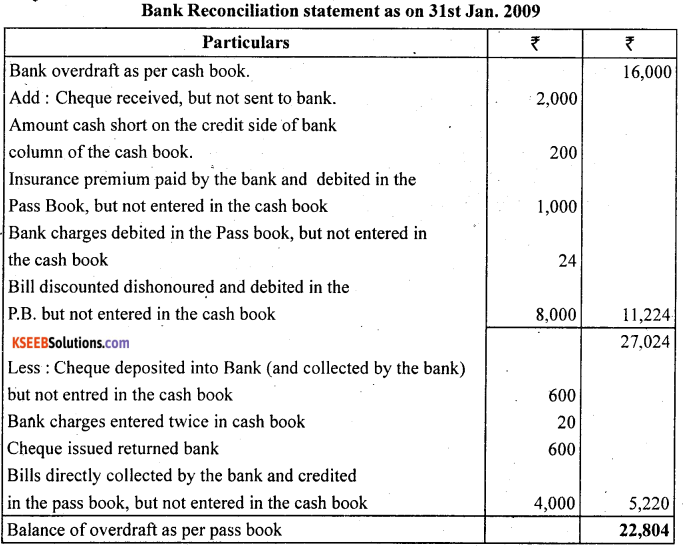

Question 18.

An extract of bank column of cash book of Keerti and his Bank pass book one given below. Prepare Bank reconciliation statement as on 30th Jan. 2010.

Answer:

![]()

Question 19.

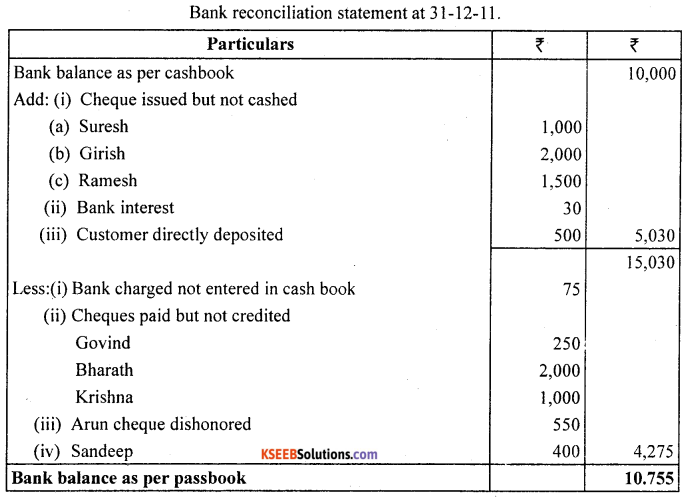

From the following particulars prepare a Bank Reconciliation Statement as at 31-12-2011. Bank Balance as per cash book ₹ 10,000

(a) Cheque issued but not cashed

Mr. Suresh – ₹ 1,000

Mr. Girish – ₹ 2,000

Mr. Ramesh – ₹ 1,500

(b) Bank had charged – ₹ 75 as charges.

(c) Cheques paid into bank, but not collected and credited:

Mr. Govind – ₹ 250

Mr. Bharath – ₹ 2,000

Mr. Krishna – ₹ 1,000

(d) Banker had given of ₹ 30 as interest on bank balance.

(e) A customer of the firm directly deposited ₹ 500 into firm’s bank A/c.

(f) A cheque of ₹ 550 received from Arun was deposited into bank for collection returned dishonored.

(g) A cheque received from Sandeep for ₹ 400 was entered twice in the cashbook.

Answer:

![]()