Students can Download 2nd PUC Economics Model Question Paper 1 with Answers, Karnataka 2nd PUC Economics Model Question Papers with Answers helps you to revise the complete Karnataka State Board Syllabus and score more marks in your examinations.

Karnataka 2nd PUC Economics Model Question Paper 1 with Answers

Time: 3 hrs 15 minutes

Max. Marks: 100

Instruction :

1. Write the question numbers legibly in the margin.

2. Answer for a question should be continuous

PART-A

I. Choose the correct answer (5 × 1 = 5)

Question 1.

In this economy, the government or the central authority plans all the important activities in the economy

(a) Market economy

(b) Centrally planned economy

(c) Mixed economy

(d) Open economy

Answer:

(b) Centrally planned economy

Question 2.

For normal goods, the demand curve shifts ______

(a) Leftward

(b) Downward

(c) Rightward

(d) Horizontal

Answer:

(c) Rightward

![]()

Question 3.

No individual has_____ resources compared to her needs

(a) Limited

(b) Unlimited

(c) Permitted

(d) None of the above

Answer:

(b) Unlimited

Question 4.

Each buyer and seller in perfect competition is a.

(a) Price-maker

(b) Price-taker

(c) Price-analyser

(d) None of the above

Answer:

(b) Price-taker

Question 5.

The government imposes upper limit on the price of a good or service which is called

(a) Price ceiling

(b) Price floor

(c) Price flow

(d) Price stock

Answer:

(a) Price ceiling

II. Fill in the blanks (5 × 1 = 5)

Question 6.

Goods produced by the firm are not homogenous. Such a market structure is called_______

Answer:

Monopolistic competition.

Question 7.

Oligopoly market structure makes the market price of the commodity______

Answer:

Rigid.

![]()

Question 8.

______tries to address situations facing the economy as a whole.

Answer:

Macroeconomics

Question 9.

Addition to the stock of capital of a firm is known as_____

Answer:

Net investment (flow)

Question 10.

The assumption of_____which literally means other things remaining equal or constant.

Answer:

Ceteris paribus

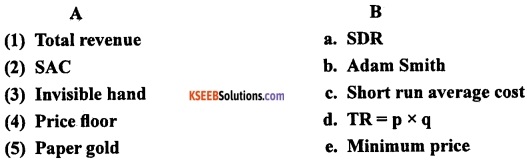

III. Match the following (1 × 5 = 5)

Question 11.

Answer:

1 – d, 2 – c, 3 – b, 4 – e, 5 – a.

IV. Answer the following questions in a sentence/word (5 × 1 = 5)

Question 12.

Define monopoly.

Answer:

Monopoly is a market with only a single seller or firm.

Question 13.

Who are the macroeconomic decision-maker or players?

Answer:

The macroeconomic decision-makers/players are Reserve Bank of India, Securities, and Exchange Board of India and other similar institutions.

Question 14.

What do you mean by ex-ante investment?

Answer:

It is planned investment. It is made with an intention to create capital goods during a particular period of time. Here, the investment is assumed and it is imaginary. It is the anticipated investment during a year.

Question 15.

Who are the ‘free riders’?

Answer:

Free riders are the consumers who will not voluntarily pay for what they can get for free and for which there is no exclusive title to the property being enjoyed. Here the link between the producer and the consumer is broken and the government steps in to provide for such goods.

Question 16.

What type of economic system is followed in Pakistan?

Answer:

Mixed economic system is followed in Pakistan.

PART-B

V. Answer any nine of the following questions in four sentences each (9 × 2 = 18)

Question 17.

What do you mean by monotonic preferences?

Answer:

When the consumer always prefers more of the product which gives him higher level of satisfaction it is called monotonic preferences. That is, an increase in the amount of good 1 along the indifference curve is associated with a decrease in the amount of good 2. This implies that the slope of the indifference curve is downward.

Here, the consumer will not remain indifferent between two combination of commodities when he has an opportunity to have more quantity in one combination than the other.

Question 18.

What do you mean by an inferior good? Give some examples.

Answer:

The inferior goods are those goods for which the demand increases with the fall in income of consumer and vice-versa. That is, there will be a negative relationship between income of consumer and demand for inferior goods.

Example: ragi, jowar, etc.

![]()

Question 19.

Give the meaning of isoquant.

Answer:

Isoquant is the set all possible combinations of the two inputs that yield the same maximum possible level of output. Each isoquant represents a particular level of output and is labelled with that amount of output. The isoquants are negatively sloped.

This is because, when the marginal products are positive, with greater amount of one input, the same level of output can be produced by using lesser amount of the other. So, isoquants are negatively sloped.

Question 20.

What do you mean by ‘break-even point’?

Answer:

The point on the supply curve at which a firm earns normal profit is called break even point. In the long run, a firm reaches break even point, when the supply curve cuts the long-run average cost curve when long run cost curve is minimum.

In the short run, a firm reaches break even point, when the supply curve cuts the short-run average cost curve when short-run cost curve is minimum.

Question 21.

Define equilibrium price and equilibrium quantity.

Answer:

The price at which equilibrium is reached is called equilibrium price. The quantity bought and sold at equilibrium price is called equilibrium quantity.

Therefore, price and quantity will be in equilibrium if qD(p) = qs (p), where p is price and qD is quantity demanded and qs is quantity supplied.

Question 22.

When do you say there in excess demand and excess supply in the market?

Answer:

In the market, at a given price level if market demand is greater than market supply, then it is called excess demand. In the market, at a given price level if market supply is greater than market demand, then it is called excess supply.

Question 23.

What are the features of simple monopoly in the commodity market?

Answer:

The features of simple monopoly in the commodity market are as follows:

- Existence of a single producer of a particular commodity

- No other commodity works as a substitute for this commodity

- Sufficient restrictions to prevent other firms from entering the market.

Question 24.

Between net investment and capital which is a stock and which is a flow? Compare with the flow of water and a tank.

Answer:

Between net investment and capital, capital is stock and net investment is flow. The stock economic and flow economic variables can be better understood with the help of an example. Suppose a tank is being filled with water coming from a tap.

The amount of water which is flowing into the tank from the tap per minute is the flow. The quantity of water that existed at a particular point of time is considered as stock.

The above example can be compared with net investment and capital. Here, the capital is compared to the water that existed at a particular point of time. The capital is the stock of capital goods existed at a particular period of time.

The net investment is compared to the flow of water into a tank. Here, the net investment is considered as the investment which is made during a year to replace the wear and tear of capital goods.

![]()

Question 25.

Mention the methods of calculating the national income.

Answer:

There are three methods to calculate national income, viz.

- The product or value-added method.

- Expenditure method.

- Income method.

Question 26.

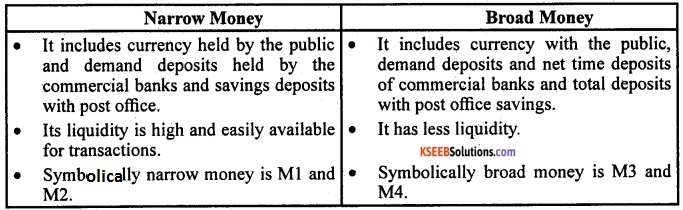

What is the difference between narrow money and broad money?

Answer:

The differences between narrow money and broad money are as follows:

Question 27.

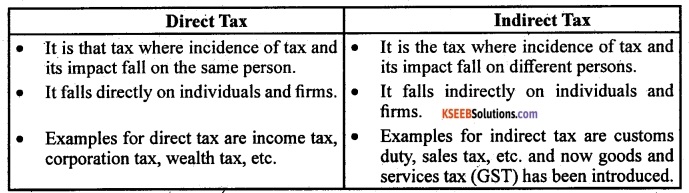

Distinguish between direct and indirect taxs.

Answer:

The differences between direct and indirect taxes are as follows:

Question 28.

What do you mean by managed floating exchange rate?

Answer:

Undermanaged floating system of exchange rate, the Central Monetary Authority, intervenes to change the exchange rate according to the situations that arise in the foreign exchange market. Here, there is no specific upper and lower limit. It is decided by the Central Bank or government in accordance with the circumstances existing in the country.

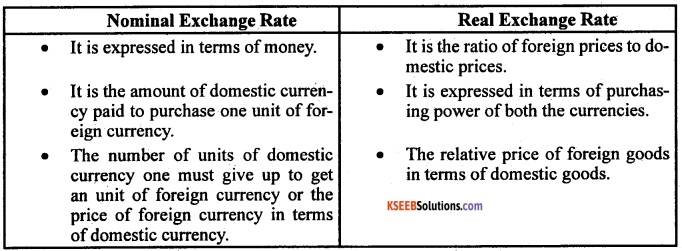

Question 29.

How nominal exchange rate is different from real exchange rate?

Answer:

PART-C

VI. Answer any seven of the following in fifteen sentences each (7 × 4 = 28)

Question 30.

Briefly explain the central problems of an economy.

Answer:

An economic system or economy is a mechanism where the scarce resources are channelized on priority to produce goods and services. These goods and services produced by all the sectors of the economy determine the national income. Generally, human wants are unlimited and resources to satisfy them are limited.

If there was a perfect match between human wants and availability of resources, there would have been no scarcity, no problem of choice and no economic problems at all. So, one has to select the most essential want to be satisfied with limited resources. In economics, this problem is called ‘problem of choice’.

The problem of choice arising out of limited resources and unlimited wants is called economic problem. Every economy whether developed or underdeveloped, capitalistic or socialistic or mixed economy, there will be three basic economic problems, viz. What to produce? How to produce? and For whom to produce? Let us discuss them in detail.

a. What to produce i.e., what is to be produced and in what quantities?

Every country has to decide which goods are to be produced and in what quantities. Whether more guns should be produced or more foodgrains should be grown or whether more capital goods like machines, tools, etc, should be produced or more consumer goods (electrical goods, daily usable products, etc.) will be produced has to be decided.

What goods to be produced and in what quantity depends on the economic system of the country. In socialistic economy, the government decides and in capitalistic economy market forces decide and in mixed economy, both the government and market forces provide solutions to this problem.

b. How to produce i.e., how are goods produced?

There are various alternative techniques of producing a product. For example, cotton cloth can be produced with either handloom or power looms. Production of cloth with handloom requires more labour and production with power loom need the use of more machines and capital. It involves selection of technology to produce goods and services.

There are two types of techniques of production viz., labor-intensive technology and capital intensive technology.

The society has to decide whether production be based on labor-intensive or capital intensive techniques. Obviously, the choice of technology would depend on the availability of different factors of production (land, labour, capital) and their relative cost (rent, wages, interest).

c. For whom to produce i.e., for whom are the goods to be produced?

Another important decision which an economy has to take is for whom to produce. The economy cannot satisfy all the wants of all the people. Therefore, it has to decide who should get how much of the total output of goods and services. The society has to decide about the shares of different groups of people-poor, middle class and the rich, in the national output.

Thus, every economy faces the problem of allocating the scarce resources to the production of different possible goods and services and of distributing the produced goods and services among the individuals within the economy. The allocation of scarce resources and the distribution of the final goods and services are the central problems of any economy.

Question 31.

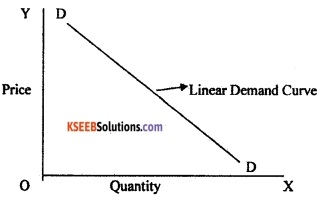

Briefly explain the law of demand with the help of linear demand curve.

Answer:

The law can be explained in the following manner, “other things being equal, a fall in price leads to expansion in demand and a rise in price leads to contraction in demand”.

According to Prof. Samuelson, the law of demand states that “people buy more at lower prices and buy less at higher prices, other things remaining the same”.

1. Individual demand schedule:

It is that demand schedule which represents the quantities demanded by an individual consumer at different levels of price.

Individual Demand Schedule

| Price (P) (in ₹) | Quantity demanded (Qd) (in kg) |

| 3 | 28 |

| 4 | 24 |

| 5 | 20 |

| 6 | 16 |

| 7 | 12 |

In the above individual demand schedule, the consumer is purchasing different quantities at different price levels. At ₹3 he buys 28 kgs, at ₹4, 24 kgs are bought and so on. As the price increases, the quantity demanded falls.

2. Demand curve:

The graphical presentation of the demand schedule is called demand curve.

In the given diagram, price is measured along OY axis and quantities demanded are measured along OX axis. The various points on the demand line represent respective quantities demanded.

The demand curve slopes downwards from left to right. It shows that the rate at which demand changes with respect to change in price. As there is inverse relationship between price and quantities demanded, the curve is negatively sloped.

![]()

Question 32.

Explain the TP, AP, and MP with examples.

Answer:

1. Total product (TP):

It refers to the aggregate output produced with the help of factor inputs during a particular period of time. It is obtained by adding the marginal product contributed by each input. For example, combination of 2 factors used to produce output is added to find the total product. Suppose factor 2 is fixed at 4 units where factor 2 takes the value of 4 and so on.

TP = ΣMP, where Σ is the summation, MP is marginal product.

2. Average product (AP):

Average product is an unit of output which is produced per unit input. It is calculated by dividing the total product with the help of variable inputs.

AP = \(\frac{\mathrm{TP}}{\mathrm{L}}\) where TP is total product and L is the variable factor input (e.g. labour)

For instance, to produce 50 units of shirts, 5 labourers are used. Here the average product of each variable input, i.e. labour is as follows:

AP = \(\frac{\mathrm{TP}}{\mathrm{L}}\) = 50/5 = 10 units.

3. Marginal product (MP):

Marginal product refers to additional unit of output produced with the help of additional unit of input of labour or capital. In other words, marginal product of an input is defined as the change in output per unit of change in one of the inputs when all the other inputs are held constant. We can calculate MP with the help of following formula:

MP = TPn – TPn-1 or MP = \(\frac{\text { Change in output }(\Delta q)}{\text { Change in input }(\Delta L)}\)

Where, MP is marginal product, TPn is total product of ‘n’ units and TPn-1 is total product of previous unit of output.

For example, if five units of labour one used to produce 25 shirts and 6 labourers are used to produce 28 shirts the marginal product is 3 shirts (28 – 25 = 3).

Question 33.

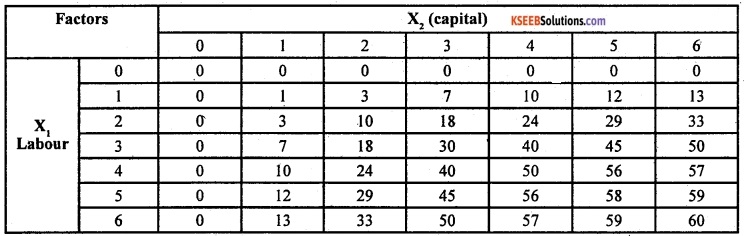

Briefly explain the production function with the examples.

Answer:

The production function of a firm is a relationship between inputs used and output produced by the firm. For various quantities of inputs used, it gives the maximum quantity of output that can be produced.

The production function gives the maximum quantity of output that can be produced. It is defined for a given technology. It is a technological knowledge that determines the maximum levels of output that can be produced using different combinations of inputs.

The inputs that a firm uses in the production process are called factors of production. In order to produce an output, a firm may require any number of different inputs. However, for the time being, we consider a firm that produces output using only two factors of production labour and capital.

Our production function, therefore, tells us what maximum quantity of output can be produced by using different combinations of these two factors.

We may write the production function as follows:

Q = f(x1, x2) which says that by using x1 amount of factor labour and x2 amount of factor capital, we can atmost produce q amount of the commodity.

This can be explained with the help of following table:

In the above table, the left column shows the amount of factor 1 and the top row shows the amount of factor 2. As we move to the right along any row, factor 2 increases and as we move down along any column, factor 1 increases.

For example, with 1 unit of factor 1 (labour) and one unit of factor 2 (capital), the firm can produce at most 1 unit of output only; Similarly, with 2 units of factor 1 and 2 units of factor 2, it can produce at most 10 units of output and so on.

Question 34.

What are the features of a perfect competitive market?

Answer:

Perfect competition is a market where there will be existence of large number of buyers and sellers dealing with homogenous products. It is a market with the highest level of competition.

a. Large number of sellers:

The first condition which a perfectly competitive market must satisfy is concerned with the sellers’ side of the market. The market must have such a large number of sellers that no one seller is able to dominate the market. No single firm can influence the price of any commodity.

The sellers will be the firms producing the product for sale in the market. These firms must be all relatively small as compared to the market as a whole. Their individual outputs should be just a fraction of the total output in the market.

b. Large number of buyers:

There must be such a large number of buyers that no one buyer is able to influence the market price in any way. Each buyer should purchase just a fraction of the market supplies. Further, the buyers should not have any kind of union or association so that they compete for the market demand on an individual basis.

c. Homogeneous products:

Another prerequisite of perfect competition is that all the firms or sellers must sell completely identical or homogeneous goods. Their products must be considered to be identical by all the buyers in the market. There should not be any differentiation of products by sellers by way of quality, colour, design, packing or other selling conditions of the product.

d. Free entry and free exit for firms:

Under perfect competition, there is absolutely no restriction on entry of new firms in the industry or the exit of the firms from the industry which want to leave. This condition must be satisfied especially for long period equilibrium of the industry.

If these four conditions are satisfied, the market is said to be purely competitive. In other words, a market characterized by the presence of these four features is called purely competitive. For a market to be perfect, some conditions of perfection of the market must also be fulfilled.

5. Perfect mobility:

Another feature of perfect competition is that goods and services, as well as resources, are perfectly mobile between firms. Factors of production can freely move from one occupation to another and from one place to another. There is no barrier on their movement. No one has monopoly or control over the factors of production. Goods can be sold at a place where their prices are the highest. There should not be any kind of limitation on the mobility of resources.

6. Absence of transport cost:

For the existence of perfect competition, the transport costs should, not be considered. All the firms have equal access to the market. Price of the product is not affected by the cost of transportation of goods.

7. Single price:

The market price charged by different sellers does not differ due to location of different sellers in the market. No seller is near or distant to any group of buyers.

8. Price taker:

The firms in the perfect competitive market are price takers. That means the producers will continue to sell their goods and services in the price existing in the market. Firms have no control over the price of the product.

9. Absence of selling cost:

Under conditions of perfect competition, there is no need of selling costs. Selling costs are the expenditures done to stimulate the sale of product or to change the shape of the demand curve. We know that under perfect competition, goods are completely homogeneous. When they cannot change the price and when their goods are completely similar, firms need not make any expenditure on publicity and advertisement.

10. Normal profit:

The firms in perfect competition will be earning normal profit. The normal profit is that profit which is just sufficient to stay in the market.

![]()

Question 35.

How does technological progress and unit prices affect the supply curve of a firm?

Answer:

1. Technological progress:

The technological progress, for instance an organizational innovation by a firm, with same levels of capital and labour, leads to more production of output.

The technological progress or organizational innovation allows the firm to use fewer units of inputs.

It is expected that this will lower the firm’s marginal cost at any level of output; that is, there will be shift of MC curve towards right from the original MC curve.

As the firm’s supply curve is the part of rising MC curve, technological progress shifts the supply curve of the firm to the right. At ai?y given market price, the firm supplies more units of output.

2. Input prices:

A change in input prices also affects a firm’s supply curve. If the price of an input increases, the cost of production rises. The consequent increase in the firm’s average cost at any level of output is usually accompanied by an increase in the firm’s marginal cost at any level of output. This means that the firm’s supply curve shifts to the left at any given market price and the firm now supplies fewer units of output.

Question 36.

What are the differences between microeconomics and macroeconomics?

Answer:

The micro and macroeconomics are distinguished on the following grounds:

1. Scope:

- Microeconomics studies in individual units so its scope is narrow.

- Macroeconomics studies in aggregates, so its scope is wider.

2. Method of study:

- The microeconomics follows slicing method as it studies individual unit.

- The macroeconomics follows lumping method as it studies in aggregates.

3. Economic agents:

- In microeconomics, each individual economic agent thinks about its own interest and welfare.

- In macroeconomics, economic agents are different among individual economic agents and their goal is to get maximum welfare of a country.

4. Equilibrium:

- Microeconomics studies the partial equilibrium in the country.

- Macroeconomics studies the general equilibrium in the economy.

5. Domain:

- Microeconomics consists of theories like consumer’s behaviour, production and cost rent, wages, interest, etc.

- Macroeconomics comprises of theory of income, output, and employment, consumption function, investment function, inflation, etc.

Question 37.

Give the meaning of final goods, consumer goods, capital goods, and intermediate goods.

Answer:

a. Final goods:

The final goods are those goods which are purchased for final utility or usage.

Example for final goods are TV, mobile, sugar, ear, shoes, etc.

b. Intermediate goods:

The intermediate goods are those goods which are produced by one producer and used by another producer to produce final goods. Examples are raw cotton, wood, etc.

c. Consumer goods:

These are the goods which are purchased for consumption. Examples are food, clothes, TV, mobile, sugar, car, shoes, etc.

d. Capital goods:

These are the goods which are used to produce other products. Examples are machinery, tools, roads.

Question 38.

What is a barter system? What are its drawbacks?

Answer:

Exchange of goods for goods is called as barter system. In other words, economic exchanges without the mediation of money are referred to as barter exchanges.

The four major drawbacks of barter system are the following:

1. Lack of double coincidence of wants:

For example, an individual who has a surplus of rice which he wants to exchange for clothing. If he is not lucky enough he may not be able to find another person who has the diametrically opposite demand for rice with a surplus of clothing to offer in exchange.

2. Lack of common measure of value:

Under barter system, it is very difficult to express the value of goods and services accurately. Here, we cannot keep record of any transactions in terms of value of goods and services exchanged.

3. Lack of divisibility:

Sometimes, it is difficult to divide goods and services according to the needs of people. For instance, the value of a horse is less than the value of cow. We cannot apportion any of these during transactions.

4. Difficult to carry forward wealth:

Under barter system, it is difficult to carry forward one’s wealth. Suppose we have an endowment of rice which we do not wish to consume today entirely. We may regard this stock of surplus rice as an asset which we may wish to consume or even sell off for acquiring other commodities at some future date. But rice is a perishable item and cannot be stored beyond a certain period. Also, holding to a big stock of rice requires a lot of space.

Question 39.

What is ‘effective demand’? Explain.

Answer:

If the supply of final goods is assumed to be infinitely elastic at a constant price over a short period of time, aggregate output is determined solely by the value of aggregate demand. This situation is called effective demand. In other words, effective demand refers to a situation in, which equlibrlium output is determined solely by the level of aggregate demand.

This is because of the assumption that the supply is infinitely elastic and if there exists any inequality between aggregate demand and aggregate supply, then the equilibrium output will only be influenced by the aggregate demand and not supply.

The derivation of aggregate demand under fixed price of final goods and constant rate of interest in the economy can be discussed here. In order to hold price constant at any particular level, however, one must assume that the suppliers are willing to supply whatever amount consumers will demand at that price.

If quantity supplied is either in excess of or falls short of quantity demanded at this price, price will change because of excess supply or demand. To avoid this problem, we assume that the elasticity of supply is infinite i.e., supply schedule is horizontal – at the fixed price. Under such circumstances, equilibrium output will be solely determined by the aggregate amount of demand at this price in the economy. This is called effective demand principle.

![]()

Question 40.

Briefly explain the balance of payments surplus and deficit.

Answer:

Balance of payments (BoP) is the record of the transactions in goods, services and assets between residents of a country with the rest of the world for a specified time period typically a year. There are two main accounts in the balance of payments viz., the current account and the capital account.

1. BoP surplus and deficit:

The essence of international payments is that just like an individual who spends more than his her income, must finance the difference by selling assets or by borrowing, a country that has a deficit in its current account must finance it by selling assets or by borrowing abroad.

Similarly, the country could engage in official reserve transactions running down its reserves of foreign exchange in case of a deficit by selling foreign currency in the foreign exchange market.

The increase in the official reserves is called the overall balance of payments surplus and the decrease in official reserves is called balance of payments deficit.

The basic idea is that the monetary authorities are the ultimate financiers of any deficit in the balance of payments (or the recipients of any surplus). The balance of payments deficit or surplus is obtained after adding the current and capital account balances.

Therefore, a country is said to be in equilibrium balance of payments when the sum of its current account and its non-reserve capital account equal to zero. Here, the total value of exports of goods and services is equal to value of imports of goods and services.

PART-D

VII. Answer any four of the following questions in 20 sentences each (4 × 6 = 24)

Question 41.

Explain the changes in the budget set with the help of diagrams.

Answer:

1. Budget set:

Budget set refers to the set-of bundles available to the consumer. It is the collection of all bundles that the consumer can buy with his income at the prevailing market prices.

2. Changes in the budget set:

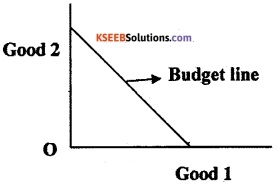

The set of available bundles depends on the prices of the two goods and the income of the consumer. When the price of either of the goods or die consumer’s income change, the set of available bundles is also likely to change.

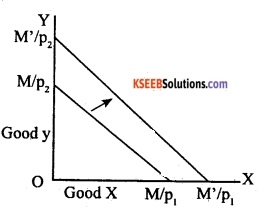

a. When the income of consumer changes:

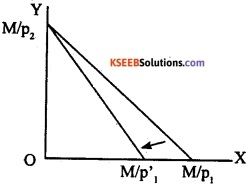

If the consumer’s income changes from M to M’ but the prices of the two goods remain unchanged, with the new income, the consumer can afford to buy all bundles say (x1, x2), such that p1x1 + p2x2 ≤ M’.

Therefore, the equation of the budget line will be:

p1x1 + p2x2 = M’

We should remember that the slope of the new budget line is the same as the slope of the budget line prior to the change in the consumer’s income. However, the vertical intercept changes when there is change in the income of consumer.

If there is an increase in the income, the vertical intercept increases and there will be a parallel outward shift of the budget line. This can be represented in the following diagram.

In the above diagram, we see two parallel budget lines M/p2 is the original budget line and M’p2 is new budget line. If the income of consumer increases, the consumer can buy more of the goods X and Y at the prevailing market prices. So the budget line shifts from Mp2 to M’p2.

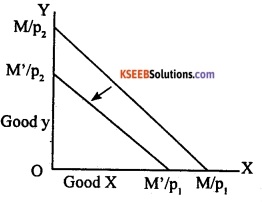

Similarly, if the income of consumer decreases, the vertical intercept decreases and hence, there is a parallel inward shift of the budget line. This can be represented in the given diagram.

In the diagram, we see two parallel budget lines, i.e. M/ p2 is the original budget line and M’p2 is new budget line. If the income of consumer decreases the availability of goods X and Y goes down. So the budget line shifts from Mp2 to M’p2.

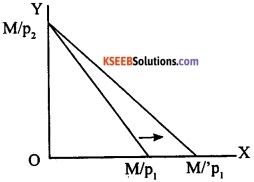

b. When the price changes:

If the price of good X changes from p1 to p’1 but the price of good Y and the consumer’s income remain unchanged, the consumer can afford to buy all bundles (x1, X2) such that p’1x1 + p2x2 ≤ M. Therefore, the equation of the budget line will be:

p’1x1+P2x2 = M

We should remember that the vertical intercept of the new budget line is the same as the vertical intercept of the budget line prior to the change in the price of good X. But, the slope of the budget line changes after the change in the price.

- If the price of good X increases, the absolute value of the slope of budget line increases and the budget line becomes steeper (inward shift). It shows the consumer cannot afford the same quantity of good X. This can be represented in the given diagram.

In the diagram, M/p1 is the original budget line and M/p’1 is the new budget line which denotes that the consumer cannot afford to buy same quantity of good x due to its rise in price.

If the price of good X decreases, the absolute value of Y the slope of budget line decreases and the budget line becomes flatter (outward shift). It shows the consumer can now afford more quantity of good X. This can be represented in the given diagram.

In the diagram, M/p1 is the original budget line and M/p’1 is the new budget line which denotes that the consumer can afford to buy more quantity of good x due to its fall in price.

Question 42.

Explain market equilibrium with the help of a diagram.

Answer:

The process of determination of price by supply and demand forces is called price mechanism and the same has been called as ‘invisible hand’ by Prof. Adam Smith.

Perfect competitive market is that market where we can see large number of sellers and buyers deal¬ing with homogenous goods. Every firm is a price taker as it cannot influence the price in the market.

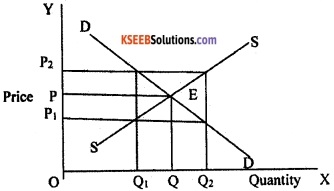

1. Equilibrium in perfect competitive market:

Equilibrium is a position from which there will not be a tendency to move or change in any direction. At equilibrium price, the quantity demanded and supplied would be equal. According to Alfred Mar-shall, both supply and demand are equally important in determining the price of a product.

Marshall has compared the supply and demand to the two blades of a scissors. Neither the upper blade nor the lower blade alone cuts the paper but both are required to do the task of cutting a paper. So, both supply and demand play an important role in determining the price of a product.

The equilibrium in perfect market is determined by the forces of market demand and market supply. Market demand is the aggregate demand and market supply is the aggregate supply. The market demand curve slopes downwards from left to right and the market supply curve slopes upwards. The point of intersection between the demand and supply curve determines the equilibrium price. This can be illustrated with the help of the following table.

| Price of Rice (₹) | Quantity Demanded (Tons) | Quantity Supplied (Tons) |

| 1000 | 100 | 10 |

| 2000 | 90 | 30 |

| 3000 | 70 | 70 |

| 4000 | 60 | 90 |

| 5000 | 50 | 100 |

In the table, it is shown that the price of rice per quintal is ₹1000 and the quantity demanded is equal to 100 tons and the supply is 10 tons. When price increases to ₹2000, the demand becomes 90 tonnes and supply increases to 30 tons.

When the price reaches ₹3000, the quantity supplied and demanded are same. Therefore, ₹3000 is the equilibrium price and 70 tons of rice is equilibrium quantity. This can be represented in the following diagram.

In the above diagram, quantity is measured along OX axis and price is measured along OY axis. OP is the original price and OQ is the original quantity. When price in case of OP2 the quantities demanded will be OQ1 and supplied will be OQ2. Here, the quantity supplied is greater than quantity demanded. This excess supply leads to reduction of price to original level.

When price falls from OP to OP1, the quantity demanded will be OQ2 and quantity supplied will be OQ1. Here, the quantity demanded is more than the quantity supplied. This excess demand makes the price to rise to the original price level.

Thus, the equilibrium of price is attained at point E where the aggregate demand is equal to aggregate supply.

Question 43.

How do firms behave in oligopoly? Explain.

Answer:

Oligopoly is one of the non-competitive markets where the market of a particular commodity consists of more than one seller but the number of sellers is few. The special case of oligopoly where there are exactly two sellers is termed duopoly.

Under oligopoly market there are only a few firms. The output decisions of any one firm would necessarily affect the market price and therefore the amount sold by the other firms. It is, therefore, only to be expected that other firms would react to protect their profits. This reaction would be through taking fresh decisions about the quantity and price of their own output. There are various ways in which this can be theorized. They are as follows:

1. Firstly, duopoly firms may collude together and decide not to compete with each other and maximize total profits of the two firms together. In such a case, the two firms would behave like a single monopoly firm that has two different factories producing the commodity.

2. Secondly, take the case of a duopoly where each of the two firms decides how much quantity to produce by maximizing its own profit assuming that the other firm would not change the quantity that it is supplying.

3. Thirdly, some economists argue that oligopoly market structure makes the market price of the commodity rigid, i.e., the market price does not move freely in response to changes in demand. The reason for this lies in the way in which oligopoly firms react to a change in price initiated by any one firm.

If one firm feels that a price increase would generate higher profits and therefore increases the price at which it sells its output, other firms do not follow. The price increase would, therefore, lead to a huge fall in the quantity sold by the firm leading to fall in its revenue and profit. It is therefore not rational for any firm to arbitrarily increase the price.

Similarly, if a firm estimates that it could earn a larger revenue and profit by selling a larger quantity of output and therefore lowers the price at which it sells the commodity, other, firms would perceive this action as a threat and therefore follow the first firm and lower their price as well.

The increase in the total quantity sold due to the lowering of price is therefore shared by all the firms and the firm that had initially lowered the price is able to achieve only a small increase in the quantity it sells. A relatively large lowering of price by the first firm leads to a relatively small increase in the quantity sold.

Therefore, any firm finds it irrational to change the prevailing price, leading to prices that are more rigid compared to perfect competition.

Question 44.

Write down some of the limitations of using GDP as an index of welfare of a country.

Answer:

Gross domestic product (GDP) is the sum total of value of goods and services created within the geographical boundary of a country in a particular year, dt gets distributed among’the people as incomes except retained earnings. So we consider that higher level of GDP of a country is an index of greater well being of the people of that country.

Welfare of a country means the well being of entire population of the country. But there are certain limitations of using GDP as an index of welfare of a country. They are as follows:

a. Distribution of gross domestic product (GDP):

Generally, the rise in GDP will not represent increase in the welfare of the country. If the GDP of the country is rising, the welfare may not rise as a consequence. This is because the rise in gross domestic product may be concentrated in the hands of only a few individuals or firms. For the remaining, the income may in fact might have decreased. In such a situation, the welfare of the entire country cannot be said to have improved.

b. Non-monetary exchanges:

Some of the activities in a country are not evaluated in terms of. money. For instance, the domestic services of housewife are pot paid for. The-exchanges which take place in the informal sector without the help of money are called barter exchanges. In barter exchanges, goods are directly exchanged against each other.

As money is not used here, these exchanges are not registered as part of economic activity. In India, because of many remote areas, these kinds of exchanges still take place and they are generally not counted in the GDP. Therefore, gross domestic product calculated in the standard manner may not give us a clear indication of welfare of a country.

c. Externalities:

An externality is a cost or benefit conferred upon second or third parties as a result of acts of individual production and consumption. In other words, externalities refer to the benefits or harms, a firm or an individual causes to another for which they are not paid or penalized.

These do not have any market in which they can be bought and sold. But the cost or benefit of an externality cannot be measured in money terms because it is not included in market activities. For example, the pleasure one gets from his neighbour’s garden is an external benefit and external cost is environmental pollution caused by industries. Both are excluded from na¬tional income estimates.

d. Leisure and work:

One of the important things that affect the welfare of a society is leisure. But this is not included in GDP. For example, longer working hours may make people unhappy because their leisure is reduced. On the contrary, shorter working hours per week may increase leisure and make people happy.

e. Manner of production:

The economic welfare also depends on the manner of production of goods and services. If goods are produced by child labour or by exploitation of workers, then the economic welfare cannot increase.

![]()

Question 45.

Explain the functions of money and how does it overcome the shortcomings of a barter system?

Answer:

The functions of money are broadly classified as follows:

- Primary functions

- Secondary functions

- Contingent functions.

1. Primary functions: The primary functions of money are as follows:

a. Medium of exchange:

Money plays an important role as a medium of exchange. It facilitates exchange of goods for money. It has solved the problems of barter system. Barter exchanges become extremely difficult in a large economy because of the high costs people would have to incur looking for suitable persons to exchange their surpluses.

It helps the people to sell in one place and buy in another place. Money has widened the scope of market transactions. Money has become a circulating material between buyers and sellers.

b. Measure of value:

The money acts as a common measure of value. The values of all goods and services can be expressed in terms of money. As a measure of value, money performs following functions:

- The value of all goods and services measured and expressed in terms of the money.

- Rate of exchange of goods and services expressed in money.

- Facilitates the maintenance of accounts.

- It facilitates price mechanism.

- It makes goods and services comparable in terms of price.

For instance, when we say that the value of a book is ₹500, we mean that the book can be exchanged for 500 units of money where a unit of money is rupee in this case. If the price of a pencil is ₹5 and that of a pen is ₹10, we can calculate the relative price of a pen with respect to a pencil i.e., a pen is worth 10/5 = 2 pencils.

2. Secondary functions: The secondary functions of money are as follows:

a. Store of value:

People can save part of their present income and hold the same for future. Money can be stored for precautionary motives needed to overcome financial stringencies. Money solves one of the deficiencies of barter system i.e., difficulty to carry forward one’s wealth under the barter system.

For instance, we have an endowment of wheat which we do not wish to consume today entirely. We may regard this stock of surplus wheat as an asset which we may wish to consume or even sell-off, for acquiring other commodities at some future date. But wheat is a perishable item and cannot be stored beyond a certain period.

Also, holding a large stock of wheat requires a lot of space. We may have to spend considerable time and resources looking for people with a demand for wheat when we wish to exchange our stock for buying other commodities. This problem can be solved if we sell our wheat for money. Money is not perishable land its storage costs are also less.

b. Standard of deferred payments:

All the credit transactions are expressed in terms of money. The payment can be delayed or postponed. So, money can be used for delayed settlement of dues or financial commitments.

c. Transfer of value:

Money acts as a transfer of value from person to person and from place to place. As a transfer of value, money helps us to buy goods, properties or anything from any part of the country or the world. Further, money earned in different places can be brought or transferred to anywhere in the world.

3. Contingent functions of money:

Other than primary and secondary functions, money also performs other functions which are as follows:

a. Basis of credit:

Money serves as a basis of the credit. The modem credit system exists only because of existence of money.

b. Distribution of national income:

Money helps in distribution of national income. The reward paid to factors of production in the form of rent, wages, interest and profit are nothing but the distribution of national income at factor prices.

c. Provides liquidity and uniformity:

Money provides liquidity to all kinds of assets both moveable and immovable. Money can be. converted into any type of asset and all assets can be converted into money.

d. Helps, in consumers’ and producers’ equilibrium:

All goods and services are expressed in terms of money. The consumer attains equilibrium when the price of a product is equal to his marginal utility. Similarly, the producers reach equilibrium if they get maximum satisfaction. Both consumers and producers try to achieve equilibrium with the help of money.

Question 46.

Explain the revenue account and revenue expenditure of the central government.

Answer:

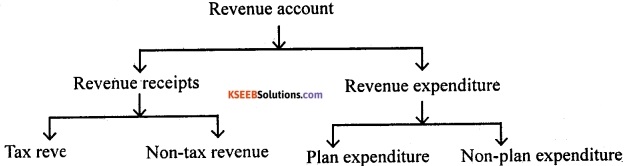

The revenue account of central government consists of revenue receipts and revenue expenditure.

The revenue account of the government budget consists of the following divisions:

The revenue account of the government consists of two categories viz., revenue receipts and revenue expenditure.

I. Revenue receipts:

The revenue receipts refer to revenue earned by the government from both tax and non-tax sources.

a. Tax revenue:

It is one of the main sources of revenue to the government. Tax is a compulsory payment made by the people to the government without expecting any direct bene¬fits from the government. Tax revenue can be classified as direct tax and indirect tax.

1. Direct tax:

The direct tax is the tax levied by the government which cannot be shifted by the person on whom it is .levied. Here, the impact and incidence of tax will be on the same person. This tax is levied on the income and wealth of the people. Personnel income tax, wealth tax, interest tax, expenditure tax are some examples.

2. Indirect tax:

It is the tax levied on goods and services paid indirectly by the consumers. The impact and incidence of tax will be on different people. Indirect tax is the large source of revenue to the government. The various sources of indirect tax are central excise duties, custom duties, etc.

b. Non-tax revenue:

The revenue collected from sources other than the tax revenue is called non-tax revenue. It consists of:

- Income from public enterprises

- Income from receipts

- Revenue from administration

- Income from railways.

II. Revenue expenditure:

The revenue expenditure of government is that expenditure incurred out of its current revenue receipts. These expenses are made by the government on its various departments and services, interest payments on public debt, subsidies, etc. The revenue expenditure is classified as follows:

a. Plan revenue expenditure:

The plan revenue expenditure is that expenditure spent by the government on implementation of economic schemes, financial assistance to local governments.

b. Non-plan expenditure: This type of expenditure is related to the expenses incurred on internal and external securities like defiance forces, law, and order, subsidies, civil administration, etc.

Question 47.

How is the exchange rate determined under a flexible exchange rate regime?

Answer:

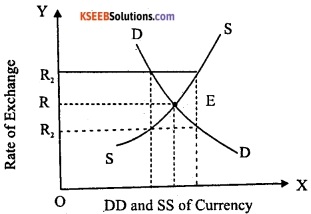

Under flexible exchange rate system, the exchange rate is determined by the forces of market demand and market supply. Here, the central banks do not intervene in the foreign exchange market.

In the given diagram, demand and supply of currency is measured along OX axis and rate of exchange is measured along OY axis. D is demand curve and S is the supply curve. The demand and supply curves of foreign exchange have intersected at point E where the exchange rate (R) is determined.

If the rate of exchange increases from OR to OR1, the supply of foreign currency exceeds its demand causing decrease in rate of exchange. On the other hand, if the exchange rate decreases from OR to OR2, the demand for foreign currency exceeds the supply of foreign currency which leads to increase in rate of exchange later.

PART-E

VIII. Answer any two of the following project-oriented questions (2 × 5 = 10)

Question 48.

A consumer wants to consume two goods. The price of good 1 is ₹4 and the price of good 2 is ₹5. The consumer has ₹20 only.

- Write down the equation of the budget line.

- How much of good 1 can the consumer consume, if she spends, her entire income on that good?

- How much of good 2 can the consumer consume if she spends her entire income on that good?

- Write the slope of the budget line (draw the budget line).

Answer:

1. We know that P1 = 4, P2= 5 and M = 20; then the equation of the budget line will be p1x1 + p2p2 = M.

By substituting devalues we get

4x1 + 5x2= 20.

2. If ₹20 is entirely spent on good 1, then

4x1 + 5(0) = 20

4x1 = 20

x1 = 20/4 = 5

The consumer can consume 5 units of good 1.

3. If ₹20 is entirely spent on good 2, then

4(0) + 5 x2 = 20

5 x2 = 20

x2 = 20/5 = 4

The consumer can consume 4 units of good 2

4. The slope of budget line is \(\frac{-P_{1}}{P_{2}}\)

That is price of good 1 divided by price of good 2.

Therefore,

-4/5 = -0.8

To sum up:

- Equation of budget line: p1x1 + p2p2 = M. By substituting the values we get 4x1 + 5x2 = 20.

- The consumer can consume 5 units of good 1 (20/4).

- The consumer can consume 4 units of good 2 (20/5).

- The slope of the budget line is downward sloping from left to right.

![]()

Question 49.

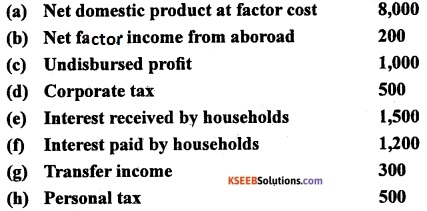

From the following data, calculate personal income and personal disposable income.

Answer:

Personal income = Net domestic product at factor cost + Net factor income from abroad + (Interest received by households – Interest paid by households) + Transfer income – Corporate tax – Undis-bursed profit.

Therefore, PI = 8000+ 200+ (1500-1200)+ 300-500-1000.

= 8000 + 200 + 300 + 300 – 500- 1000 = 7300

Personal disposable income = Personal income – Personal tax

Therefore, PDI = 7300-500 = 6800.

Question 50.

Write the currencies of any five countries given below. India, USA, UK, Germany, Japan, China, Argentina, UAE, Bangladesh, Russia.

Answer:

| Countries | Currency |

| India | Indian Rupee |

| USA | US Dollars |

| UK | British Pound |

| Germany | Euro |

| Japan | Japanese Yen |

| China | Chinese Yuan |

| Argentina | Argentine Peso |

| UAE | UAE Dirham |

| Bangladesh | Bangladeshi Taka |

| Russia | Russian Ruble/Rouble |