Students can Download 2nd PUC Accountancy Previous Year Question Paper March 2019, Karnataka 2nd PUC Accountancy Model Question Papers with Answers helps you to revise the complete Karnataka State Board Syllabus and score more marks in your examinations.

Karnataka 2nd PUC Accountancy Previous Year Question Paper March 2019

Time: 3 Hrs 15 Min

Max. Marks: 100

Instructions: –

- All sub questions of Section – A should be answered continuously at one place.

- Provide working notes wherever necessary.

- 15 minutes extra time has been allotted for the candidates to read the questions.

- Figures in the right hand margin indicates full marks.

Section – A

I. Answer any Eight questions, each question carries One mark : (8 × 1 = 8)

Question 1.

Government grant is treated as __________ receipt.

Answer:

Revenue receipt.

Question 2.

When the partners current accounts are prepared in partnership firm?

Answer:

Partners current account is prepared when the partners maintain their capital under Fixed Capital Method.

Question 3.

If the amount brought by a new partner is more than his share in capital, the excess is known as ___________

Answer:

Hidden Goodwill

Question 4.

Give the formula for calculation of new profit sharing ratio on retirement of a partner.

Answer:

New profit ratio = Old Ratio + Gain Ratio.

Question 5.

What is buy-back of shares?

Answer:

Buy – back of shares :

Also known as repurchase of shares by the company that issued them or purchase of its own shares from the market.

Question 6.

Debentures cannot be redeemed out of:

(a) Profits

(b) Provisions

(c) Capital

(d) All the above

Answer:

(b) Provisions

![]()

Question 7.

Financial statements generally include:

(a) Comparative statement

(b) Fund flow statement

(c) Income statement and balance sheet

(d) None of the above

Answer:

(c) Income statement and balance sheet

Question 8.

Financial analysis is used only by the creditors. State True / False.

Answer:

False.

Question 9.

Give one example for current liability.

Answer:

Current liabilities → Creditors, Bills payable, Short term provisions, Short term borrowings.

Question 10.

Expand ICAI.

Answer:

The Institute of chartered Accountants of India.

Section – B

II. Answer any Five questions, each question carries Two marks : (5 × 2 = 10)

Question 11.

State any two features of Receipts and Payments account.

Answer:

Features of receipts and payments account

(a) It is real account

(b)It is prepared on cash system of accounting.

Question 12.

Name any two contents of partnership deed.

Answer:

contents of partnership deed.

(a) Name and addresses of the firm

(b)Name and address of all the partners or any other

Question 13.

Goodwill of the firm is valued at two years purchase of the average profit of last four years. The total profits for last four years is ? 40,000.

Calculate the goodwill of the firm.

Answer:

Calculation of Good will:

Good will = Average profit of last 4 year x Number of years of purchase of Average profits.

Average profits = \(\frac { 40,000 }{ 4 }\) = Rs. 10000

Good will = Rs. 10,000 × 2 year purchase = Rs. 20,000

Question 14.

Give the Journal entry for the asset taken over by a partner in case of dissolution of partnership firm.

Answer:

Partner capital account Dr.

To Realisation A/c

Question 15.

What is forfeiture of shares?

Answer:

Forfeiture of shares means cancellation of the rights of the shareholders on the shares held by him for Non payment of allotment money or call money or both, on such shares.

Question 16.

Give the meaning of financial statements.

Answer:

Financial statements are the basic and formal annual reports through which the company communicates financial information to its owners and other stake holders/extemal parties.

Question 17.

List out any two techniques of financial statement analysis.

Answer:

- Comparitive statements

- common size statements

- Trend and ratio analysis

Question 18.

Mention any two activities which are classified as per AS – 3.

Answer:

The two activities classified as per AS – 3 are

- Operating Activities

- Investing activities.

![]()

Section – C

III. Answer any Four questions, each question carries Six marks : (4 × 6 = 24)

Question 19.

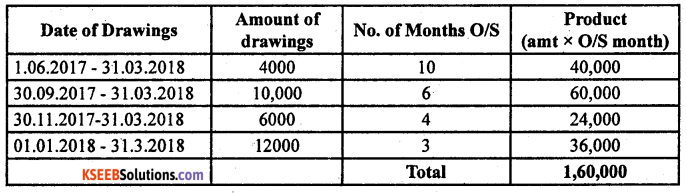

Yashas and Abhi are partners in a firm, sharing profits and losses in the ratio of 2:1. Yashas withdrew the following amounts during the year 2017-18 are given as under:

₹ 4,000 on 1.6.2017

₹ 10,000 on 30.09.2017

₹ 6,000 on 30.11.2017

₹ 12,000 on 1.1.2018

Interest on drawings is to be charged at 8% p.a.

Calculate the amount of interest to be charged on Yashas drawings for the year ending 31.3.2018.

Answer:

Calculation of Yashas interest on Drawing for the year ending 31.3.2018

Interest on Drawings = Total product \(\times \frac{\text { Rate }}{100} \times \frac{1}{12}=1,60,000 \times \frac{8}{100} \times \frac{1}{2}\) = Rs. 1067

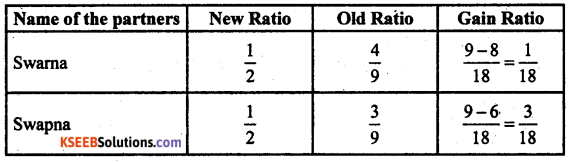

Question 20.

Swarna, Swapna and Vidya are partners in a firm sharing profits and losses in the ratio of 4 : 3 : 2. Vidya retires from the firm. Swarna and Swapna agreed to share equally in future.

Calculate the gain ratio of Swarna and Swapna.

Answer:

Calculation of Gain Ratio :

∴ Gain Ratio =1:3

Question 21.

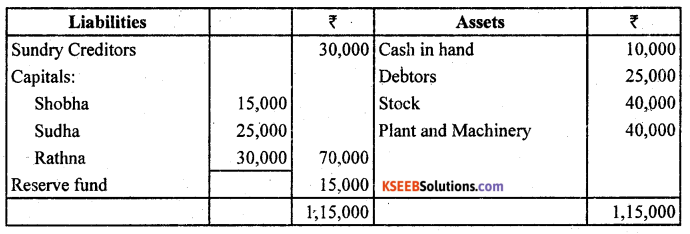

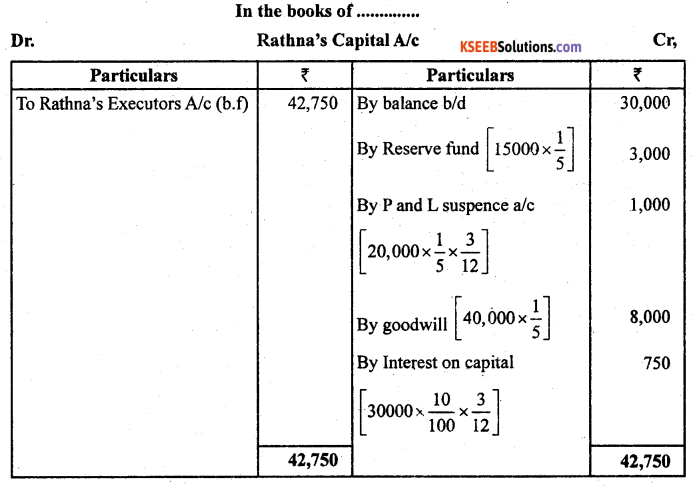

Shobha, Sudha and Rathna are partners. Sharing profits and losses in the ratio 2:2:1.

Their Balance sheet as on 31.03.2018 was as follows:

Rathna died on 30.06.2018. Her executor’s should be entitled to :

(a) Her capital on the date of last Balance sheet.

(b) Her share of reserve fund on the date of last Balance sheet.

(c) Her share of profit up to the date of death, on the basis of previous year’s profit. Previous year profit is Rs. 20,000.

(d) Her share of goodwill. Goodwill of the firm is valued at Rs. 40,000.

(e) Interest on capital at 10% p.a

You are required to ascertain amount payable executors of Rathna by preparing Rathna’s capital account. .

Answer:

Question 22.

Ganesh co., ltd., purchased assets of the book value of Rs. 99,000 from another firm. It was agreed that purchase consideration be paid by issuing 11% debenture of Rs. 100 each. Assume debentures have been issued.

(a) At par

(b) At discount of 10% and

(c) At a premium of 10%

Record necessary Journal entries.

Answer:

![]()

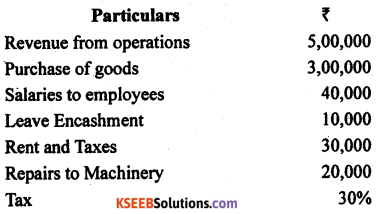

Question 23.

From the following information, prepare statement of profit and loss for the year ended 31.03.2018 as per schedule – III of the companies Act. 2013.

Answer:

Answer:

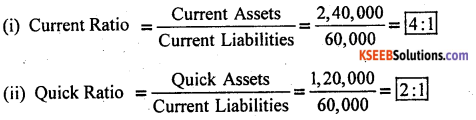

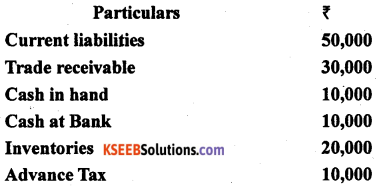

Question 24.

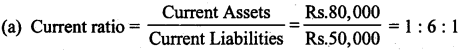

Calculate current ratio and Liquid ratio from the following information :

Answer:

Calculation of Ratios:

Current Liabilities Rs.50,000

Note: Current Assets = Trade receivable + Cash in hand + cash at Bank + Inventories + Advance Tax

= 30000+ 10000+ 10000+ 20000+ 10000 = Rs.80,000

Note: Liquid / Quick assets = Current assets – Stock – Prepaid expenses

= Rs. 80,000 – 20,000 – 10,000 = Rs. 50,000

Question 25.

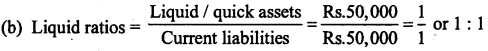

Mangala ltd. arrived at a Net income of Rs. 5,00,000 for the year ended 31.03.2018. Depreciation for the year was Rs. 2,00,000. There was a profit of Rs. 50,000 on assets sold which was transferred to statement of profit and loss. Trade receivable increased during the year Rs. 40,000 and Trade payables also increased by Rs. 60,000.

Compute cash flow from operating activities by the indirect method.

Answer:

Section-D

VI. Answer any four questions, each question carries Twelve marks : (4 × 12 = 48)

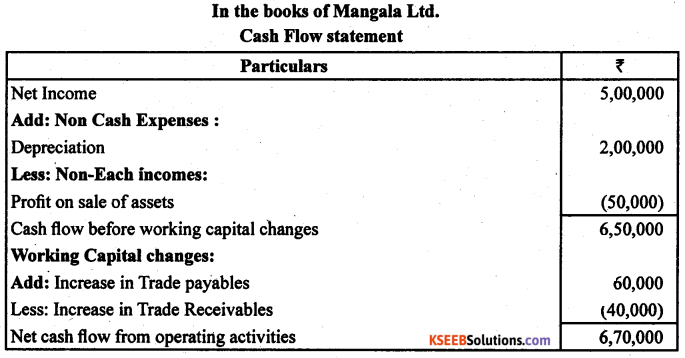

Question 26.

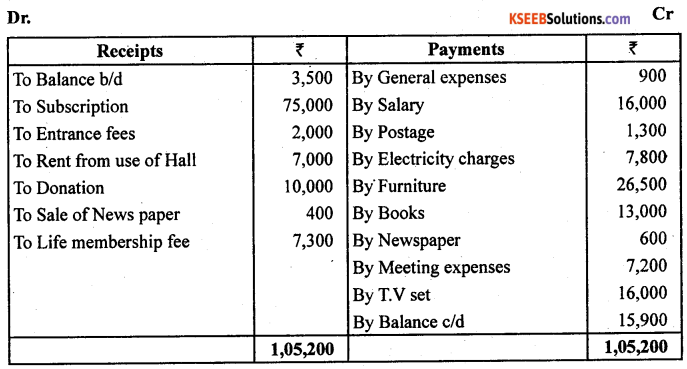

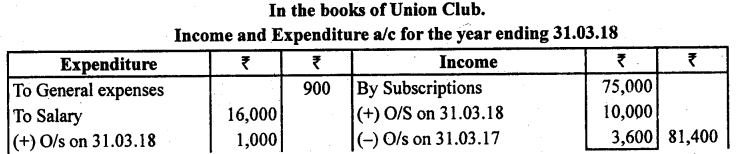

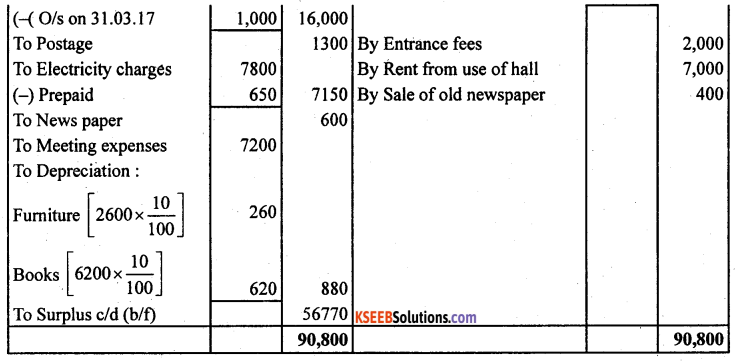

From the following Receipts and payments account and Balance sheet of union club, prepare Income and Expenditure account for the year ended 31.03.2018 and the Balance sheet as on that date.

Receipts and payments a/c for the year ended 31.03.2018

Adjustments:

(a) Subscription outstanding on 31 March, 2018 ₹ 10,000.

(b) Salary outstanding on 31 March, 2018 ₹ 1,000.

(c) Depreciate furniture and Books at 10% each (only on opening Balances)

(d) Donation to be capitalised.

(e) Electricity charges paid in Advance ₹ 650.

Answer:

![]()

Question 27.

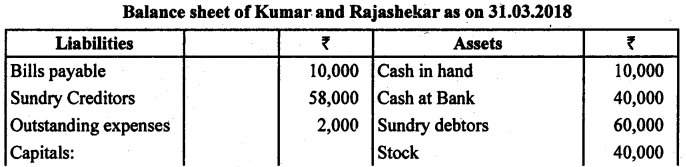

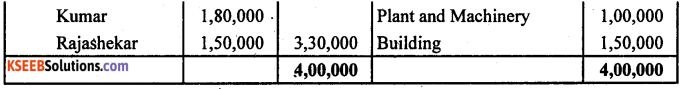

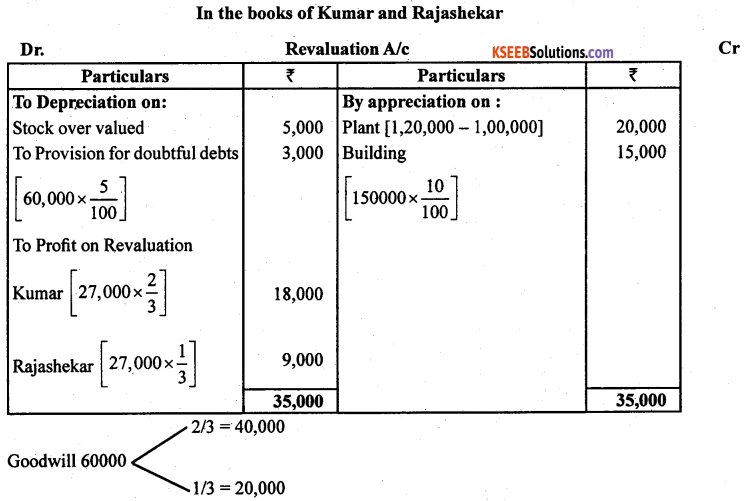

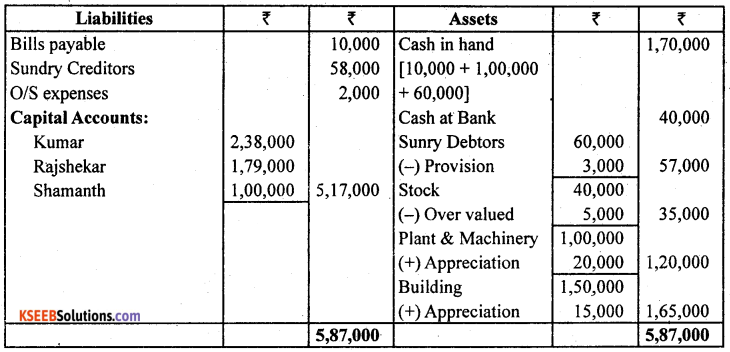

Given below is the Balance sheet of Kumar of Kumar and Rajashekar, who are carrying on partnership business as on 31 March, 2018. Kumar and Rajashekar share profits and losses in the ratio of 2 :1.

Shamanth is admitted as a partner on the date of the Balance sheet on the following terms.

(a) Shamanth bring in Rs. 1,00,000 as his capital and Rs, 60,000 as his share of goodwill for l/4th share in profits.

(b) Plant is to be appreciated to Rs. 1,20,000 and the value of Building is to be appreciated by 10%.

(c) Stock is found over valued by Rs. 5,000.

(d) A provision for Doubtful debts is to be created at 5% on Debtors. Prepare Revaluation account, partners capital accounts and Balance sheet of the constituted firm after admission of the new partner.

Answer:

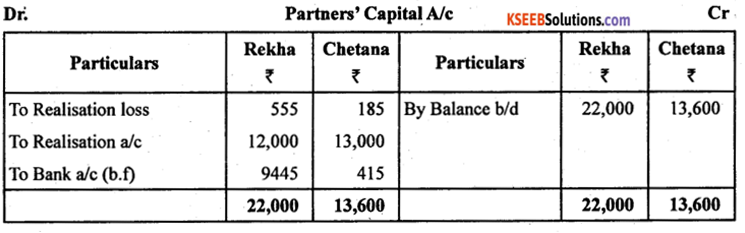

Question 28.

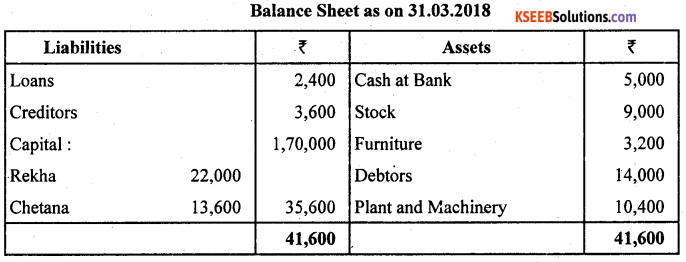

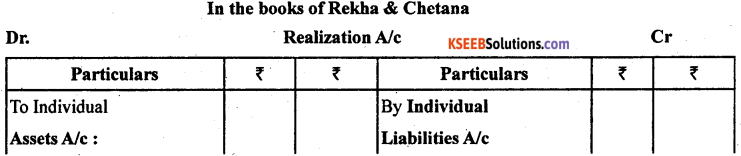

Rekah and Chetana sharing profits as 3 :1 and they agree upon dissolution. The balance sheet as on 31 March, 2018 is as under :

Additional information:

(a) Rekah took over plant and Machinery at an agreed value of ₹ 12,000.

(b) Stock and furniture were sold for f 8,400 and ₹ 2,780 respectively.

(c) Debtors were taken over by Chetana at ₹ 13,000.

(d) Liabilities were paid in full by the firm.

(e) Realisation expenses were ₹ 320.

Prepare:

(a) Realisation A/c

(b) Partners’ Capital Accounts and

(c) Bank A/c

Answer:

![]()

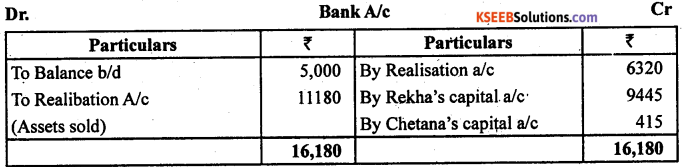

Question 29.

Vigneshwara Trading Co., Ltd., issued 10,000 ordinary shares of ₹ 100 each, at a premium of ₹ 10 per share. The amount payable is as follows:

On application ₹ 20

On Allotment ₹ 40 (including premium)

On First and final call ₹ 50.

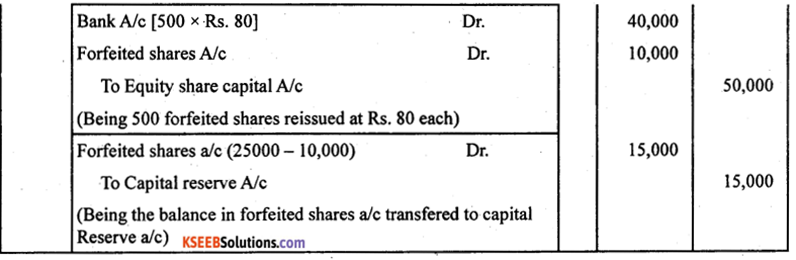

All the shares were subscribed and the money duly received except the first and final call on 500 shares. The directors forfeited there shares and re-issued them as fully paid at ? 80 per share.

Pass the necessary Journal entries in the books of the company.

Answer:

Question 30.

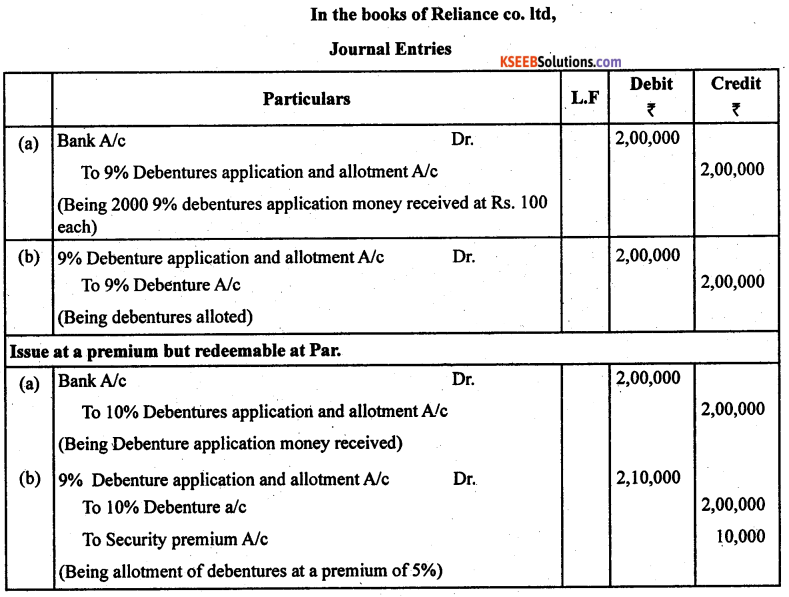

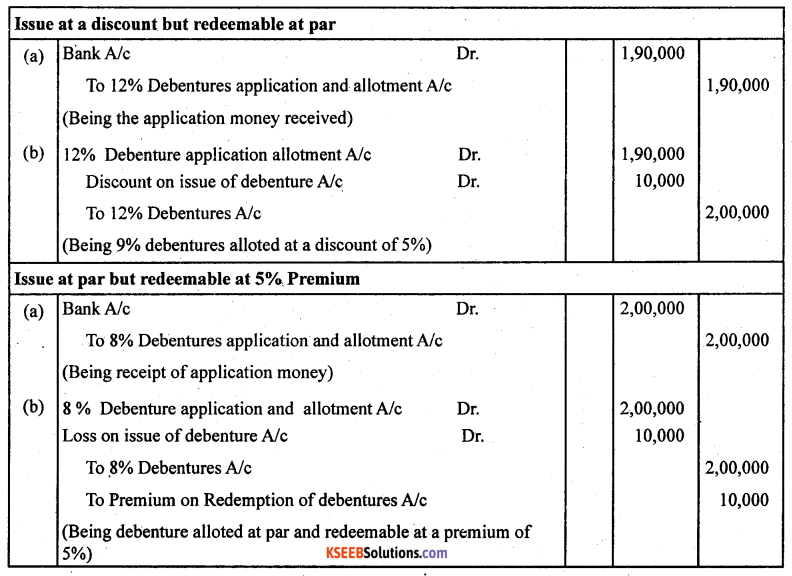

Give the Journal entries for issue of Debentures for the following cases in the Books of Reliance co., Ltd. .

(a) Issue of ₹ 2,00,000,9% Debentures of ₹ 100 each at par and redeemable at par.

(b) Issue of ₹ 2,00,000,10% Debentures of ₹ 100 each at a premium of 5% but redeemable at par.

(c) Issue of ₹ 2,00,000,12% Debentures of ₹ 100 each at a discount of 5%, redeemable at par.

(d) Issue of ₹ 2,00,000, 8% Debentures of ₹ 100 each at par but redeemable at a premium of 5%.

Answer:

Question 31.

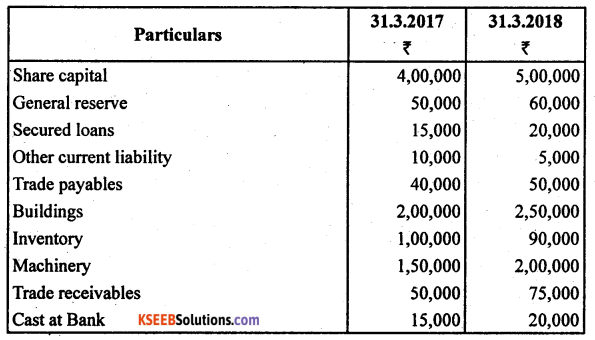

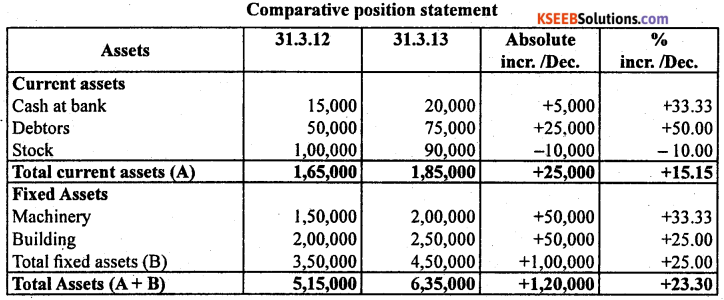

From the following information, prepare comparative Balance sheet of Honda company Ltd.,

Answer:

![]()

Question 32.

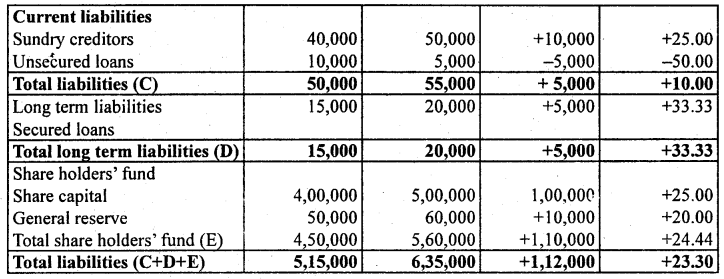

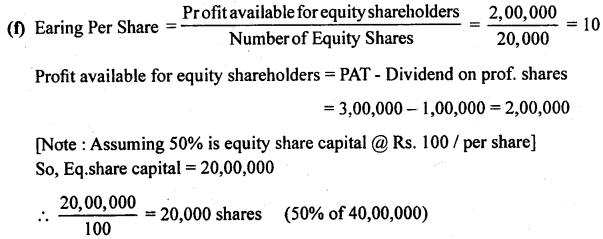

From the following particulars calculate:

(a) Inventory turn over ratio.

(b) Trade receivable turn over ratio

(c) Trade payable turn over ratio

(d) Gross profit ratio

(e) Operating ratio

(f) Net profit ratio.

Answer:

Section-E

(Practical Oriented Questions)

V. Answer any Two questions, each question carries Five marks: (2 × 5 = 10)

Question 33.

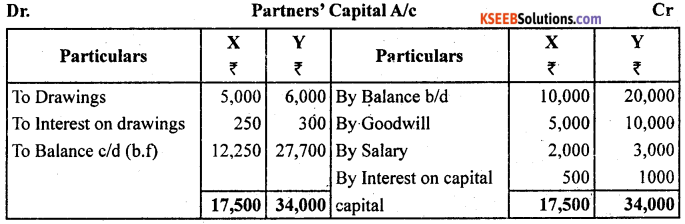

Write two partners capital accounts under fluctuating capital system with 5 imaginary figure.

Answer:

![]()

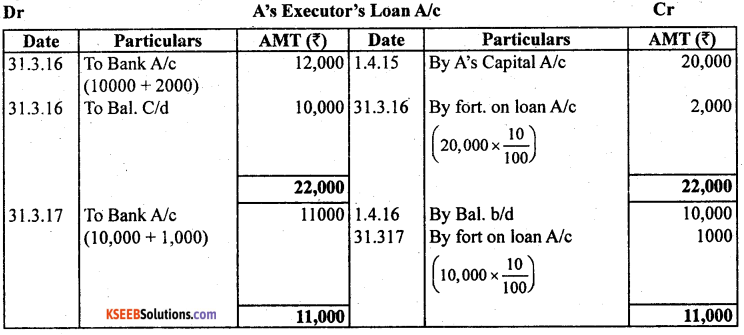

Question 34.

Prepare Executor’s loan account with imaginary figures showing the repayment in two annual equal installments along with interest.

Answer:

Question 35.

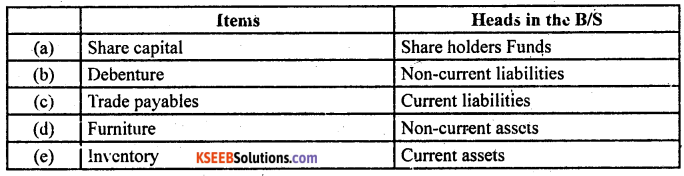

Name the major heads under which the following items will be presented in the Balance sheet of a company

(a) Share Capital

(b) Debentures

(c) Trade payables

(d) Furniture

(e) Inventory

Answer: