Students can Download 2nd PUC Accountancy Previous Year Question Paper June 2019, Karnataka 2nd PUC Accountancy Model Question Papers with Answers helps you to revise the complete Karnataka State Board Syllabus and score more marks in your examinations.

Karnataka 2nd PUC Accountancy Previous Year Question Paper June 2019

Time: 3 Hrs 15 Min

Max. Marks: 100

Instructions: –

- All sub questions of Section – A should be answered continuously at one place.

- Provide working notes wherever necessary.

- 15 minutes extra time has been allotted for the candidates to read the questions.

- Figures in the right hand margin indicates full marks.

Section-A

1. Answer any Eight questions, each question carries One mark : (8 × 1 = 8)

Question 1.

Give an example for specific donation.

Answer:

Legacies.

Question 2.

In order to form a partnership there should be atleast.

(a) One person

(b) Two persons

(c) Seven persons

(d) None of the above

Answer:

(b) Two persons

Question 3.

State any one method of valuation of goodwill.

Answer:

The important methods of valuation of good will are as follows

(a) Average profit methods

(b) Super profit method or any other method

![]()

Question 4.

General reserve is transferred to continuing partners capital account (State True/False)

Answer:

True

Question 5.

Equity shareholders are

(a) Creditors

(b) Owners

(c) Customers of the company

(d) None of the above

Answer:

(b) Owners

Question 6.

Expand D.R.R.

Answer:

DRR – Debenture redemption reserve.

Question 7.

Capital Reserve is shown under _______ head in the balance sheet of a company.

Answer:

Reserves and surplus – Equities and liabilities head.

Question 8.

Give any one objective of Financial Statement Analysis.

Answer:

Two objectives of financial statement:

- To present a true and fair view of the financial performance, i.e., profit/loss of the business

- To provide information about cashflows

Question 9.

Quick ratio is also known as

Answer:

Liquid ratio.

Question 10.

What do you mean by cash flows?

Answer:

A cash flow statement is a statement showing inflows (receipts) and out flows (payments) of caash during a particular period.

Section – B

II. Answer any Five questions, each question carries Two marks : (5 × 2 = 10)

Question 11.

What is not for profit organisation?

Answer:

Non profit organisation are those orgainsations which are formed to render social service and not for making profits, such as promotion of education, sports, and games, science and techonology etc.

Question 12.

State any two features of partnership.

Answer:

The features of partnership are

- Partnership is an agreement between two or more persons to do business and to share its profit or loss in agreed ratio.

- Partnership may be carried on by all or by any of them acting for all.

Question 13.

Goodwill of the firm is valued at two years purchase of average profits of last 4 years. The total profits for the last 4 years are ₹ 80,000. Calculate the goodwill of the firm.

Answer:

Goodwill = Average profit of last 4 years × No. of years of purchase = Rs. 20,000 × 2 years = Rs. 40,000.

Average profit = \(\frac{\text { Total profit }}{\text { No. of years }}=\frac{80,000}{4}\) = 20,000

Question 14.

Give the journal entry for the asset taken over by a partner on dissolution of firm.

Answer:

Partner capital account Dr.

To Realisation A/c

![]()

Question 15.

Mention any two features of company.

Answer:

The features of a company are

- Company is an artificial person created by law

- A company has perpetual legal existence different and distinct from that of its member.

- Enjoys limited liability.

Question 16.

Write any two limitations of financial statements.

Answer:

The limitations of financial statements are –

(a) Doesn’t reflect current situation

(b) Non-monetary factors are ignored

(c) It records only historical costs.

Question 17.

List any two tools of financial statement analysis.

Answer:

The two tools of financial statement analysis are

- Common size statements.

- Comparative statements.

Question 18.

Investing activities.

Answer:

It is an important item in the cash flow statement related to sales and purchase of long-term fixed assets like land and building, plant and machinery, furniture etc.

Section-C

III. Answer any Four questions, each question carries Six marks : (4 x 6 = 24)

Question 19.

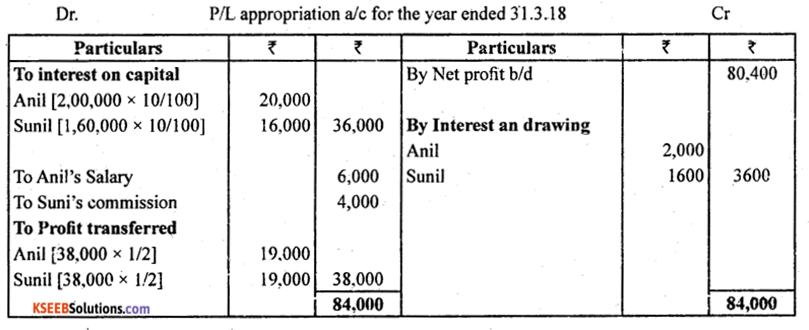

Anil and Sunil are partners, started business on 1.4.2017. They share profits and losses equally. They invested capital ₹ 2,00,000 and ₹ 1,60,000 respectively. For the year ended 31.3.2018, they earned a profit of 80,400 before following adjustments.

(a) Interest on capital at 10% p.a.

(b) Interest on drawing Anil – ₹ 2,000 Sunil – ₹ 1,600

(c) Annual salary payable to Anil – ₹ 6,000

(d) Annual commission payable to Sunil ₹ 4,000

Prepare Profit and loss appropriation account for the year ended 31.3.2018.

Answer:

In the books of Anil and Sunil

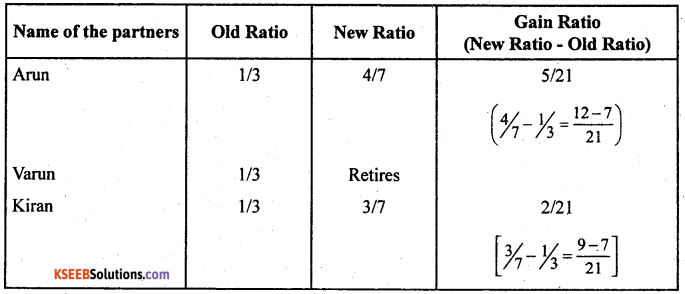

Question 20.

Arun, Varun and Kiran are equal partners in a partnership firm. Varun retires from the firm. Arun and Kiran decided to share the profits in future in the ratio of 4:3.

Calculate gain ratio.

Answer:

Calculation of Gain Ratio of Arun and Kiran

∴ Gain Ratio = 5:2

Question 21.

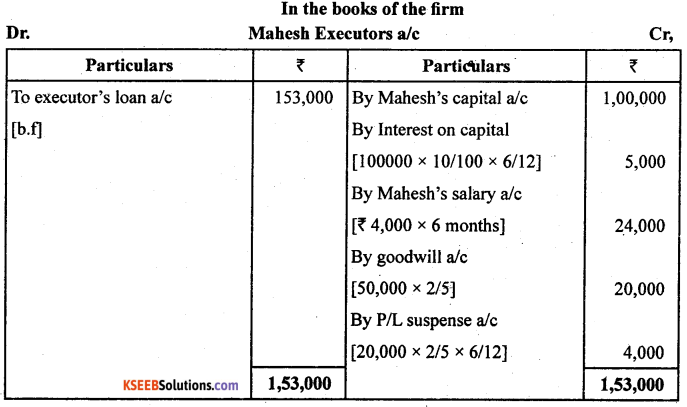

Mahesh, Mohan and Naresh are partners sharing profits and losses in the ratio of 2 :2 :1. Their capitals on 1.4.2017 was 1,00,000, 80,000 and 50,000 respectively. Mahesh died on 1.10.2017 and the partnership deed provides the following:

(a) Interest on capital at 10% p.a.

(b) Mahesh entitles for a monthly salary of ₹ 4,000.

(c) Mahesh’s share of goodwill. The total goodwill of the firm is ₹ 50,000

(d) His share of profit upto the date of death, on the basis Of previous year’s profit. Previous year profit is ₹ 20,000.

Prepare Mahesh’s Executors Account.

Answer:

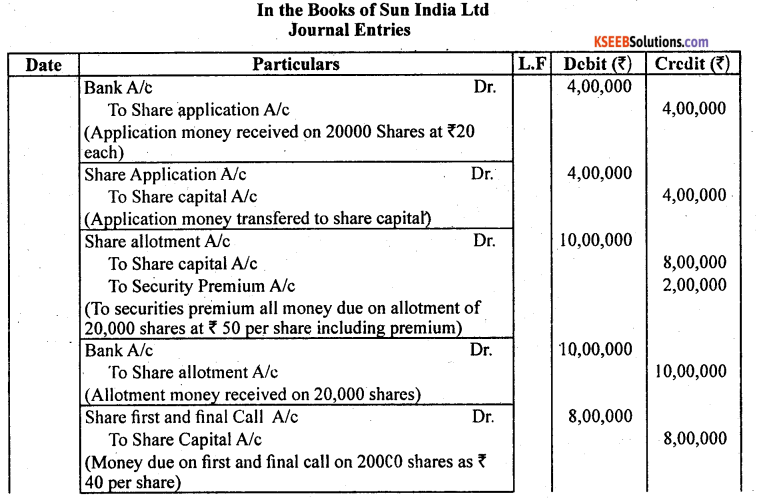

Question 22.

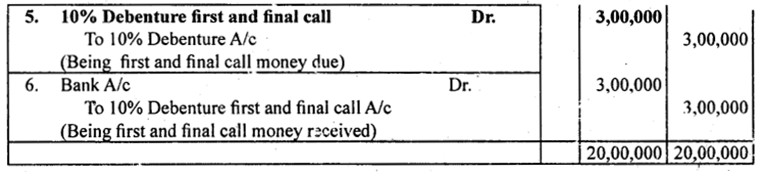

Sunlight Ltd., issued 20,000 10% Debentures of ₹100 each payable.

₹ 10 per debenture on application

₹ 40 per debenture on allotment

₹ 50 per debenture on first and final call

All the debentures were subscribed and money duly received

Pass the journal entries in the books of the company.

Answer:

![]()

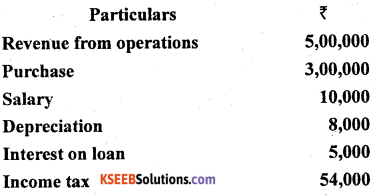

Question 23.

Following information is related to Akash Ltd.,

Prepare statement of profit or loss for the year ended 31.3.2017 as per Schedule III of Company Act 2013.

Question 24.

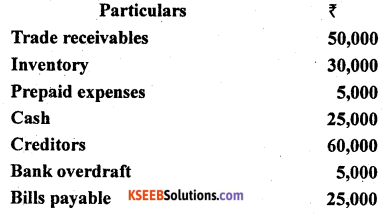

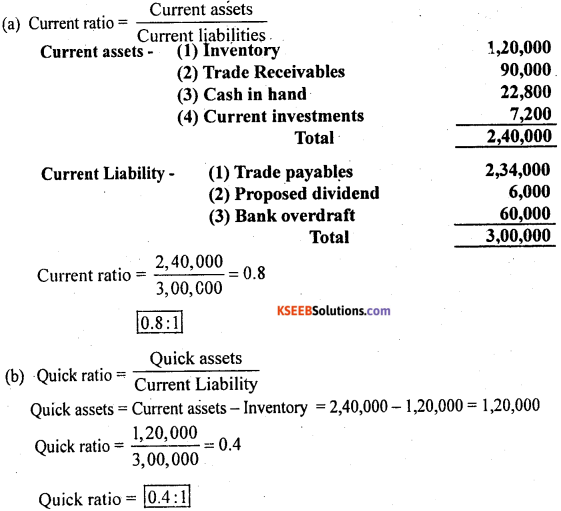

Calculate current ratio and Quick ratio from the following information :

Answer:

Question 25.

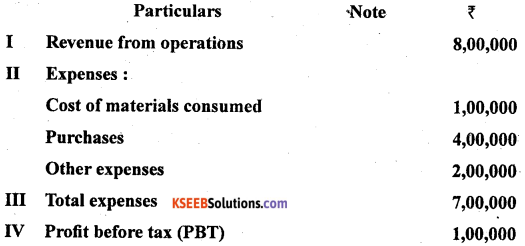

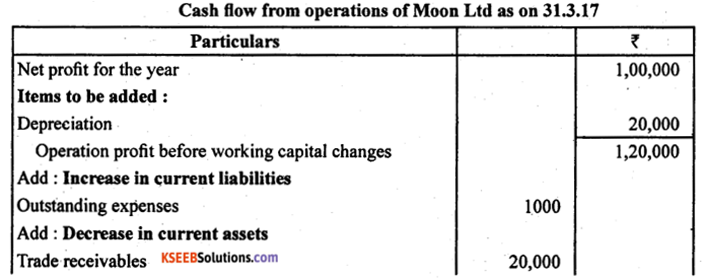

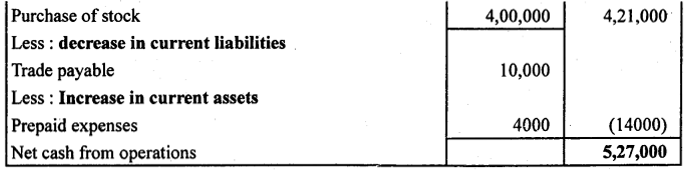

The following is the statement of Profit and loss of Moon Ltd., Statement of Profit or loss for the year ended 31.3.2017

Additional Information :

(a) Trade receivable decreased by ₹ 20,000 during the year

(b) Prepaid expenses increased by ₹ 4,000 during the year

(c) Trade payable increased by ₹ 10,000 during the year

(d) Outstanding expenses increased by ₹ 1,000 during the year

(e) Other expenses includes depreciation ₹ 20,000.

Compute Net cash flow from operations for the year ended 31.3.2017 by indirect method.

Answer:

Section – D

VI. Answer any four questions, each question carries Twelve marks : 4 × 12 = 48

Question 26.

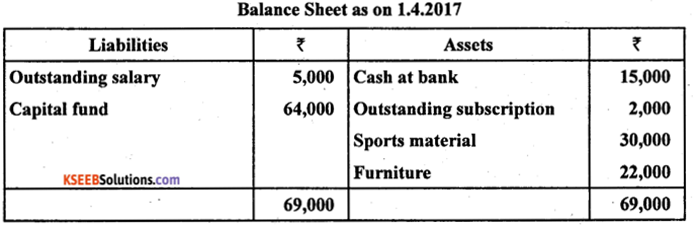

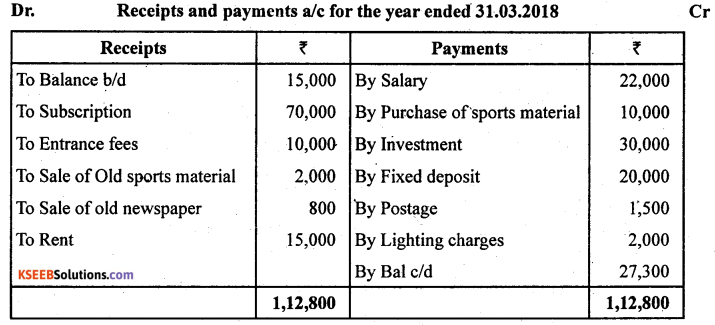

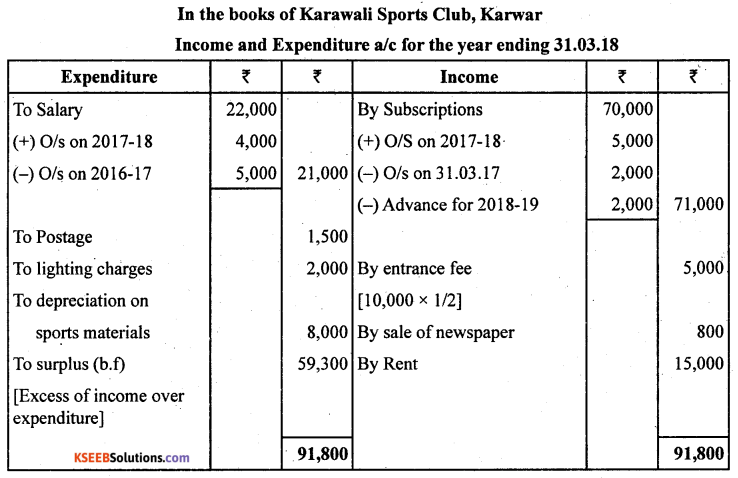

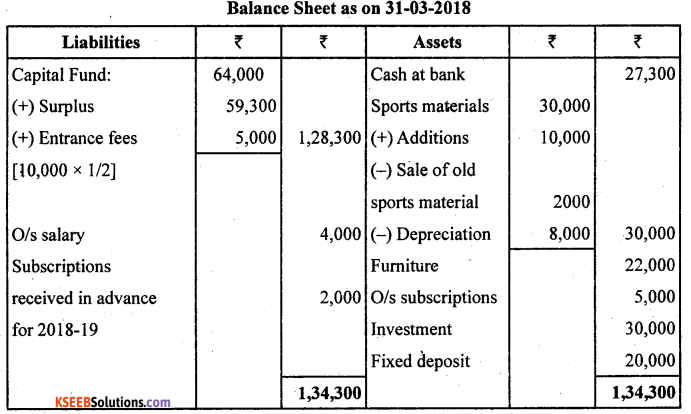

The following is the Balance Sheet and Receipts and payments account of Karawali Sports club, Karwar.

Adjustments:

(a) Subscription outstanding for the year 2017-18 is ₹ 5,000.

(b) Subscriptions received in advance for 2018-19 ₹ 2,000.

(c) Depreciate sports materials by ₹ 8,000

(d) Outstanding salary for 2017-18 ₹ 4,000

(e) Capitalize, 1/2 of the entrance fees.

Prepare:

(i) Income and expenditure account for the year ended 31.3.2018

(ii) Balance Sheet as on 31.3.2018.

Answer:

![]()

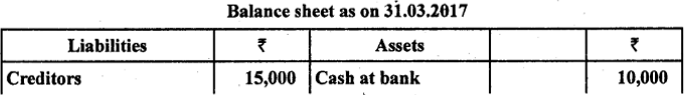

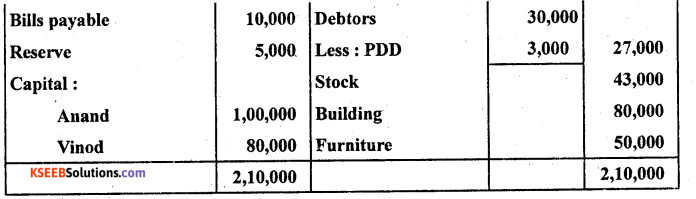

Question 27.

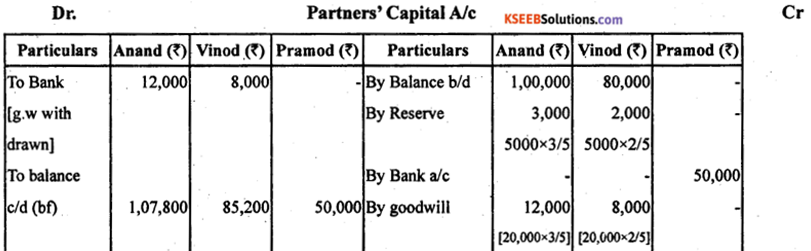

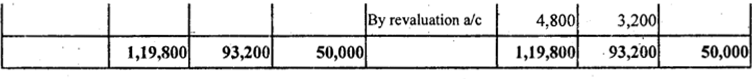

Anand and Vinod are partners in a firm, sharing profit and losses in the ratio of 3 : 2. Their balance sheet as on 31.3.2017 was as follows:

On 1.4.2017 Pramod was admitted into partnership on the following terms:

(a) He should bring ₹ 50,000 as capital and ₹ 20,000 towards goodwill for 1/5 share of profits in future.

(b) Depreciate furniture at 10% p.a. and appreciate building by 20% p.a.

(c) Provision for doubtful debts increased by ₹ 3,000

(d) Goodwill is to be withdrawn by the old partners.

Prepare:

(i) Revaluation account

(ii) Partners capital account

(iii) Balance sheet of the firm after admission.

Answer:

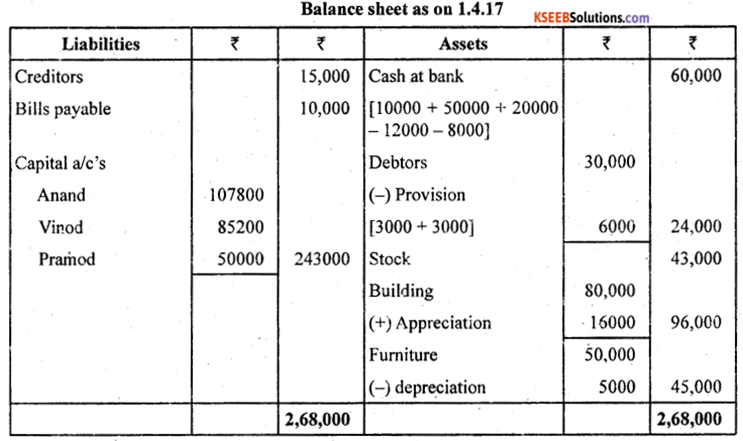

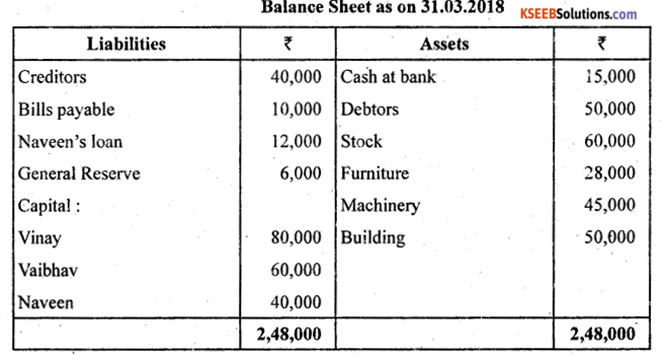

Question 28.

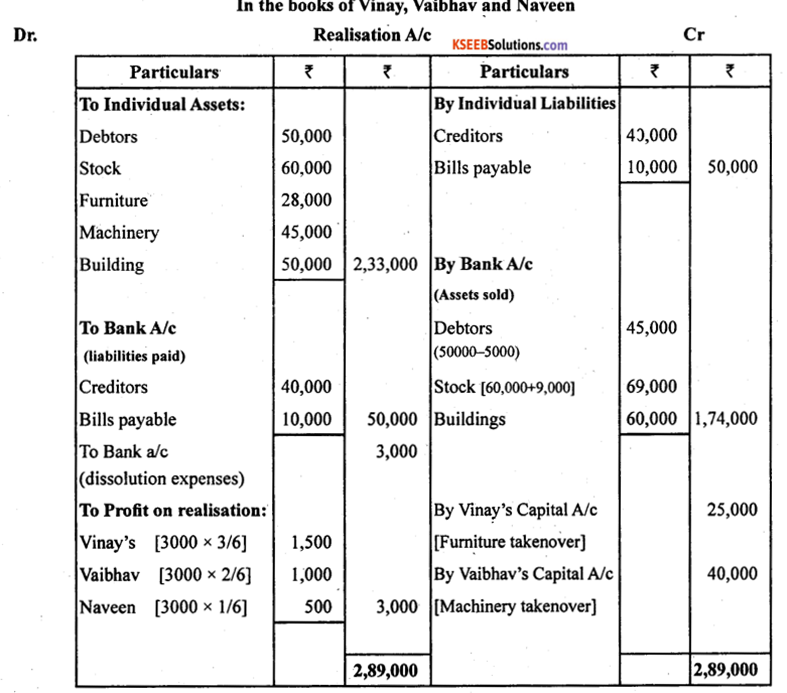

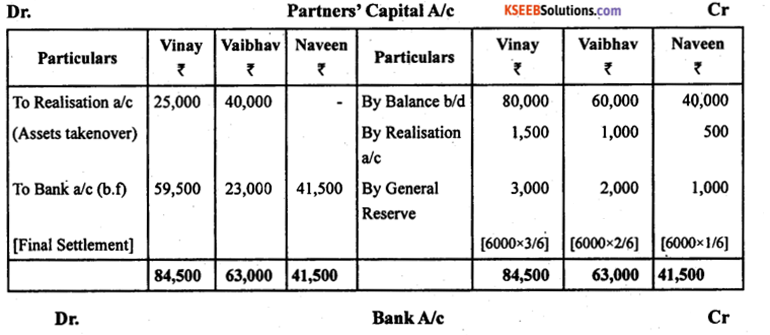

Vinay and vaibhav and Naveen are partners is a firm, sharing profits and losses in the ratio of 3:2:1 respectively. Their balance sheet as on 31.3.2018 was as under

The firm was dissolved on the above date. The assets realised as under :

(a) Debtors realised 10% less than book value, stock realised 15% more than book value. Building realised ₹ 60,000.

(b) Creditors and Bills payable were paid in full.

(c) Furniture was taken over by Vinay for ₹ 25,000

(d) Machinery was taken over by Vaibhav for ₹ 40,000

(e) Cost of dissolution amounted to ₹ 3,000.

Prepare:

(a) Realisation account

(b) Partners’ Capital Account and

(c)BankA/c

Answer:

![]()

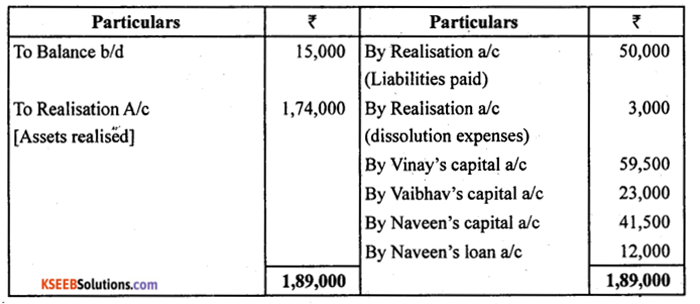

Question 29.

Murdershwar Tiles Ltd., issued ₹ 50,000 equity shares of 10 each at a premium of ₹ 2 per share. The amount payable was as under:

₹ 2 on application

₹ 6 on allotment (including premium)

₹ 4 on first and final call. ‘

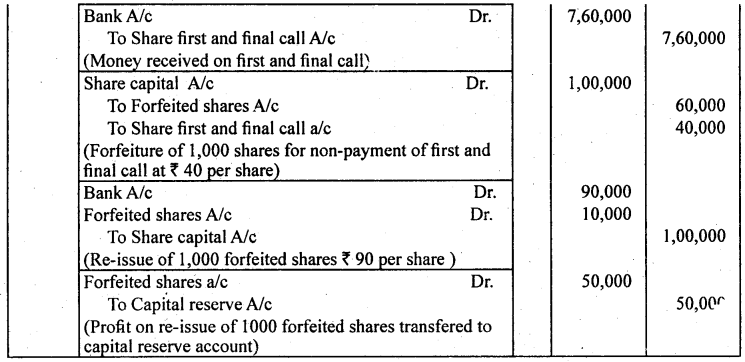

All the shares were subscribed and the money was duly received except first and final call on 5,000 shares. The directors forfeited these shares and reissued them as fully paid up at ₹ 7 per share.

Pass the journal entries regarding issue, forfeiture and re-issue of forfeited shares.

Answer:

Question 30.

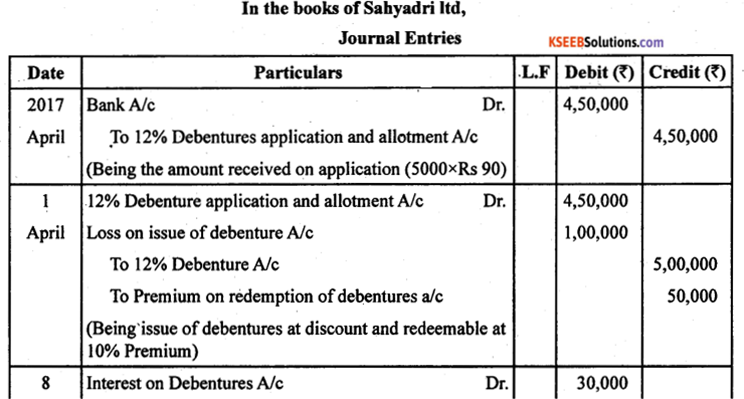

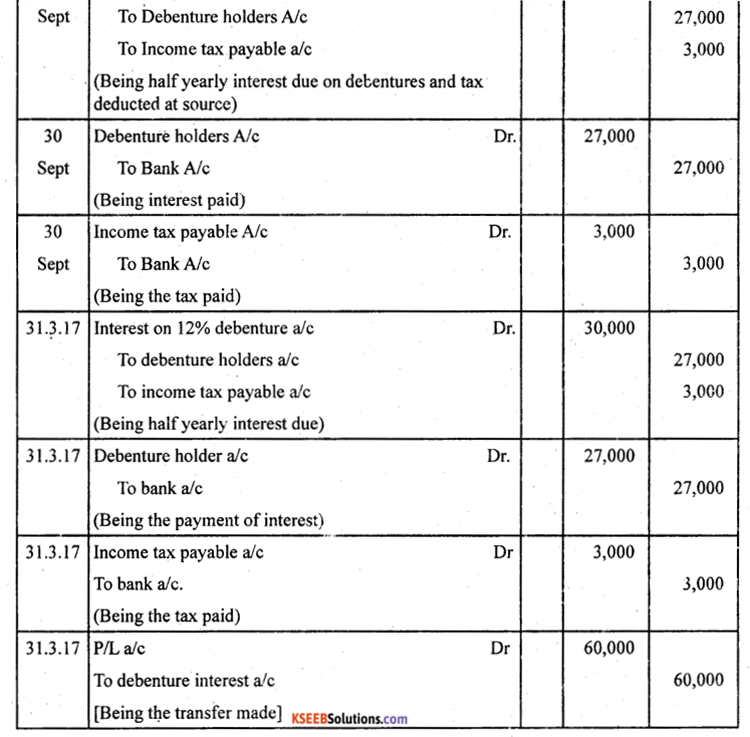

Sahyadri Ltd., issued 5000, 12% debentures of? 100 each on 1.4.2017 at a discount of 10% redeemable at a premium of 10%.

Give journal entries relating to the issue of debentures and debenture interest for the year ending 31.3.2018 assuming that interest was paid half yearly on 30th September and 31st March. Tax deducted at source is 10%.

Answer:

![]()

Question 31.

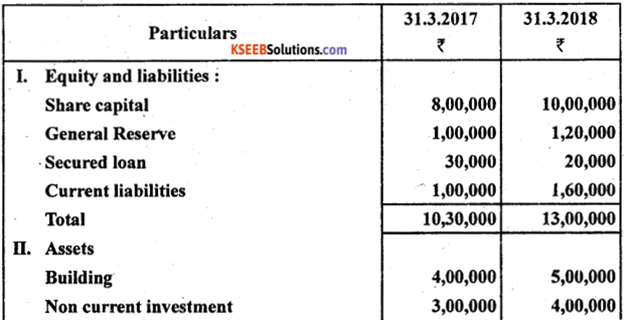

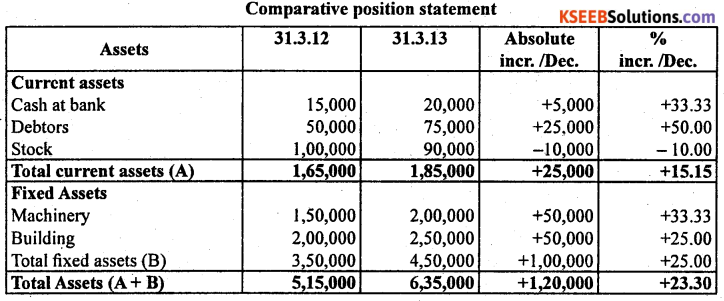

The following are the balance sheets of Samudra Ltd., as on 31.3.2017 to 31.3.2018

Prepar comparative balance sheet

Answer:

Question 32.

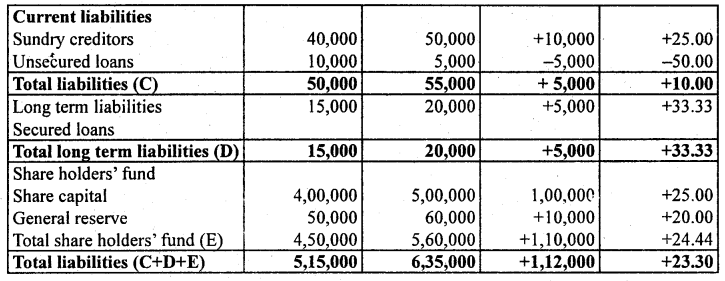

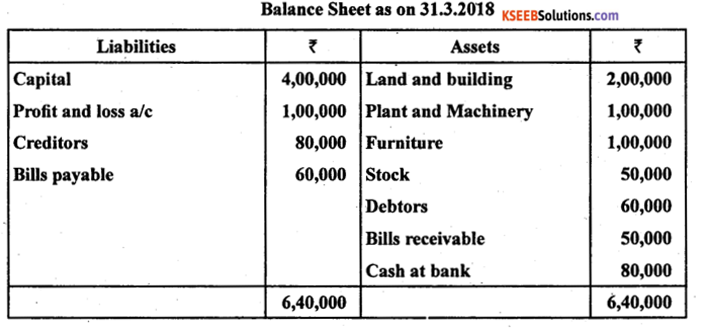

The following are the Summarised Profit and loss a/c for the year ended 31.3.2018 and balance sheet as on that date.

Calculate:

(a) Inventory turnover ratio

(b) Trade receivable turnover ratio

(c) Trade payable turnover ratio

(d) Gross profit ratio

(e) Net profit ratio

(f) Operating ratio.

Answer:

![]()

Section – E

(Practical Oriented Questions)

V. Answer any Two questions, each question carries Five marks : (2 × 5 = 10)

Question 33.

How do you treat the following in the absence of partnership deed?

(a) Sharing of profit

(b) Interest on capital

(c) Interest on drawing

(d) Interest on advances from partners

(e) Remuneration to partners for firms work.

Answer:

(a) Interest on capital – Nil

(b) Interest on drawing – Nil

(c) Interest on loan – 6%P.a

(d) Distribution of Profit or losses – Equally

(e) Salary to partner – Nil

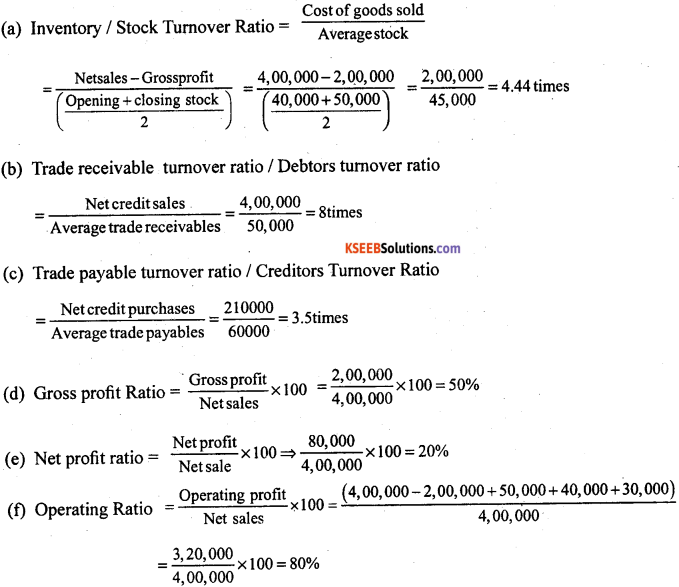

Question 34.

Write the pro-forma of balance sheet of a company with main heads only.

Answer:

Question 35.

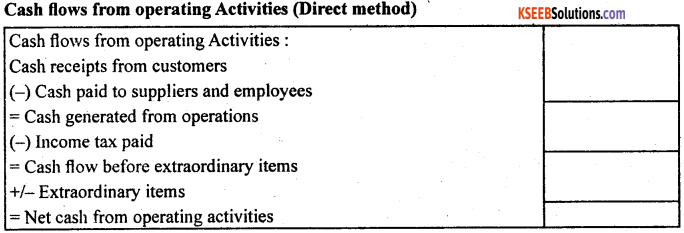

Write the pro-forma of cash flows from operating activities under direct method.

Answer: