Karnataka 1st PUC Business Studies Question Bank Chapter 11 International Business

One Mark Questions

Question 1.

Name anyone model entering into international business. (March -N- 2018)

Answer:

Exporting and importing.

Question 2.

What is export trade?

Answer:

Export trade refers to the sale of a home or domestic goods to other countries.

![]()

Question 3.

What is Import trade? (March – S -2018)

Answer:

Import trade refers to the purchase of goods from other countries for domestic use.

Question 4.

Which is the easiest mode of gaining entry mtoiternationaI markets?

Answer:

Exporting/Importing.

Question 5.

Give an example of a business organization that has entered into the international business through a licensing system.

Answer:

General Motors.

Question 6.

Give an example of a business organization that has entered into the international business through a franchising system.

Answer:

McDonald.

Question 7.

What ¡s contract manufacturing known as?

Answer:

Outsourcing.

Question 8.

Mention any one type of foreign investment.

Answer:

Foreign direct investment.

Question 9.

Name the parties In the licensing system.

Answer:

Licensor and licensee.

Question 10.

Name the parties In the franchising system.

Answer:

Franchisor and franchisee.

Question 11.

State any one way by which wholly-owned subsidiaries enter m tutçrhonaI business

Answer:

Setting up a new firm altogether to start operations in a foreign country.

Question 12.

State one major for of is a lie that constitutes international. business.

Answer:

Licensing.

Question 13.

Give analysis for service export and import.

Answer:

Transportation and insurance.

Two Mark Questions

Question 1.

Define international business.

Answer:

According to Michael R. Czinkota, “International business consists of transactions that are devised and carried out across national borders to satisfy the objectives of the individuals, companies, and organizations. These transactions take on various forms which are often interrelated.”

Question 2.

Give any two reasons for international business.

Answer:

(a) To earn more profit.

(b) Advanced technology.

Question 3.

Write the meaning of licensing.

Answer:

Licensing is a contractual arrangement in which one firm grant access to its patents, trade secrets, or technology to another firm in a foreign country for a fee called royalty.

Question 4.

Define franchising.

Answer:

According to Charles W.L. Hill, “Franchising is basically a specialized form of licensing in which the franchisor not only sells the intangible property to the franchisee but also insists that the franchisee agrees to abide by strict rules as to how it does business.”

Question 5.

What is meant by foreign direct investment?

Answer:

Direct investment takes place when a company directly invests in properties such as plants and machinery in foreign countries with a view to undertaking production and marketing of goods and services in those countries. The direct investment provides the investor a controlling interest in a foreign company. This is otherwise known as Foreign Direct Investment, i.e. FDI.

Question 6.

What is portfolio investment?

Answer:

A portfolio investment, on the other hand, is an investment that a company makes into another company by the way of acquiring shares or providing loans to the latter and earns income by way of dividends or interest on loans.

Question 7.

Write the meaning of contract manufacturing.

Answer:

Does contract manufacturing refer to a type of international business where a firm enters? into a contract with one or a few local manufacturers in foreign countries to get certain components or goods produced as per their specifications.

Question 8.

Write the meaning of cross-licensing.

Answer:

If there are a mutual exchange of knowledge, technology, and/or patents between the firms which is known as cross-licensing.

Question 9.

State any two differences between licensing and franchising.

Answer:

One major distinction between the two is that while licensing is used in connection with the production and marketing of goods, the term franchising applies to service business.

Question 10.

Another point of difference between the two is that franchising is relatively more stringent than licensing.

Answer:

A joint venture means establishing a firm that is jointly owned by two or more otherwise independent firms. In the widest sense of the term, it can also be described as any form of association which implies collaboration for more than a transitory period.

Question 11.

Mention any two ways of forming a joint venture.

Answer:

(a) Foreign investor buying an interest in a local company.

(b) Local firm acquiring an interest in an existing foreign firm.

![]()

Question 12.

Name any two countries with which India trades.

Answer:

USA, UK.

Question 13.

What is direct export or import?

Answer:

Direct exporting/importing, a firm itself approaches the overseas buyers/suppliers and looks after all the formalities related to exporting/importing activities including those related to shipment and financing of goods and services.

Question 14.

What is indirect export or import?

Answer:

Indirect exporting/importing is one where the firm’s participation in the export/import operations is minimum, and most of the tasks relating to export/import of the goods are carried out by some middlemen such as export houses or buying offices of overseas customers located in the home country or wholesale importers in the case of import operations.

Question 15.

State any two modes of entry into international business.

Answer:

(a) Joint venture.

(b) Wholly owned subsidiaries.

Question 16.

State any two benefits of international business to firms.

Answer:

(a) Prospects for higher profits.

(b) Increased capacity utilization.

Question 17.

State any two benefits of international business to the nation.

Answer:

(a) Earning of foreign exchange.

(b) More efficient use of resources.

Question 18.

State any two ways by which wholly-owned subsidiaries enter into international business.

Answer:

(a) Setting up a new firm altogether to start operations in a foreign country.

(b) Acquiring an established firm in the foreign country and. using that firm to manufacture and/or promote its products in the host nation.

![]()

Question 19.

Distinguish between licensing and franchising.

Answer:

(a) Licensing is an agreement between Licensor and licensee whereas franchising is an agreement between franchisee and franchiser.

(b) Licensing means permitting another party in a foreign country to produce and sell goods under trademark, patents whereas franchising means sell or distribute the branded products in a specific geographical area.

Question 20.

Why is it necessary to get registered with an export promotion council?

Answer:

It is necessary for the exporter to become a member of the appropriate Export Promotion ^ Council and obtain a Registration Cum Membership Certificate (RCMC) for availing benefits available to export firms from the government like duty exemptions. These councils also provide incentives to the exporters.

Question 21.

What is the IEC number?

Answer:

Import Export Code (IEC) number is given to -an export firm by Director General for Foreign Trade (DGFT) which the firm needs to be filled in various export/import documents. For obtaining the IEC number, a firm has to apply to the DGFT with documents such as exporter. importer profile, bank receipt for a requisite fee, a certificate from the banker on the prescribed form, two copies of photographs attested by the banker, details of the non-resident interest, and declaration about the applicant’s non-association with caution listed firms.

Question 22.

What is pre-shipment finance?

Answer:

Pre-shipment finance is the finance that the exporter needs before the shipment of the order for procuring raw materials and other components, processing and packing of goods, and transportation of goods to the port of shipment or we can say pre-shipment finance is the finance which is required to undertake export production.

Question 23.

What is a shipping bill?

Answer:

The shipping bill is the main document on the basis of which the customs office gives permission for export. Shipping bill contains particulars of the goods being exported, the name Of the vessel, the port at which goods are to be discharged, country of final destination, exporters name and address, etc. Exporter prepares the shipping bill for obtaining customs clearance. Thus, we can say the shipping bill is the bill that is prepared by the exporter and required for customs clearance.

Question 24.

List out major affiliated bodies of the World Bank.

Answer:

Major affiliated bodies of the World Bank are:

(a) International Bank for Reconstruction and Development (IBRD).

(b) International Financial Corporation (IFC).

(c) International Development Association (IDA).

(d) Multilateral Investment Guarantee Agency (MIGA).

(e) International Centre for Settlement of Investment Disputes (ICSID).

Eight Mark Questions

Question 1.

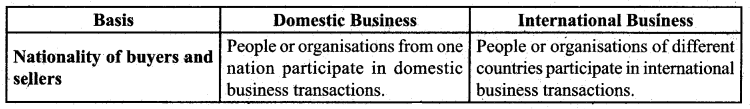

How an international business does differ from a domestic business?

Answer:

Question 2.

Explain the scope of international business.

Answer:

Merchandise exports and imports: Merchandise means goods that are tangible, i.e. those that can be seen and touched. When viewed from this perceptive, it is clear that while merchandise exports mean sending tangible goods abroad, merchandise imports mean bringing tangible goods from a foreign country to one’s own country.

Service exports and imports: Service exports and imports involve trade in intangibles. It is because of the intangible aspect of services that trade in services is also known as invisible trade. A wide variety of services are traded internationally and these include tourism and travel, boarding and lodging, etc.

Licensing and franchising: Permitting another party in a foreign country to produce and sell goods under your trademarks, patents, or copyrights in lieu of some fee is another way of entering into international business.

Foreign investments: It is another important form of international business. Foreign investment involves investments of funds abroad in exchange for financial return.

Foreign investment can be of two types:

(a) Direct investments: It provides the investor a controlling interest in a foreign company. This is otherwise known as Foreign Direct Investment, i.e. FDI.

(b) Portfolio investments: A portfolio investment, on the other hand, is an investment that a company makes into another company by the way of acquiring shares or providing loans to the latter and earns income by way of dividends or interest on loans.

![]()

Question 3.

Explain the benefits of International business both to national and firms.

Answer:

Benefits of international business to the nation:

(a) Earning of foreign exchange: International business helps a country to earn foreign exchange which it can later use for meeting its imports of capital goods, technology, petroleum products, and fertilizers, pharmaceutical products, and a host of other consumer products which otherwise might not be available domestically.

(b) More efficient use of resources: As stated earlier, the international business operates on a simple principle produce what your country can produce more efficiently, and trade the surplus production so generated with other countries to procure what they can produce more efficiently. When countries trade on this principle, .they end up producing much more than what they can when each of them attempts to produce all the goods and services on its own.

(c) Improving growth prospects and employment potentials: Producing solely for the purposes of domestic consumption sev1erely restricts a country’s prospects for growth and employmeñt. Many cõufltries, especially the developing ones, could not execute their plans to produce on a larger scale, and thus create employment for people because their domestic market was not large enough to absorb all that extra production. ‘

(d) Increased standard of living: In the absence of international trade of goods and services, it would not have been possible for the world community to consume goods and services produced in other countries that the people in these countries are able to consume and enjoy a higher standard of living.

(e) Greater variety of goods available for consumption: International trade brings in different varieties of a particular product from different destinations. This gives consumers a wider array of choices which will not only improve their quality of life but as a whole, It will help the country to grow.

(f) Consumption at a cheaper cost: International trade enables a country to consume things that either cannot be produced within its borders or production may cost very high. Therefore it becomes cost cheaper to import from other countries through foreign trade.

(g) Reduces trade fluctuations: By making the size of the market large with large supplies an extensive demand, international trade reduces trade fluctuations. The prices of goods tend to remain more stable.

Benefits of international business to firms

(a) Prospects for higher profits: International- business can be more profitable than domestic business. When the domestic prices are lower, business firms can earn more profits by selling their products in countries where prices are high.

(b) Increased capacity utilization: Many firms set up production capacities for their products that are in excess of demand in the domestic market. By planning overseas expansion Mid procuring orders from foreign customers, they can think of making use of their surplus production capacities and also improving the profitability of their operations.

(c) Prospects for growth: Business firms find it quite frustrating when demand for their products starts getting Curated in -the domestic market. Such firms can considerably improve the prospects of their growth by plunging into overseas markets. This is precisely what has prompted many of the multinationals from the developed countries to enter into markets of developing countries.

(d) Way out to intense competition in the domestic market: When competition in the domestic market is very intense, internationalization seems to be the only way to achieve significant growth. The highly competitive domestic market drives many companies to go international in search of markets for their products.

(e) Improved business vision: The growth of the international business of many companies is essentially a part of their business policies or strategic management. The vision to become international comes from the urge to grow, the need to become more competitive, the need to diversify, and to gain strategic advantages of internationalization.

Question 4.

What are exporting and importing? State its advantages and limitations.

Answer:

Exporting refers to sending of goods and services from the home country to a foreign country. In a similar Vein, importing is the purchase of foreign products and bringing them into one’s home country.

Major advantages of exporting include:

(a) As compared to other modes of entry, exporting/importing is the easiest way of gaining entry into international markets.

(b) Exporting/importing is less involved in the sense that business firms are not required to invest that much time and money.

(c) Since exporting/importing does not require much investment in foreign countries, exposure to foreign investment risks is nil or much lower.

Major limitations of exporting/importing:

(a) Since the goods physically move from one country to another, exporting/importing involves additional packaging, transportation, and insurance costs.

(b) Exporting is not a feasible option when import restrictions exist in a foreign country. In such a situation, firms have no alternative but to opt for other entry modes such as licensing/ franchising or joint venture, etc.

(c) Export firms basically operate from their home country. They produce in the home country and then ship the goods to foreign countries. Except for a few visits made by the executives of export firms to foreign countries to promote their products, the export firms, in general, do not have much contact with the foreign markets.

Question 5.

What is a joint venture? Write its advantages and limitations.

Answer:

A joint venture means establishing a firm that is jointly owned by two or more otherwise independent firms. In the widest sense of the term, it can also be described as any form of association which implies collaboration for more than a transitory period.

Advantages

(a) Since the local partner also contributes to the equity capital of such a venture, the international firm finds it financially less burdensome to expand globally.

(b) Joint ventures make it possible to execute large projects requiring huge capital outlays and manpower.

(c) The foreign business firm benefits from a local partner’s knowledge of the host countries regarding the competitive conditions, culture, language, political systems, and business systems.

(d) In many cases entering into a foreign market is very costly and risky. This can be avoided by sharing costs and/or risks with a local partner under joint venture agreements.

Limitations

(a) Foreign firms entering into joint ventures share the technology and trade secrets with local firms in foreign countries, thus always running the risks of such technology and secrets being disclosed to others.

(b) The dual ownership arrangement may lead to conflicts, resulting in a battle for control between the investing firms.

![]()

Question 6.

What is contract manufacturing? State its advantages and limitations.

Answer:

Contract manufacturing refers to a type of international business where a” firm enters into a contract with one or a few local manufacturers in foreign countries to get certain components or goods produced as per its specifications.

Advantages:

(a) Contract manufacturing permits the international firms too. get the goods produced on a large scale without requiring investment in setting up production facilities.

(b) Since there is no or little investment in the foreign countries, there is hardly any investment risk involved in the foreign countries,

(c) Contract manufacturing also gives an advantage to the international company of getting products manufactured or assembled at lower costs especially if the local producers happen to be situated in countries that have lower material and labor costs.

Limitations

(a) Local firms might not adhere to production design and quality standards, thus causing serious product quality problems to the international firm.

(b) Local manufacturer in the foreign country loses hiS control over the manufacturing process because goods are produced strictly as per the terms and specifications of the contract.

(c) The local firm producing under contract manufacturing is not free to sell the contracted output as per its will. It has to sell the goods to the international company at predetermined prices. This results in lower profits for the local firm.

Question 7.

Write the meaning of licensing and franchising. State its advantages and limitations.

Answer:

Licensing is a contractual arrangement in which one firm grant access to its patents, trade secrets, or technology to another firm in a foreign country for a fee called royalty.

Franchising is a term, very similar to licensing. One major distinction between the two is that while the former is used in connection with the production and marketing of goods, the term franchising applies to service business.

Advantages of licensing and franchising are:

(a) Under the licensing/franchising system, it is the licensor/franchiser who sets up the business unit and invests his/her own money in the business. As such, the licensor/franchiser has to virtually make no investments abroad.

(b) Since no or very little foreign investment is involved, licensor/franchiser is not a party to the losses, if any, that occur to foreign business. Licensor/franchiser is paid by the licensee/ franchisee by way of f6es fixed in advance as a percentage of production or sales turnover.

(c) Since the business in the foreign country is managed by the licensee/franchisee who is a local person, there are lower risks of business takeovers or government interventions.

(d) Licensee/Franchisee being a local person has greater market knowledge and contacts which can prove quite helpful to the licensor/franchiser in successfully conducting its marketing operations.

Limitations of licensing and franchising are;

(a) When a licensee/franchisee becomes skilled in the manufacture and marketing of the licensed/franchised products there is a danger that the licensee can start marketing an identical product under a slightly different brand name.

(b) If not maintained properly, trade secrets can get divulged to others in the foreign markets. Such lapses on the part of the licensee/franchisee can cause severe losses to the licensor/ franchiser.

(c) Over time, conflicts Often develop between the licensor/franchisor and licensee/franchisee over issues such as maintenance of accounts, payment of royalty, and non-adherence to norms relating to the production of quality products.

Question 8.

What do you understand about wholly owned subsidiaries? Write its advantages and limitations.

Answer:

This entry mode of international business is preferred by companies that want to exercise full control over their overseas operations. The parent company acquires full control over the foreign company by making 100 percent investment in its equity capital.

Advantages:

(a) The parent firm is able to exercise full control over its operations in foreign countries.

(b) Since the parent company on its own looks after the entire operations of a foreign subsidiary, it is not required to disclose its technology or trade secrets to others.

![]()

Limitations

(a) The parent company has to make 100 percent equity investments in the foreign subsidiaries. This form of international business is, therefore, not suitable for small and medium-sized firms that do not have enough funds with them to invest abroad.

(b) Since the parent company owns 100 percent equity in the foreign company, it alone has to bear the entire losses resulting from the failure of its foreign operations.

(c) Some countries are averse to setting up 100 percent wholly-owned subsidiaries by foreigners in their countries. This form of international business operations, therefore, becomes subject to higher political risks.

One Mark Questions

Question 1.

Expand DC FT.

Answer:

Director-General for Foreign Trade.

Question 2.

Expand IEC.

Answer:

Import Export Code.

Question 3.

Expand KTZ.

Answer:

Free Trade Zones.

Question 4.

Expand EPZ.

Answer:

Export Processing Zones.

Question 5.

Expand SEZ.

Answer:

Special Economic Zones.

Question 6.

Expand ITO.

Answer:

International Trade Organisation.

Question 7.

Expand GATT.

Answer:

General Agreement for Tariffs and Trade.

Question 8.

Expand EXIM.

Answer:

Export-Import.

Question 9.

Name any one document of export business.

Answer:

Export invoice.

Question 10.

Name any one document of import business.

Answer:

Proforma invoice.

Question 11.

How many commodity boards arc working at present in India?

Answer:

Seven.

Question 12.

At present, how many export promotion councils are working at present in India?

Answer:

Twenty-one.

Question 13.

Name any one export promotion /one.

Answer:

Santa Cruz zone.

Question 14.

Name any one institution set up by the Indian government to promote export trade.

Answer:

Department of Commerce.

![]()

Question 15.

State any one scheme undertaken by the government to promote foreign trade.

Answer:

Export Oriented Unit (EOU) Scheme.

Question 16.

Name the authority to issue a bill of lading.

Answer:

Bill of lading is issued by the shipping company to alter the receipt of freight.

Question 17.

Name the authority to issue an airway bill.

Answer:

Airway bill is issued by the airline company.

Question 18.

Name any one international trade institution.

Answer:

International Monetary fund (IMF).

Question 19.

Expand IMF.

Answer:

International Monetary Fund.

Question 20.

Expand IBRD.

Answer:

International Bank for Reconstruction and Development.

Question 21.

Expand GATS.

Answer:

General Agreement on Trade in Services.

Question 22.

State any one WTO agreement.

Answer:

Agreement on Import Licensing Procedures.

Question 23.

Name any one affiliate agency of the World Bank.

Answer:

International Financial Corporation (IFC).

Two Mark Questions

Question 1.

Give the meaning of proforma invoice.

Answer:

A proforma invoice- is a document that contains details as to the quality, grade, design, size, weight, and price of the export product, and the terms and conditions on which their export will take place.

Question 2.

What is pre-shipment advice?

Answer:

Pre-shipment advice is a letter or form sent by an exporter to a foreign buyer informing that the shipment of the ordered goods is on its way.

Question 3.

What is the certificate of origin?

Answer:

A Certificate of Origin is an importañt international trade document confirming that the goods in a particular shipment have been wholly obtained, produced, manufactured, or processed in a particular country.

Question 4.

Why certificate of origin is necessary?

Answer:

(a) Certificate of Origin is one of the required documents for import customs ciçarance in most of the importing countries.

(b) Certificate of origin is the document, certifying the origin of the country wherein the export goods are procured and manufactured originally.

Question 5.

What is a shipping order?

Answer:

A shipping order is a copy of the shipper’s instruction issued by the shipping company to a shipper regarding the disposition of goods to be transported.

Question 6.

What is mate’s receipt? (March -5-2018)

Answer:

Mate’s receipt is given by the commanding officer of the ship to the exporter after the cargo is loaded on the ship. The mate’s receipt indicates the name of the vessel, berth, date of shipment, description of packages, marks and numbers, condition of the cargo ät the time of receipt on board the ship, etc.

Question 7.

Give the meaning of the bill of lading. (March -N- 201$) (March S-2019)

Answer:

Bill of lading is a document wherein a shipping company gives its official receipt of the goods put on board its vessel and at the same time gives an undertaking to carry them to the port of destination.

Question 8.

What is an airway bill?

Answer:

An airway bill is a document wherein an airline company gives its official receipt of the goods on board its aircraft and at the same time gives the undertaking to carry them to the port of destination.

![]()

Question 9.

Write the meaning of 1ettef cr :

Answer:

A letter of credit is a guarantee issued by the importer’s bank that it will honor up to a certain amount of the payment of export bills to the bank of the exporter.

Question 10.

Write the meaning of the bill of entry.

Answer:

Bill of entry is a form supplied by the customs office to the importer. It is to be filled in by the importer at the time of receiving the goods. It has to be in triplicate and is to be submitted to the customs office.

Question 11.

What is an import general manifest?

Answer:

Import general manifest is a document that contains the details of the imported good. It is the document on the basis of which unloading of cargo takes place.

Question 12.

State any two schemes undertaken by the government to promote international business.

Answer:

(a) Duty drawback scheme.

(b) Export manufacturing under the bond scheme.

Question 13.

Write the meaning of the duty drawback scheme.

Answer:

Since goods meant for exports are not consumed domestically, these are not subjected to payment of various excise and customs duties. Any such duties paid on export goods are, therefore, refunded to exporters on the production of proof of exports of these goods to the concerned authorities. Such refunds are called duty drawbacks.

Question 14.

What is meant by export manufacturing under a bond scheme?

Answer:

Export manufacturing under a bond scheme refers to a facility that entitles the firms to produce goods without payment of excise and other duties. The firms desirous of availing such facility have to give an undertaking (i.e., bond) that they are manufacturing goods for export purposes and will export such products on their production.

Question 15.

Name any two export processing zone.

Answer:

(a) Santa Cruz zone.

(b) Kandla export processing zone.

Question 16.

State any two institutions set up by the government to promote export trade.

Answer:

(a) Export Inspection Council.

(b) Commodity Boards.

Question 17.

Write the meaning of the advance license scheme.

Answer:

It is a scheme under which an exporter is allowed a duty-free supply of domestic as well as imported inputs required for the manufacture of export goods. As such the exporter is not required to pay customs duty on goods imported for use in the manufacture of export goods.

Question 18.

Name any two commodity boards.

Answer:

(a) Coffee Board.

(b) Rubber Board.

Question 19.

State any two objectives of IMF.

Answer:

(a) To promote international monetary cooperation through a permanent institution.

(b) To promote exchange stability with a view to maintaining orderly exchange arrangements among member countries.

Question 20.

State any two objectives of IDA.

Answer:

(a) To provide development finance on easy terms to the less developed member countries.

(b) To provide assistance for poverty alleviation in the poorest countries.

![]()

Question 21.

State any two objectives of WTO.

Answer:

(a) To ensure reduction of tariffs and other trade barriers imposed by different countries,

(b) To facilitate the optimal use of the world’s resources for sustainable development.

Question 22.

State any two objectives of MIGA.

Answer:

(a) To provide promotional and advisory services

(b) Toestablishcredibility.

Question 23.

State any two agreement of WTO

Answer:

(a) Agreement on textile and clothing.

(b) Agreement on agriculture.

Question 24.

What is the IEC number?

Answer:

Import Export Code (ÌEC) number is given to an export firm by Director General for Foreign Trade (DGFT) which the firm needs to be filled in various export-import documents. For obtaining the IEC number, a firm has to apply to the DGFT with documents such as exporter importer profile, bank receipt for a requisite fee, a certificate from the banker on the prescribed form, two copies ofphòtographs attested by the banker, details of the non-resident interest and declaration about the applicant’s non-association with caution listed firms.

Question 25.

What is a shipping bill?

Answer:

The shipping bill is the main document on the basis of which the customs office gives permission for export. Shipping bill contains particulars of the goods being exported, the name of the vessel, the port at which goods are to be discharged, country of final destination, exporters name and address, etc. Exporter prepares the shipping bill for obtaining customs clearance. Thus, we can say the shipping bill is the bill that is prepared by the exporter and required for customs clearance.

![]()

Question 26.

List any two major affiliated bodies of the World Bank.

Answer:

Major affiliated bodies of the World Bank are:

(a) International Bank for Reconstruction and Development (IBRD).

(b) International Financial Corporation (IFC)

(c) International Development Association (IDA).

(d) Multilateral Investment Guarantee Agency (MIGA).

(e) International Centre for Settlement of Investment Disputes (ICSID).

Eight Mark Questions

Question 1.

Explain the steps to be followed in export trade to obtain excise clearance.

Answer:

(a) Receipt of inquiry and sending quotations: The prospective buyer of a product sends an inquiry to different exporters requesting them to send information regarding price, quality, and terms and conditions for export of goods

(b) Receipt of order or indent: In case the prospective buyer finds the export price and other terms and conditions acceptable, it places an order for the goods to be despatched. This order, also known as indent, contains a description of the goods ordered, prices to be paid, delivery terms, packing and marking details, and delivery instructions.

(c) Assessing the importer’s creditworthiness and securing a guarantee for payments: After receipt of the indent, the exporter makes necessary inquiries about the creditworthiness of the importer. The purpose underlying the inquiry is to assess the risks of non-payment by the importer once the goods reach the import destination. To minimize such risks, most exporters demand a letter of credit from the importer.

(d) Obtaining export license: Having become assured about payments, the exporting firm initiates the steps relating to compliance with export regulations. Export of goods in India is subject to customs laws which demand that the export firm must have an export license before it proceeds with exports.

(e) Obtaining pre-shipment finance: Once” a confirmed order and also a letter of credit has been received, the exporter approaches his banker for obtaining pre-shipment finance to undertake export production. Pre-shipment finance is the finance that the exporter needs for procuring raw materials and other components, processing, and packing of goods, and transportation of goods to the port of shipment.

(f) Production or procurement of goods: Having obtained the pre-shipment finance from the bank, the exporter proceeds to get the goods ready as per the specifications of the importer.

(g) Pre-shipment inspection: The Government of India has initiated many steps to ensure that only good quality products are exported from the country. One such step is the compulsory inspection of certain products by a competent agency as designated by the government. The government has passed Export Quality Control and Inspection Act, 1963 for this purpose.

(h) Excise clearance: As per the central excise tariff act, excise duty is required to be paid on the materials used in the production of goods meant for export. So if the exporter desires to produce the goods meant for export by himself, he has to pay the excise duty on the material materials used in the production of goods for export and obtain export clearance from the concerned excise commissioner.

For obtaining export clearance from the concerned excise commissioner exporter has to follow the following steps:

(i) The exporter has to apply, to the concerned Excise Commissioner in the region with an invoice because according to the Central Excise Tariff Act, excise duty is payable on the materials used in manufacturing goods. If the Excise Commissioner is satisfied, he may issue the excise clearance.

(ii) But in many cases the government exempts payment of excise duty or later on refunds

it if the goods so manufactured are meant for exports. This is done to provide an incentive to the exporters to export more and also to make the export products more competitive in the world markets.

Question 2.

What are the steps to be followed in export trade after obtaining excise clearance?

Answer:

The steps to be followed in export trade after obtaining excise clearance are:

(a) Obtaining a certificate of origin: Some importing countries provide tariff concessions or other exemptions to the goods coming from a particular country. For availing of such benefits, the importer may ask the exporter to send a certificate of origin. The certificate of origin acts as proof that the goods have actually been manufactured in the country from where the export is taking place.

![]()

(b) Reservation of shipping space: The exporting firm applies to the shipping company for the provision of shipping space. It has to specify the types of goods to be exported, the probable date of shipment, and the port of destination. On acceptance of an application for shipping, the shipping company issues a shipping order.

(c) Packing and forwarding: The goods are then properly packed and marked with necessary details such as name and address of the importer, gross and net weight, port of shipment ‘ and destination, country of origin, etc. The exporter then makes necessary arrangements for the transportation of goods to the port.

(d) Insurance of goods: The exporter then gets the goods insured with an insurance company x to protect against the risks of loss or damage of the goods due to the perils of the sea during the transit.

(e) Customs clearance: The goods must be cleared from the customs before these can be loaded on the ship. For obtaining customs clearance, the exporter prepares the shipping bill. The shipping bill is the main document on the basis of which the customs office gives permission for export.

(f) Obtaining mates receipt: The goods are then loaded onboard the ship for which the mate or the captain of the ship issues mate’s receipt to the port superintendent. A mate receipt is a receipt issued by the commanding officer of the ship when the cargo is loaded on board and contains the information about the name of the vessel, berth, date of shipment, description of packages, marks and numbers, condition of the cargo at the time of receipt on board the ship, etc.

(g) Payment of freight and issuance of bill of lading: The C&F agent surrenders the mate’s receipt to the shipping company for computation of freight. After receipt of the freight, the shipping company issues a bill of lading which serves as evidence that the shipping company has accepted the goods for carrying to the designated destination.

(h) Preparation of invoice: After sending the goods, an invoice of the despatched goods is prepared. The invoice states the number of goods sent and the amount to be paid by the importer.

(i) Securing payment: After the shipment of goods, the exporter informs the importer about the shipment of goods. The importer needs various documents to claim the title of goods on their arrival at his/her country and getting them customs cleared.

![]()

Question 3.

Explain the various steps involved in the import procedure. (March – S – 2018) (March – N – 2019)

Answer:

(a) Trade inquiry: The importing firm approaches the export firms with the help of trade inquiry they collecting information about their export prices and terms of exports. After receiving a trade inquiry, the exporter will prepare a quotation called a proforma invoice.

(b) Procurement of import license: There are certain goods that can be imported freely, while others need licensing. The importer needs to consult the Export-Import (EXIM) policy in force to know whether the goods that he or she wants to import are subject to import licensing.

(c) Obtaining foreign exchange: Since the supplier in the context of an import transaction resides in a foreign country, he/she demands payment in a foreign currency: Payment in foreign currency involves the exchange of Indian currency into foreign currency.

(d) Placing order or indent: After obtaining the import license, the importer places an import order or indent with the exporter for the supply of the specified products. The import order contains information about the price, quantity size, grade, and quality of goods ordered and the instructions relating to packing, shipping, ports of shipment and destination, etc

(e) Arranging for finance: The importer should make arrangements in advance to pay to the exporter on the arrival of goods at the port. Advanced planning for financing imports is necessary so as to avoid huge demurrages (i.e., penalties) on the imported goods lying uncleared at the port for want of payments.

(f) Obtaining a letter of credit: If the payment terms agreed between the importer and the overseas supplier is a letter of credit, then the importer should obtain the letter of credit from its bank and forward it to the overseas supplier.

(g) Receipt of shipment advice: After loading the goods on the vessel, the overseas supplier dispatches the shipment advice to the importer. Shipment advice contains information about the shipment of goods.

(h) Retirement of import documents: Having shipped the goods, the overseas supplier prepares a set of necessary documents as per the terms of contract and letter of credit and hands it over to his or her banker for their onward transmission and negotiation to the importer in the manner as specified in the letter of credit.

(i) Arrival of goods: Goods are shipped by the overseas supplier as per the contract. The

person in charge of the carrier (ship or airway) informs the officer in charge at the dock or the airport about the arrival of goods in the importing country. He provides the document called import general manifest. Import general manifest is a document that contains the details of the imported goods.

(j) Customs clearance and release of goods: All the goods imported into India have to pass through customs clearance after they cross the Indian borders. Customs clearance is a somewhat tedious process and calls for completing a number of formalities. It is, therefore, advised that importers appoint C&F agents who are well versed with such formalities and play an important role in getting the good’s customs cleared.

![]()

Question 4.

Explain any eight various incentives and schemes that the government has evolved for promoting the country’s export.

Answer:

Major export promotion measures are as follows:

(a) Duty Drawback Scheme: Excise and customs duties paid on export goods are refunded to exporters on the production of proof of exports of these goods to the concerned authorities.

(b) Export Manufacturing Under Bond Scheme: This facility entitles firms to produce goods without payment of excise and other duties if the firms give an undertaking (i.e„ bond) that they are manufacturing goods for export purposes and will export such products on their production.

(c) Exemption from Payment of Sales Taxes and Income Tax: Goods meant for export purposes are not subject to sales tax exemption from income tax is available only to 100% export oriented units (100% EOUs) and units set up in export processing zones (EPZs)/ special economic zones (SEZs) for select years.

(d) Advance Licence Scheme: It is a scheme under which an exporter is allowed to the duty-free supply of domestic as well as imported inputs required for the manufacture of export goods.

(e) Export Promotion Capital Goods Scheme (EPCGS): The main objective of this scheme is to encourage the importance of capital goods for export production. This scheme allows export firms to import capital goods at very low rates of customs duties subject to actual user conditions and fulfillment of specified export obligations.

(f) Scheme of Recognizing Export Firms as Export House, Trading House, and Superstar Trading House: The government grants the status of the export house, trading house, star trading ‘house to select export firms based on achieving a prescribed average export of performance in past select years and assistance is given to them in marketing their products globally.

(g) Export of services: In order to boost the export of services, various categories of service houses have been recognized on the basis of the export performance of the service providers.

(h) Export finance: Finance is made available at concessional rates of interest to the exporters. Pre-shipment finance is provided to an exporter for financing the purchase, processing, manufacturing, or packaging of goods for export purposes. Post-shipment finance is provided to the exporter from the date of extending the credit after the shipment of goods to the export country.

![]()

(i) Export Processing Zones (EPZs): Tliese is an industrial estate usually situated near seaports or airports with an objective to provide an internationally competitive duty-free environment for export production at a low cost. EPZs are now converted to Special Eco¬nomic Zones (SEZs) which are free from all rules and regulations governing imports and exports units except relating to labor and banking.

(j) 100% Export Oriented Units (100% EOUs): The 100% export-oriented units scheme

was introduced in early 1981 adopting the same production regime as EPZs but a wider option in location. EOUs were established with a view to generating additional production capacity for exports by providing an appropriate policy framework, flexibility of operations arid incentives.

Question 5.

Discuss the principal documents used in exporting.

Answer:

Documents related to goods

(a) Export invoice: It is a sellers’ bill for merchandise and contains information about goods such as quantity, total value, number of packages, marks on packing, port of destination, name of the ship, bill of lading number, terms of delivery and payments, etc.

(b) Packing list: A packing list is a statement of the number of cases or packs and the details of the goods contained in these packs. It gives details of the nature of goods which are being exported and the form in which these are being sent.

(c) Certificate of origin: This is a certificate that specifies the country in which the goods are being produced. This certificate entitles the importer to claim tariff concessions or other exemptions. This certificate is also required when there is a ban on imports of certain goods from select countries.

(d) Certificate of inspection: For ensuring quality, the government has made it compulsory for certain products that be inspected by some authorized agency. Export Inspection Council of India (EICI) is one such agency that carries out such inspections and issues the certificate that the consignment has been inspected as required under the Export (Quality Control and Inspection) Act, 1963.

Documents related to shipment

(a) Mate’s receipt: This receipt is given by the commanding officer of the ship to the exporter after the cargo is loaded on the ship. The mate’s receipt indicates the name of the vessel, date of shipment, description of packages, marks and numbers, condition of the cargo at the time of receipt on board the ship, etc.

(b) Shipping bill: The shipping bill is the main document on the basis of which the customs office grants permission for the export. The shipping bill contains particulars of the goods being exported, the name of the vessel, the port at which goods are to be discharged, country of final destination, exporter’s name and address, etc.

(c) Bill of lading: It is a document wherein a shipping company gives its official receipt of the goods put on board its vessel and at the same time gives an undertaking to carry them to the port of destination.

(d) Airway bill: Like a bill of lading, an airway bill is a document wherein an airline company gives its official receipt of the goods on board it’s aircraft and at the same time gives the undertaking to carry them to” the port of destination.

(e) Marine insurance policy: It is a certificate of insurance contract whereby the insurance company agrees in consideration of a payment called premium to indemnify the insured against loss incurred by the latter in respect of goods exposed to perils of the sea.

![]()

Documents related to payment:

(a) Letter of credit: A letter of credit is a guarantee issued by the importer’s bank that it will honour up to a certain amount of the payment of export bills to the bank of the exporter. Letter of credit is the most appropriate and secure method of payment adopted to settle international transactions.

(b) Bill of exchange: It is a written instrument whereby the person issuing the instrument directs the other party to pay a specified amount to a certain person or the bearer of the instrument. In the context of an export-import transaction, a bill of exchange is drawn by the exporter on the importer asking the latter to pay a certain amount to a certain person or the bearer of the bill of exchange.

(c) Bank certificate of payment: Bank certificate of payment is a certificate that the necessary documents relating to the particular export consignment have been negotiated and the payment has been received in accordance with the exchange control regulations.

Practical Oriented Questions

Question 1.

As the owner of a business unit, what risks do you face in running it? (March -N- 2019, March – N – 2018, March – S – 2018)

Answer:

The risk faced by the owner while running a business unit are:

- Market information risk

- Consumer taste and preferences risk

- Government policy risk

- Capital risk

- Operational risk.

Question 2.

You are planning to start a new business. Make a list of any five factors you consider while selecting a suitable form of business organization.

Answer:

The five-factor that should be considered while selecting a suitable form of business organization are:

(a) Cost

(b) Liability

(c) Continuity

(d) Management ability

(e) Degree of control

(f) Capital consideration

(g) Nature of business.

Question 3.

Assuming that you are a businessman, state what benefits do you enjoy by entering into a Joint venture.

Answer:

The benefit that enjoyed by businessman entering into joint ventures are:

(a) Increased resources and capacity.

(b) Innovation.

(c) Access to technology.

(d) Access to new market and distribution network.

(e) Low cost of production.

(f) Established brand fame.

Question 4.

As a customer of a Bank, list out any five e-banking services enjoyed by you. (March – S – 2019)

Answer:

The five e-banking services are:

(a) Electronic fund transfer.

(b) Automated teller machines.

(c) Electronic data Interchange.

(d) Credit cards electronic or digital cash.

(e) Telebanking / Mobile banking.

(f) Anywhere banking (of) core banking.

![]()

Question 5.

As an online buyer, mention any five information-intensive products that can be delivered electronically to your computer.

Answer:

The five information-intensive product that can be delivered electronically are:

(a) Tally ERP

(b) e-journals

(c) e-Books.

(d) e-musics

(e) e-games

Question 6.

As a businessman having concern for environmental protection, suggest any five measures to control environmental pollution. (March – N – 2019)

Answer:

Five measure to control environmental pollution are:

(a) Definite commitment by top management of the enterprise to create, maintain and develop work culture for environmental protection and pollution prevention.

(b) Complying with laws and regulations enacted by the government for the prevention of pollution.

(c) Participation in government programs relating to the management of hazardous substances, plantation of trees, and checking deforestation.

(d) Ensuring that commitment to environmental protection is shared throughout the enterprise by all divisions and employees.

(e) Arranging educational workshops and training materials to share technical information and experience with suppliers, dealers, and customers to get them actively involved in pollution control programs.

Question 7.

As a promoter, state five important documents to be prepared for the incorporation of a joint-stock company.

Answer:

Five documents to be prepared for the incorporation of a joint-stock company.

(a) Memorandum of association.

(b) Articles of association / Statement in lien of the prospects.

(c) Written consent of the proposed directors.

(d) A copy of the registrar’s letter approving the name of the company.

(e) A statutory declaration affirming that all legal requirements for registration have been complied with.

Question 8.

Suggest any five important sources of finance available for a business organization. (March – N – 2018, March – N – 2019)

Answer:

Five important sources of finance available for a business organization:

(a) Owner’s fund:

- Equity shares

- Retained earnings.

(b) Borrowed funds:

- Debenture

- Loans from banks

- Loans from a financial institution

- Public deposit

- Lease financing.

![]()

Question 9.

Give a list of any five Institutions which support small business in Indias (March – N -2018, March – S – 2018, (March – S – 2019)

Answer:

Five institutions which support small business in India are;

(a) National Bañk for Agriculture and Rural Development (NABARD)

(b) National Small Industrial Corporation (NSIC)

(c) Small Industrial Development Bank of India (SIDBI)

(d) Rural and Women Entrepreneurship Development (RWED)

(e) District Industries Centres (DICs).

Question 10.

Being a consumer, name the types of large fixed retail shops which you would like to do your shopping

Answer:

The types of large fixed retail shops:

(a) Departmental stores

(b) Chain stores

(e) Consumer co-operative stores

(d) Supermarkçt

(e) Mail order houses.

Question 11.

As an aspirant of doing international business what different modes of entry into International Business do you find? , (March – N -2019)

Answer:

Different modes of entry into international business are:

(a) Export and import

(b) Joint venture

(c) Liceñsing and franchising

(d) Contract manufacturing

(e) Wholly owned subsidiaries.

Question 12.

Mention any ‘five foreign trade promotion measures and schemes undertaken by the Government of India to boost up foreign trade. (March S -2018)

Answer:

Five foreign trade promotion measures and schemes are undertaken by the Government of India to boost up foreign trade are:

(a) Duty drawback scheme.

(b) Advance licence sheme.

(e) Exemption from payment of sales taxes.

(d) Export promotion capital goods scheme.

(e) Export finance at concessional rates of interest.

(f) Export of services.

(g) Export processing zones.

(h) 100 percent export-oriented unit.

1st PUC Business Studies International Business Textbook Questions and Answers

Multiple Choicesone Mark Questions

Question 1.

In which of the following modes of entry, does the domestic manufacturer give the right to use intellectual property such as patent and trademark to a manufacturer in a foreign country for a fee

(a) Licensing

(b) Contract manufacturing

(C) Joint venture

(d) None of these

Answer:

(a) Licensing

Question 2.

When two or more firms come together to create a new business entity that is legally separate and distinct from its parents, it is known as (March – N -2019)

(a) Contract manufacturing

(b) Franchising

(c) Joint ventures

(d) Licensing

Answer:

(c) Joint ventures

Question 3.

Which of the following is not an advantage of exporting?

(a) Easier way to enter into the international market

(b) Comparatively lower risks

(c) Limited presence of markets in foreign markets

(d) Fewer investment requirements

Answer:

(c) Limited presence of markets in foreign markets.

![]()

Question 4.

Which one of the following modes of entry permits the greatest degree of control over overseas operations?

(a) Licensing/Franchising

(b) Wholly owned subsidiaries

(c) Contract manufacturing

(d) Joint venture

Answer:

(b) Wholly owned subsidiaries

Question 5.

Which one of the following is not amongst India’s major import items?

(a) Ayurvedic medicines

(b) Oil and petroleum products

(c) Pearls and precious stones

(d) Machinery

Answer:

(a) Ayurvedic medicines

Question 6.

Which of the following documents are not required for obtaining an export license?

(a) IEC number

(b) Letter of credit

(c) Registration cum membership certificate

(d) Bank account number

Answer:

(b) Letter of credit

Question 7.

Which of the following documents is not required in connection with an import transaction?

(a) Bill of lading

(b) Shipping bill

(c) Certificate of origin

(d) Shipment advice

Answer:

(b) Shipping bill

Question 8.

Which the following documents are not required in connection with an impact transaction?

(a) Bill of lading

(b) Shipping bill

(c) Certificate of origin

(d) Shipment advice

Answer:

(b) Shipping bill

Question 9.

Which of the following do not form part of the duty drawback scheme?

(a) Refund of excise duties

(b) Refund of customs duties

(c) Refund of export duties

(d) Refund of income dock charges at the port of shipment

Answer:

(d) Refund of income dock charges at the port of shipment

Question 10.

Which one of the following is not a part of export documents?

(a) Commercial invoice

(b) Certificate of origin

(c) Bill of entry

(d) Mate’s receipt

Answer:

(c) Bill of entry

Question 11.

A receipt issued by the commanding officer of the ship when the cargo is loaded on the ship is known as:

(a) Shipping receipt

(b) Mate receipt

(c) Cargo receipt

(d) Charter receipt

Answer:

(b) Mate receipt

![]()

Question 12.

Which of the following document is prepared by the exporter and includes details of the cargo in terms of the shipper’s name, the number of packages, the shipping bill, port of destination, name of the vehicle carrying the cargo?

(a) Shipping bill

(b) Packaging list

(c) Mate’s receipt

(d) Bill of Exchange

Answer:

(a) Shipping bill

Question 13.

The document containing the guarantee of a bank to honor drafts drawn on it by an exporter is

(a) Letter of hypothecation

(b) Letter of credit

(c) Bill of lading

(d) Bill of exchange

Answer:

(b) Letter of credit

Question 14.

TRIP is one of the WTO agreements that deal with

(a) Trade-in agriculture

(b) Trade in services.

(c) Trade-related investment measures

(d) None of these

Answer:

(d) None of these

Question 15.

Outsourcing a part or entire production and concentrating on marketing operations in international business is known as

(a) Licensing

(b) Franchising

(c) Contract Manufacturing

(d) Joint Venture

Answer:

(c) Contract Manufacturing

Question 16.

Which one of the following modes of entry requires a higher level of risks?

(a) Licensing

(b) Franchising

(c) Contract manufacturing

(d) Joint venture

Answer:

(d) Joint venture

Question 17.

Which one of the following modes of entry brings the firm closer to international markets?

(a) Licensing

(b) Franchising

(c) Contract manufacturing

(d) Joint venture

Answer:

(c) Contract manufacturing

Question 18.

Which one of the following Is net amongst India’s major trailing partner? (March -S-2019)

(a) USA

(b) the UK

(c) Germany

(d) New Zealand

Answer:

(d) New Zealand

Question 19.

Which of the following documents is not required in the export procedure?

(a) Certificate of origin

(b) Certificate of Inspection

(c) Mate’s receipt

(d) Bill of entry

Answer:

(d) Bill of entry.

Question 20.

Which of the following document is not required in the impact procedure? (March -N- 2018)

(a) Trade inquiry

(b) Bill of entry

(c) Import general manifesto

(d) Certificate of origin

Answer:

(d) Certificate of origin.

Short Answer Questions

Question 1.

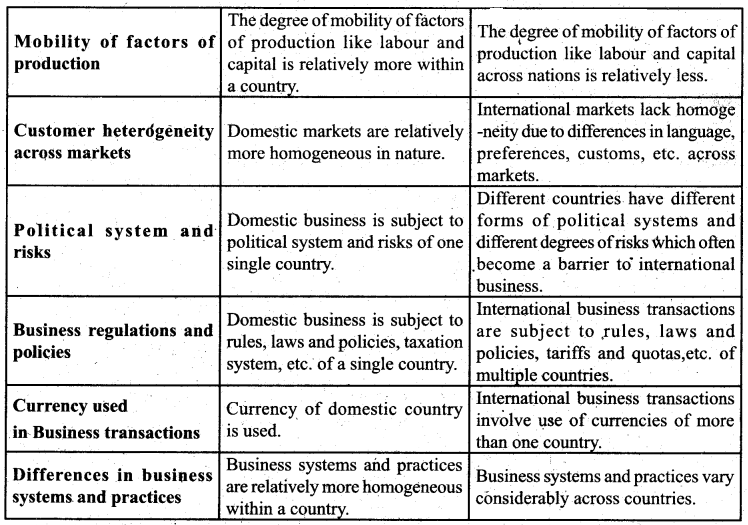

Differentiate between internal trade and international trade.

Answer:

| Internal Trade | International Trade |

| 1. Internal trade means trade within the countries. | 1. International trade means between two countries. |

| 2. Internal trade accounts for about 90% of the total volume of the trade of a country. | 2. International trade accounts for only 10% of the total volume of the trade of a country. |

| 3. The number of documents of trade required is less. | 3. The number of documents of trade required is more. |

| 4. Internal trade is subjected to regulations and laws of one country. | 4. International trade is subjected to the regulation and laws of two or more countries. |

| 5. Cost of transport is less. | 5. Cost of transportation is more. |

| 6. Trade payment is made or received in local currency. | 6. Trade payment is made or received in foreign currency. |

| 7. License need not be obtained. | 7. License needs to be obtained. |

| 8. Homogeneous market | 8. Heterogeneous market. |

Question 2.

Discuss any three advantages of international business.

Answer:

(a) Availability of latest technology: The business firm can use the latest technology which helps them to reduce the cost of production and increases the productivity of an organization. This results in more profit for an organization.

(b) Employment opportunities: International business provides employment opportunities to millions of people throughout the world and, helps to solve the unemployment problem.

(c) Prospects for higher profits: International business can be more profitable than domestic business. When the domestic prices are lower, business firms can earn more profits by selling their products in countries where prices are high.

![]()

Question 3.

What is the major reason underlying trade between nations?

Answer:

The major reason behind the international business is that:

(a) The countries have unequal distribution of natural resources among them or have differences in their productivity levels because of which they cannot produce all that » they need equally well or at equal costs.

(b) Trade between nations allows a country to produce what a country can produce more efficiently, and trade the surplus production so generated with other countries to procure what they can produce more efficiently.

Question 4.

Why is it said that licensing is an easier way to expand globally?

Answer:

Licensing is considered to be the easier way of expanding globally due to the following advantages:

(a) Under the licensing system, it is the licensor who sets up the business unit and invests his/her own money in the business and the licensor has to virtually make no investments abroad. Licensing is, therefore, considered a less expensive mode of entering into international business.

(b) Licensor is paid by the licensee by way of fees fixed in advance as a percentage of production or sales turnover and licensor does not bear the risk of losses.

(c) Since the business in the foreign country is managed by the licensee who is a local person, there are lower risks of business takeovers or government interventions.

(d) Licensee is a local person has the greater market knowledge and contacts-which can prove quite helpful to the licensor in successfully conducting its marketing operations.

![]()

Question 5.

Differentiate between contract manufacturing and setting up wholly-owned production subsidiaries abroad.

Answer:

Contract manufacturing refers to a type of international business where a firm enters into a contract with one or a few local manufacturers in foreign countries to get certain components or goods produced as per its specifications while in a wholly-owned subsidiary the parent company acquires full control over the foreign company by making 100% investment in its equity capital.

Question 6.

State any two formalities involved in getting an export license.

Answer:

Formalities in getting an export license are as follows:

(a) Opening a bank account in any bank authorized by the Reserve Bank of India (RBI) and getting an account number.

(b) Obtaining Import Export Code (IEC) number from the Directorate General Foreign Trade (DGFT) or Regional Import Export Licensing Authority.

(c) Registering with appropriate export promotion council.

(d) Registering with Export Credit and Guarantee Corporation (ECGC) in order to safeguard against risks of non-payments.

Question 7.

Why is it necessary to get registered with an export promotion council?

Answer:

It is necessary for the exporter to become a member of the appropriate export promotion council and obtain a Registration Cum Membership Certificate (RCMC) for availing benefits available to export firms from the Government like duty exemptions. These councils also provide incentives to the exporters.

Question 8.

Why is it necessary for an export firm to go in for a pre-shipment inspection? ‘

Answer:

An export firm has to go in for pre-shipment inspection as required by the Government of India to ensure that only good quality products are exported from the country. The government has passed the Export Quality Control and Inspection Act, 1963 for the purpose of compulsory inspection of certain products by a competent agency as designated by the government.

Question 9.

What is a bill of lading? How does it differ from the bill of entry?

Answer:

Bill of lading is issued by the shipping company after the receipt of freight; it serves as evidence that the shipping company has accepted the goods for carrying to the designated destination. In case the goods are being sent by air, this document is referred to as an airway bill.

On the other hand “Bill of entry” is filled by the importer for assessment of customs import duty. One appraiser examines the document carefully and gives the examination order. The importer procures the said document prepared by the appraiser and pays the duty if any. After payment of the import duty, the bill of entry has to be presented to the dock superintendent. The examiner gives his report on the bill of entry which is then presented to the port authority which issues the release order after receiving necessary charges.

![]()

Question 10.

Explain the meaning of mate’s receipt.

Answer:

A mate receipt is a receipt issued by the commanding officer of the ship when the cargo is loaded on board and contains the information about the name of the vessel, berth, date of shipment, description of packages, marks and numbers, condition of the cargo at the time of receipt on board the ship, etc. The port superintendent, on receipt of port dues, hands over the mate’s receipt to the C&F agent.

Question 11.

What is a letter of credit? Why does an exporter need this document?

Answer:

A letter of credit is a guarantee issued by the importer’s bank that it will honour up to a certain amount of export bills to the bank of the exporter. Letter of credit is the most appropriate and secure method of payment adopted to settle international transactions.

The exporter needs this letter to insure against the non-payment of dues by the importer in the ‘ foreign country as there is always a risk in the collection of payment from the importers. Thus, in order to protect the exporter from financial Joss “Letter of credit” is needed.

Question 12.

Discuss the process involved in securing payment for exports.

Answer:

The process involved in securing payment for exports includes the following steps:

(a) After the shipment of goods, the exporter informs the importer about the shipment of goods.

(b) The exporter sends the documents like a certified copy of the invoice, bill of lading, packing list, etc. needed by the importer to claim the title of goods on their arrival at his/her country and getting them customs cleared. These documents are sent through the exporter’s banker with the instruction that these may be delivered to the importer after acceptance of the bill of exchange.

(c) On receiving the bill of exchange, the importer releases the payment in case of sight draft or accepts the usance draft for making payment on maturity of the bill of exchange.

(d) The exporter’s bank receives the payment through the importer’s bank and is credited to the exporter’s account.

(e) The exporter can get immediate payment from his/her bank on the submission of documents by signing a letter of indemnity.

(f) After receiving the payment for experts, the exporter needs to get a bank certificate of payment which states that the necessary documents relating to the particular export consignment have been presented to the importer for payment and the payment has been received in accordance with the exchange control regulations.

Long Answer Questions

Question 1.

“International business is more than International trade”. Comment.

Answer:

International trade comprises exports and imports of goods and forms an important component of international business. But the scope of international business is substantially wider than that of international trade. International business includes the international exchange of services such as international travel and tourism, transportation, communication, banking, warehousing, distribution, and advertising. It also covers foreign investments and overseas production of goods and services.

Multinational companies have started making investments in foreign countries and undertaking the production of goods and services in fàreign countries to explore foreign markets and produce at lower costs. All these activities form part of international business.

To conclude, we can say that international business is a much broader term and is comprised of both the trade and production of goods and services across frontiers. International trade is done through exporting of goods while international business includes licensìng, franchising, contract manufacturing, joint ventures, and establishment of wholly-owned subsidiaries apart from exporting.

Question 2.

Explain the benefits of international business both to the nation and firm. (March…N-2018, S-2019)

Answer:

Benefits of international business to the nation:

(a) Earning of foreign exchange: International business helps a country to earn foreign exchange which it can later use for meeting its imports of capital goods, technology, petroleum products, and fertilizers, pharmaceutical products, and a host of other consumer products which otherwise might not be available domestically.

(b) More efficient use of resources: As stated earlier, the international business operates on a simple principle produce what your country can produce more efficiently, and trade the surplus production so generated with other countries to procure what they can produce more efficiently. When countries trade on this principle, .they end up producing much more than what they can when each of them attempts to produce all the goods and services on its own.

(c) Improving growth prospects and employment potentials: Producing solely for the purposes of domestic consumption sev1erely restricts a country’s prospects for growth and employmeñt. Many cõufltries, especially the developing ones, could not execute their plans to produce on a larger scale, and thus create employment for people because their domestic market was not large enough to absorb all that extra production. ‘

(d) Increased standard of living: In the absence of imitational trade of goods and services, it would not have been possible for the world community to consume goods and services produced in other countries that the people in these countries are able to consume and enjoy a higher standard of living.

(e) Greater variety of goods available for consumption: International trade brings in different varieties of a particular product from different destinations. This gives consumers a wider array of choices which will not only improve their quality of life but as a whole, It will help the country to grow.

![]()

(f) Consumption at a cheaper cost: International trade enables a country to consume things that either cannot be produced within its borders or production may cost very high. Therefore it becomes cost cheaper to import from other countries through foreign trade.

(g) Reduces trade fluctuations: By making the size of the market large with large supplies an extensive demand, international trade reduces trade fluctuations. The prices of goods tend to remain more stable.

Benefits of international business to firms

(a) Prospects for higher profits: International- business can be more profitable than domestic business. When the domestic prices are lower, business firms can earn more profits by selling their products in countries where prices are high.

(b) Increased capacity utilization: Many firms set up production capacities for their products that are in excess of demand in the domestic market. By planning overseas expansion Mid procuring orders from foreign customers, they can think of making use of their surplus production capacities and also improving the profitability of their operations.

(c) Prospects for growth: Business firms find it quite frustrating when demand for their products starts getting Curated in -the domestic market. Such firms can considerably improve the prospects of their growth by plunging into overseas markets. This is precisely what has prompted many of the multinationals from the developed countries to enter into markets of developing countries.

(d) Way out to intense competition in the domestic market: When competition in the domestic market is very intense, internationalization seems to be the only way to achieve significant growth. The highly competitive domestic market drives many companies to go international in search of markets for their products.

(e) Improved business vision: The growth of the international business of many companies is essentially a part of their business policies or strategic management. The vision to become international comes from the urge to grow, the need to become more competitive, the need to diversify, and to gain strategic advantages of internationalization.

Question 3.

In what ways is exporting a better way of entering into international markets than setting up wholly-owned subsidiaries abroad.

Answer:

Exporting is a better way of entering into international markets than setting up wholly-owned subsidiaries abroad in the following ways:

(a) Exporting is the easiest way of gaining entry into international markets. It is less complex than setting up and managing joint ventures or wholly-owned subsidiaries abroad.

(b) Exporting involves lesser time and effort as business firms are not required to invest that much time and money as is needed when they set up manufacturing plants and facilities as wholly-owned subsidiaries in host countries.

(c) Since exporting does not require much investment in foreign countries, exposure to foreign investment risks is nil or .much lower than that in establishing wholly-owned subsidiaries.

Question 4.

Rekha Garments has received an order to export 2000 men’s trousers to Swift Imports Ltd. located in Australia. Discuss the procedure that Rekha Garments would need to go through for executing the export order.

Answer:

The steps involved in executing the export order are as follows:

(a) Assessing creditworthiness of swift imports Limited and Securing a Guarantee for Payments: After receiving the receipt of indent, Rekha Garments should make a necessary inquiry about the creditworthiness of Swift Imports Limited, in order to assess the risks of non-payment by the importer.